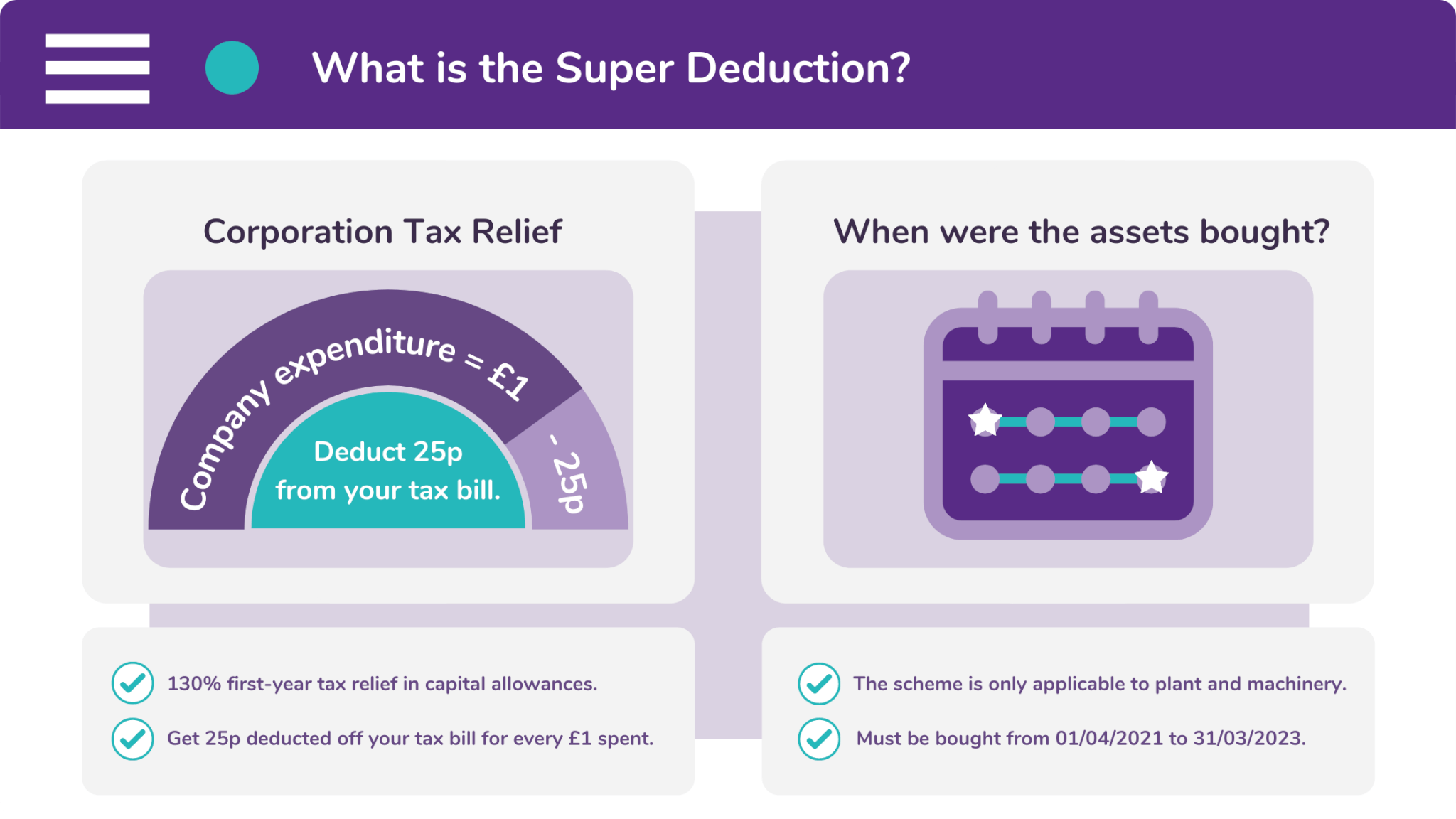

The Super Deduction Tax Scheme allows businesses to claim 130% first-year tax relief in the form of capital allowances. Capital allowances let taxpayers remove part of the cost of an asset from their taxable income, thus reducing their bill.

This means that for every £1 you spend on an asset, 25 pence is deducted from your Corporation Tax bill. However, the Super Deduction is only applicable to certain assets. These include plant and machinery.

And not only must these assets fall under the category of plant and machinery, but you must also use them to generate income. This income can be gained from increasing production, streamlining your services, or reducing your overheads.

And finally, the assets which you acquire under the scheme must be bought within a certain date range. Specifically, you must have bought them sometime between the 1st of April 2021 and the 31st of March 2023.

How does the Super Deduction work?

Your company will benefit from the Super Deduction Tax Scheme when you purchase plant and machinery in cash. But you will also benefit from the scheme if you purchase equipment using a finance facility called a hire purchase.

A hire purchase gives you guaranteed ownership (known as the ‘title’) of an asset, making you it’s legal owner. This, in turn, means that the asset will go on your balance sheet and will therefore influence your Corporation Tax bill.

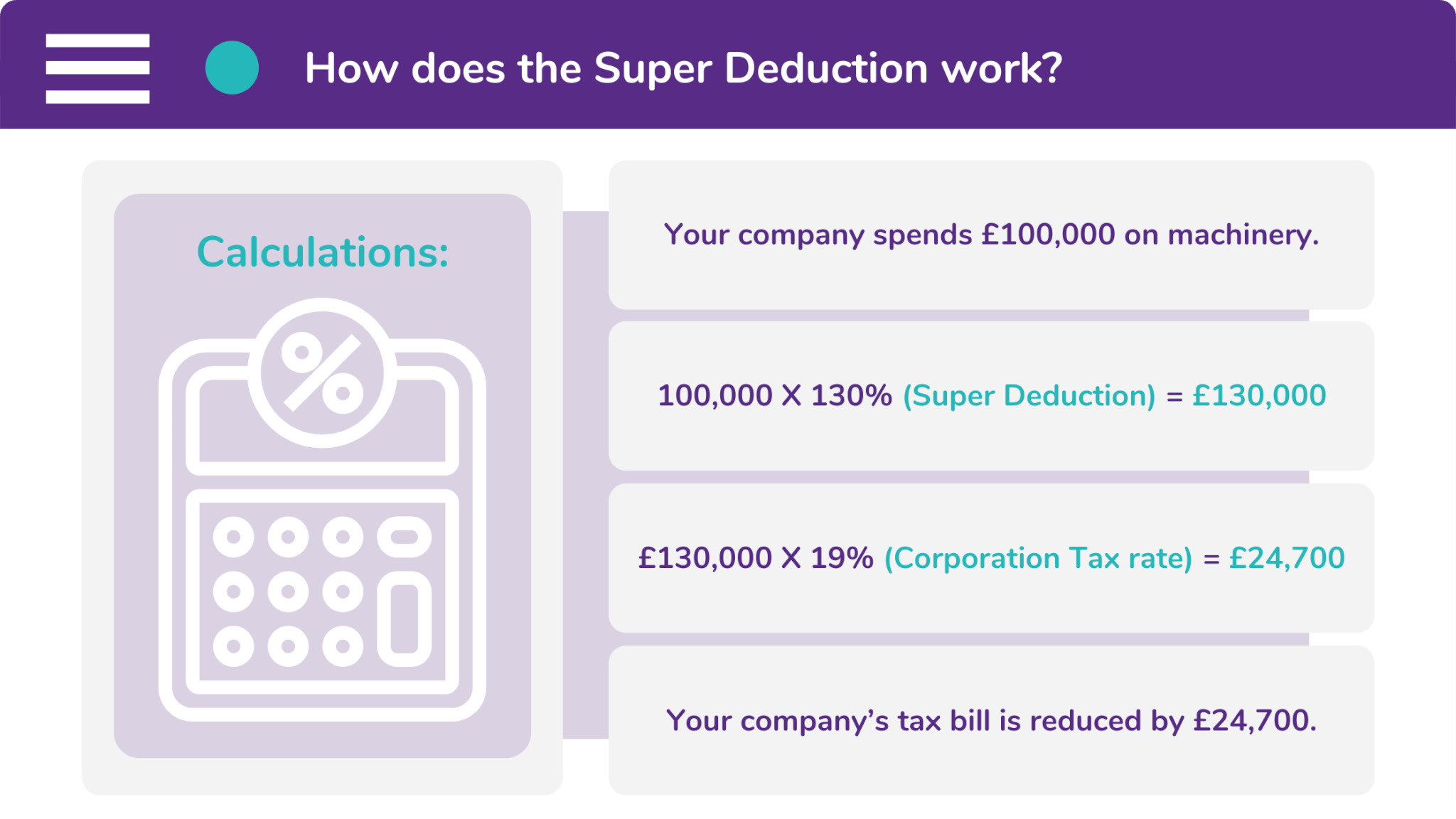

Here is an example of how the scheme works:

- Your company spends £100,000 on plant and machinery products.

- £100,000 X 130% (Super Deduction rate) = £130,000

- £130,000 X 19% (Corporation Tax rate) = £24,700

- Your company’s tax bill is then reduced by £24,700.

What falls under ‘plant and machinery’?

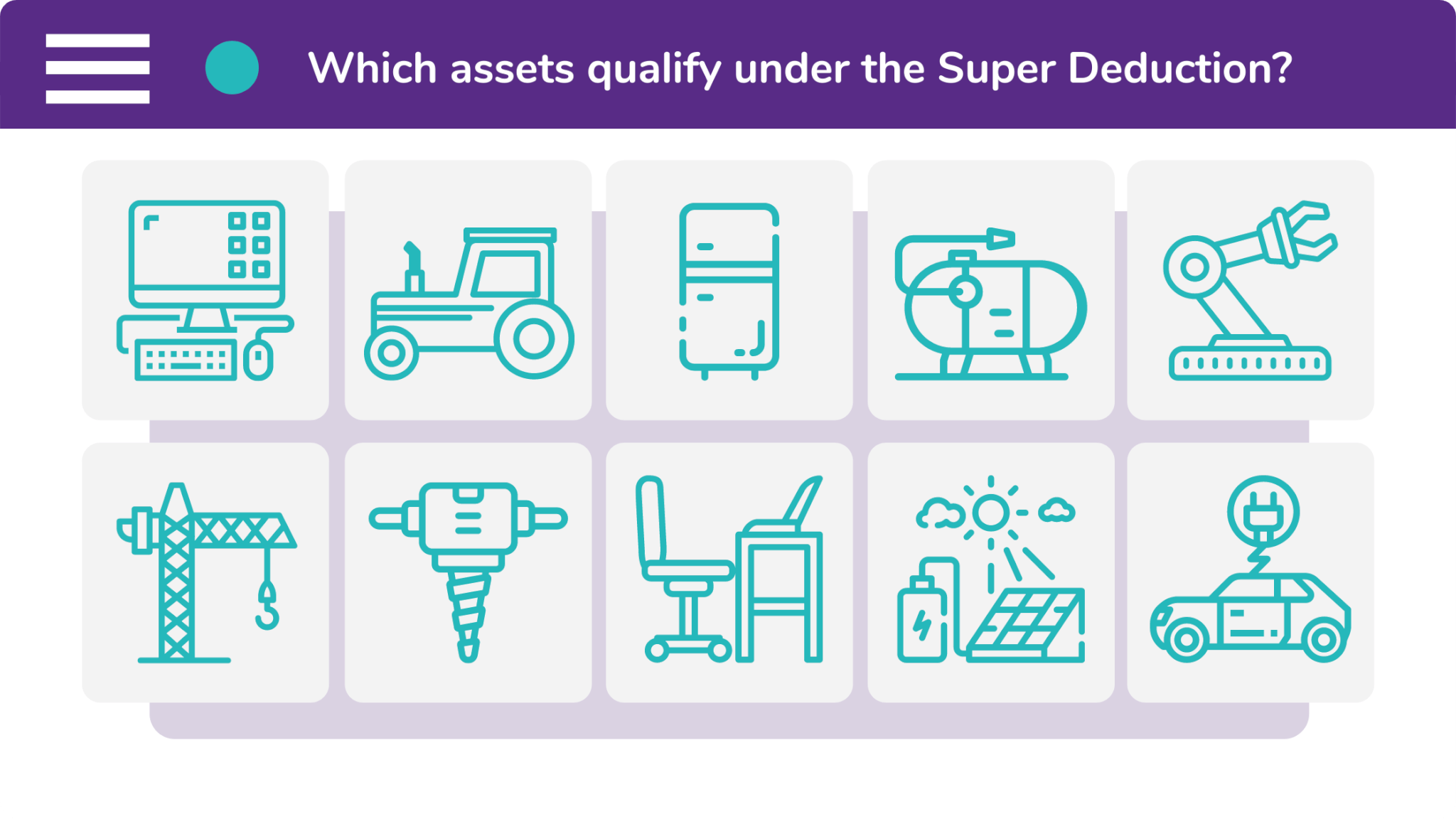

Here is a non-exhaustive list of assets which qualify under the Super Deduction Scheme:

- Computer equipment and servers

- Tractors, lorries, and vans

- Refrigeration units

- Compressors

- Foundry equipment

- Ladders and cranes

- Drilling equipment

- Office chairs and desks

- Solar panels

- Electric vehicle charge points

Why is the Super Deduction available?

The COVID-19 pandemic caused business investment to shrink by 11.6% between Q3 of 2019 and Q3 of 2021. Low business investment plays a big part in slowing down productivity, and this has been the case since the 2008 recession.

To combat the lack of investment, the government drafted the Super Deduction Tax Scheme in order to stimulate business growth. This provided a strong incentive for companies who wanted to make additional investments and bring their plans forward.

Ultimately, this will drive economic growth and bring us back to a pre-COVID state-of-health. To find out more about the Super Deduction Tax Scheme, and arrange asset finance which compliments it, contact one of our friendly brokers.