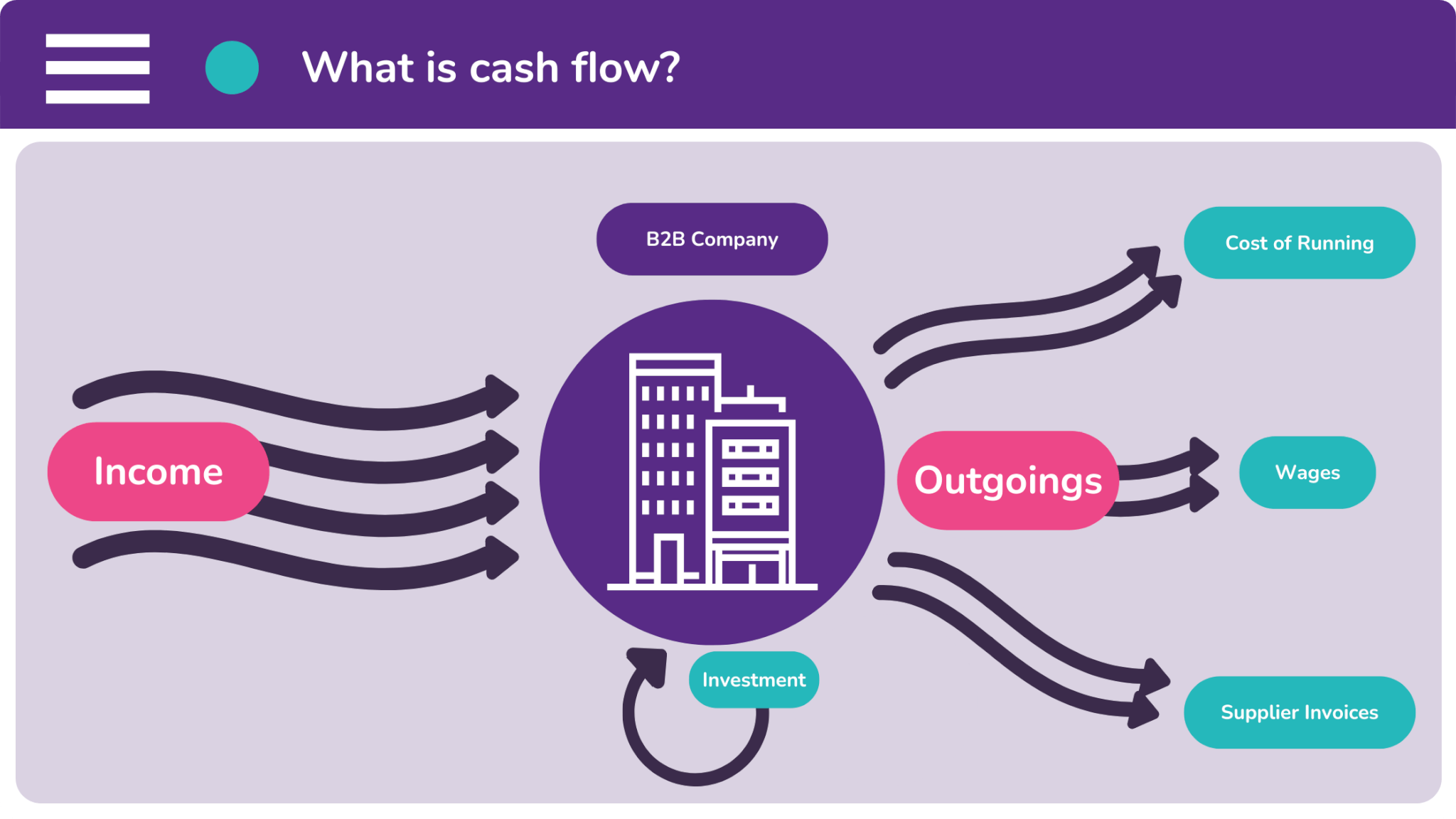

What is cash flow? This is a question which every layperson in the business world will be asking themselves. And quite simply, cash flow refers to the flow of capital through a company.

You are probably aware of the two directions that money takes within a business. There is income. And there are outgoings. Obviously, income is money that comes in. And outgoings go out.

Some examples of outgoings in a typical business include: the cost of running (electricity bills, water bills, office rent, etc), employee wages, supplier invoices, and also inward company investment.

A business is considered profitable when you take the cost of its outgoings away from its income and the result is a positive one. If the result were negative, the business would clearly be struggling.

However, a business can be profitable whilst having a restricted cash flow. Late customer payments can cause this because a company will have to pay supplier invoices before getting paid themselves.

A healthy cash flow is every business’s goal. Your cash reserves will remain untouched. You won’t have to chase your customers for payment. And your company will look like a better investment.

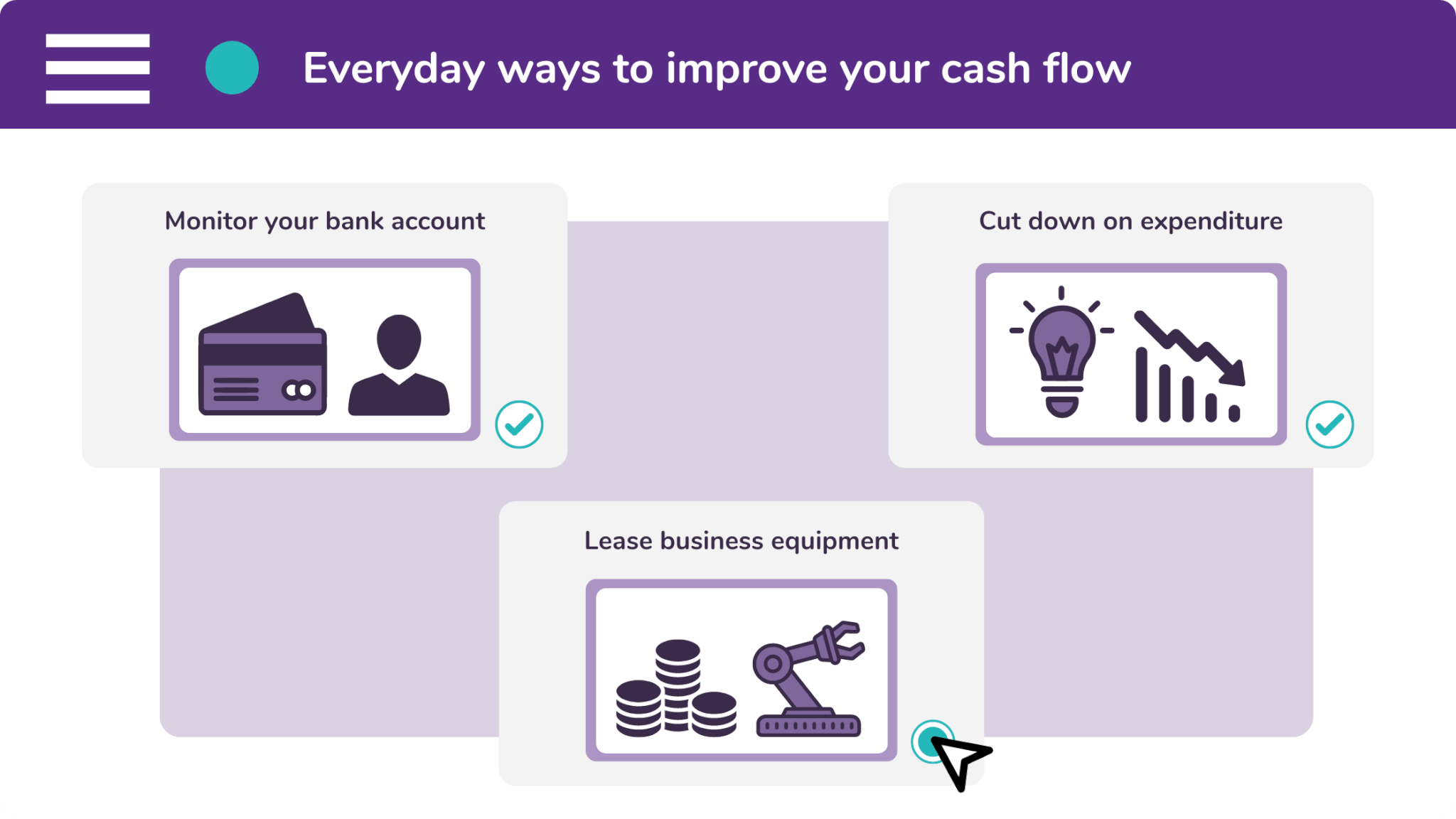

Everyday Ways to Improve Your Cash Flow

There are many things you can do to improve your business’s cash flow. But sometimes the more extravagant solutions can be overkill. So, here are three everyday ways to improve your cash flow:

- Number 1 – Monitor your bank account every day,

You should keep a handle on your company’s incomings and outgoings. Just because it’s considered normal to give your customers thirty days’ worth of credit, doesn’t mean that you have to abide by it.

- Number 2 – Cut down on unnecessary expenditure,

There is always unnecessary expenditure in a business. Whether that comes down to inefficient assets, over-staffing, or even poorly thought-out processes. Separate the wheat from the chaff.

- Number 3 – Lease business equipment instead of buying it,

Don’t sink your hard-earned cash into depreciating assets. You should finance equipment over the course of its economic life. That way, your company won’t be stuck with old, outdated products.

How Can Finance Help Your Business?

Some companies struggle to maintain a healthy cash flow. This could be down to the nature of their products, their customers, or even their industry. But there is a solution for these businesses.

They should take advantage of cash flow finance. Naturally, cash flow finance products help companies that are experiencing restrictions and need to find a way to trade more smoothly.

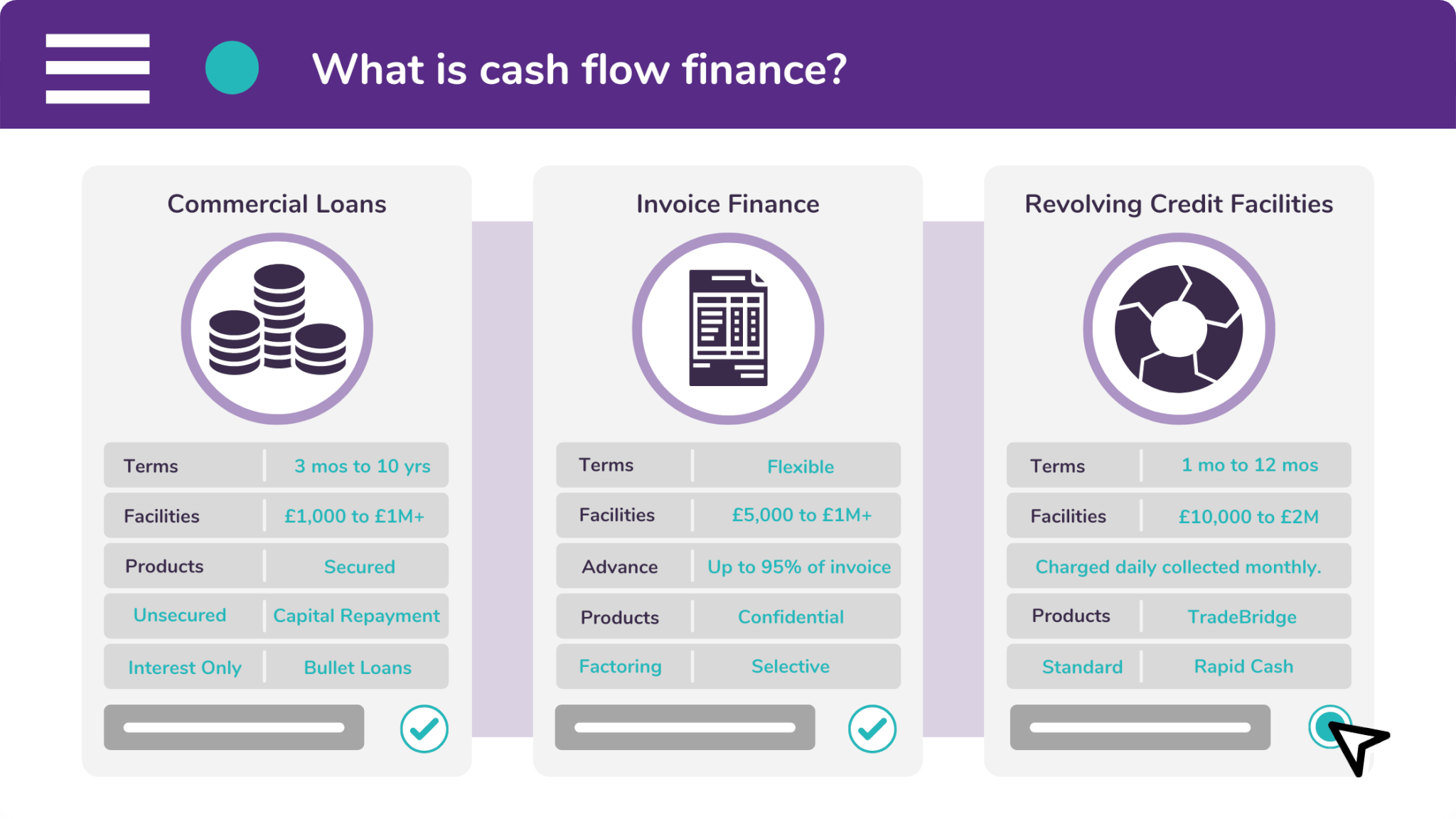

There are three types of cash flow finance that businesses should consider.

Commercial loans are the most widely known type of business finance. And this is down to the simplicity and the flexibility of a loan. They can be used to kickstart a variety of different projects.

Invoice finance is best used by companies who’s customers are paying them beyond their terms. Invoice finance bridges the gap between an invoice being sent and payment being received.

Overdrafts are normally offered by banks. But sometimes, the interest rates on overdrafts can be undesirable. The bank might also want to hold a charge over the business. Instead, you can use a revolving credit facility or trade finance.

If you would like to take the next step towards improving your business’s cash flow, please visit our enquiry page. We’ll need a few details about you and the assistance you are looking for.

Or if you would like to find out more about cash flow, as well as the products we have available to you, call our brokers on 0333 242 3311. You can also email us at info@synergi-finance.co.uk.