Customer retention is something that every salesperson wants. After all, what greater validation is there than your customers trusting you enough to come back for your services, time and time again?

It’s the greatest endorsement that your company can receive. So how can you increase customer retention? And therefore use your returning customers as social proof? Simple. You keep in touch.

But while this might sound easy, there are only so many excuses that you can come up with to keep calling them. So how can you find a way of staying in your customer’s minds, without being a nag?

In answer to this question, we suggest extending the transaction process. But then wouldn’t this frustrate the customer? Well, not if the transaction is broken up into a series of installments.

When your customer pays for your solutions in cash, the transaction is over and done with quickly. And this leaves no room for you (the vendor) to keep in touch and stay in the customer’s mind.

However, when you offer a finance payment option at the point-of-sale, the opposite is the case. The customer can pay for your products and services through a series of manageable payments.

This provides your company with more touchpoints in the transaction. And it gives you a better excuse to keep calling. You can then show off your company’s exceptional customer service.

And it’s your customer service, as well as your cutting edge products, that increase your customer retention. Also, to top it off, you’re paid in full and upfront when you offer a finance payment option.

How does a finance payment option work?

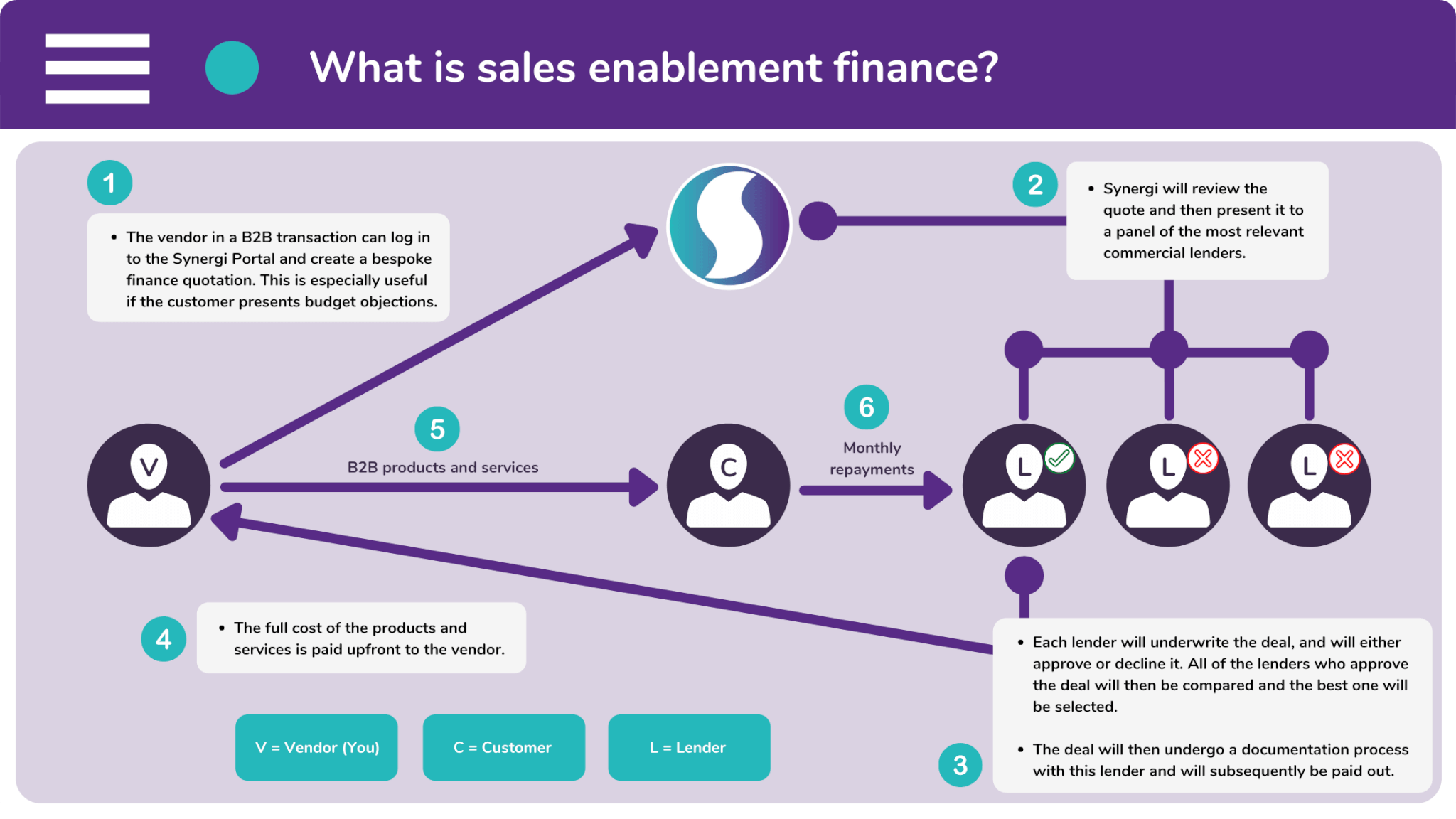

Sales enablement finance is commonly used by the sellers of B2B solutions. These vendors typically offer their customers a finance payment option in order to improve their sales performance.

B2B solutions are notoriously expensive. Therefore, salespeople often encounter budget objections and hesitation. These problems are a drain on their valuable time and stop them from closing further sales.

Sales enablement finance overcomes these obstacles by breaking costs down into a manageable series of installments. As a result, the products look much more affordable and much more appealing.

Vendors who offer finance subsequently go through quicker transactions. They receive full, upfront payment within 24 hours, giving salespeople time to make prospecting calls and pursue other opportunities.

How is this possible? Simple. We invite a commercial lender into the transaction. The lender will buy the solution from the vendor. And the customer will make their monthly repayments to them.

What online tool can increase customer retention?

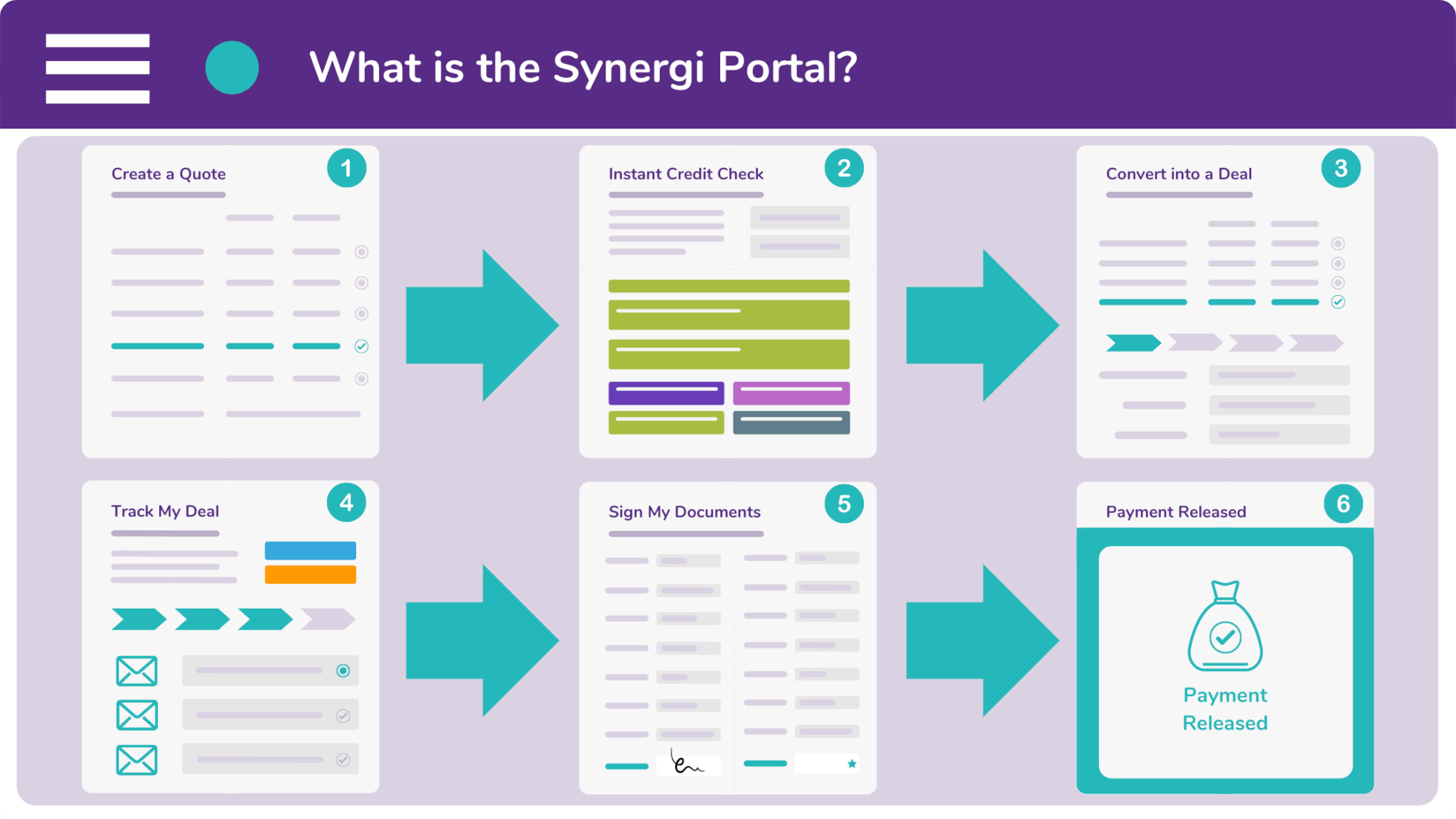

Synergi’s B2B vendors offer finance on their products and services through our multi-award winning portal. The Synergi Portal is a sales enablement tool which is free to use. And what’s more, it allows you to carry out four key functions. These include:

- Quoting

You can create a bespoke finance quotation for your customer. It will even have your company logo featured on it.

- Appraising

The Synergi Portal is integrated with Companies House and Credit Safe. You can therefore run credit appraisals on customers.

- Converting

Tell your broker that a quote has been given the green light by converting it into a deal. Synergi will then secure the finance.

- Tracking

And last of all, you can track your deals through the underwriting and documentation process. This keeps you in the know.

Do you want to start increasing your customer retention? If your answer is yes, register for a demonstration of our Partner Portal and take the first step towards becoming a Synergi Partner.

Although, if you would like to learn more about offering a point-of-sale finance option, call our brokers on 0333 242 3311. Or drop a line to our offices by emailing info@synergi-finance.co.uk.