There are three little words that can have a dramatic effect on your company’s B2B sales. And these are: sales aid finance. Sales aid finance is often referred to as ‘vendor finance’ or ‘supplier finance’.

But here at Synergi, we prefer to call it ‘sales enablement finance’. Naturally, we use this name because it has a positive impact on your sales. In fact, it can increase conversion rate by 63%.

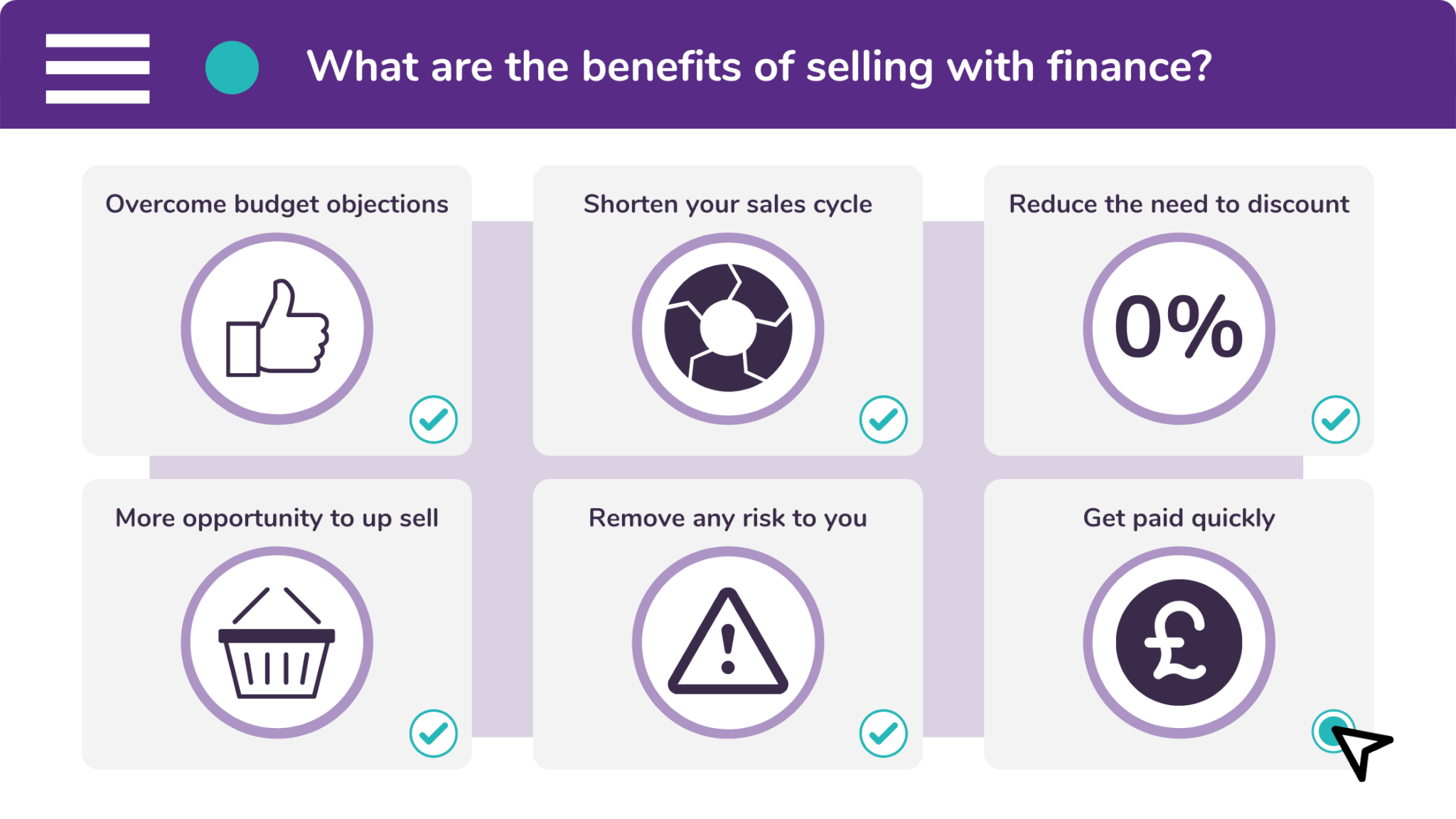

There are six benefits of sales enablement finance. And these are:

- Overcomes budget objections,

Budget objections are the number one reason why a sale does not go ahead. However, sales enablement finance overcomes this obstacle by breaking the cost down into a number of payments.

- Shortens your sales cycle,

A drawn-out sales cycle is a massive waste of a B2B salesperson’s time. But when you offer a point-of-sale finance option to your customers, your solution will look more appealing.

- Reduces the need to discount,

If you’re constantly having to offer a discount in order to convert a sale, finance can help. You will not need to offer a discount because the total cost is broken up into a series of manageable installments.

- More opportunity to up sell,

When you offer an affordable payment option, you are more able to up sell. Your customers will be more willing to add products and services to their package, at a small increase to the cost per month.

- Removes any risk to you,

When you offer ‘staged payments’, you are left waiting for payment in full. And there’s always a risk of customers not paying. But with sales enablement finance, you’re paid in full and upfront.

- And get paid quickly.

Once a customer chooses a finance payment option, you could be paid within as little as 24 hours.

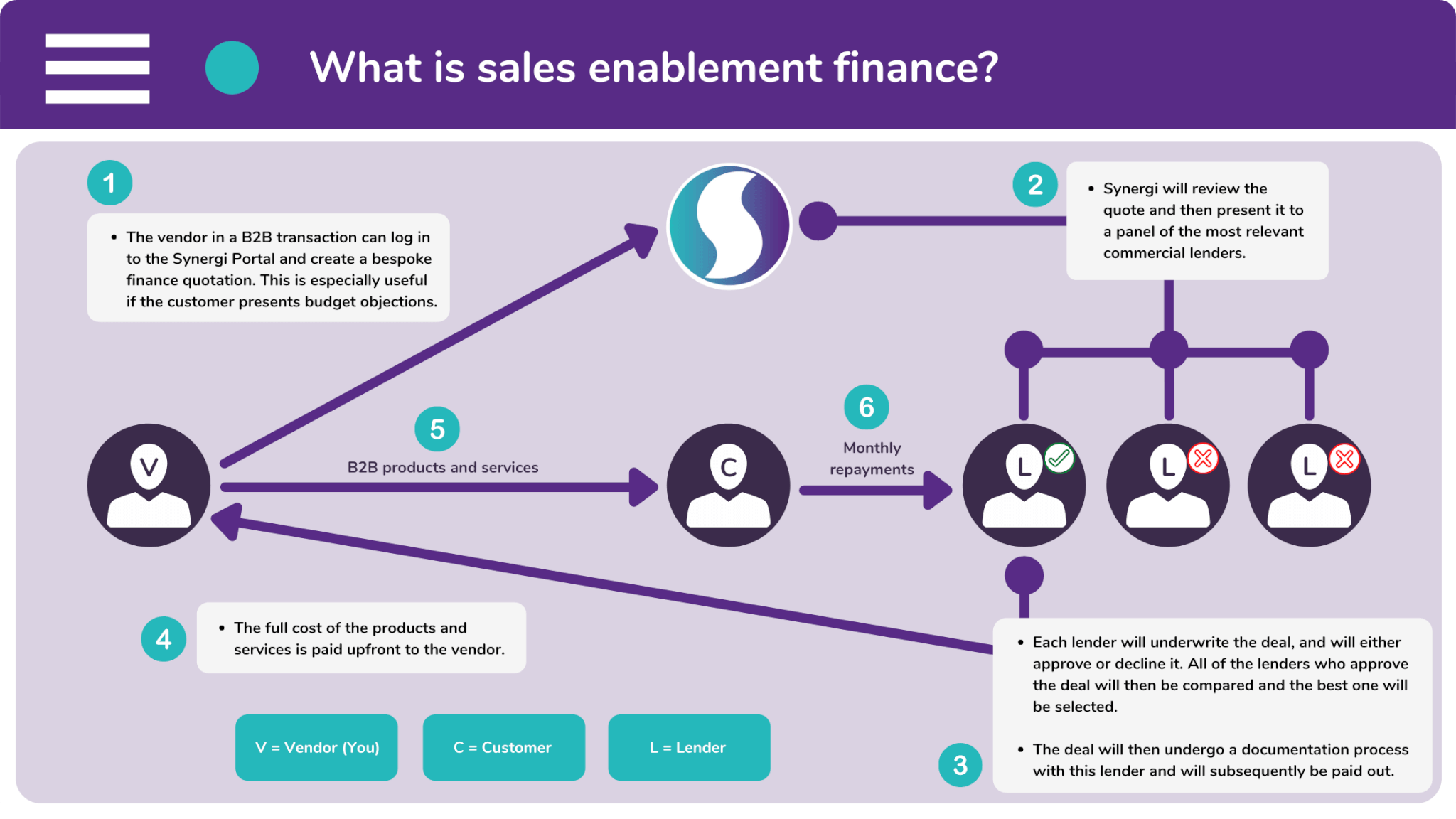

What is sales enablement finance?

Sales enablement finance is commonly used by the sellers of B2B solutions. These vendors typically offer their customers a finance payment option in order to improve their sales performance.

B2B solutions are notoriously expensive. Therefore, salespeople often encounter budget objections and hesitation. These problems are a drain on their valuable time and stop them from closing further sales.

Sales enablement finance overcomes these obstacles by breaking costs down into a manageable series of installments. As a result, the products look much more affordable and much more appealing.

Vendors who offer finance subsequently go through quicker transactions. They receive full, upfront payment within 24 hours, giving salespeople time to make prospecting calls and pursue other opportunities.

How is this possible? Simple. We invite a commercial lender into the transaction. The lender will buy the solution from the vendor. And the customer will make their monthly repayments to them.

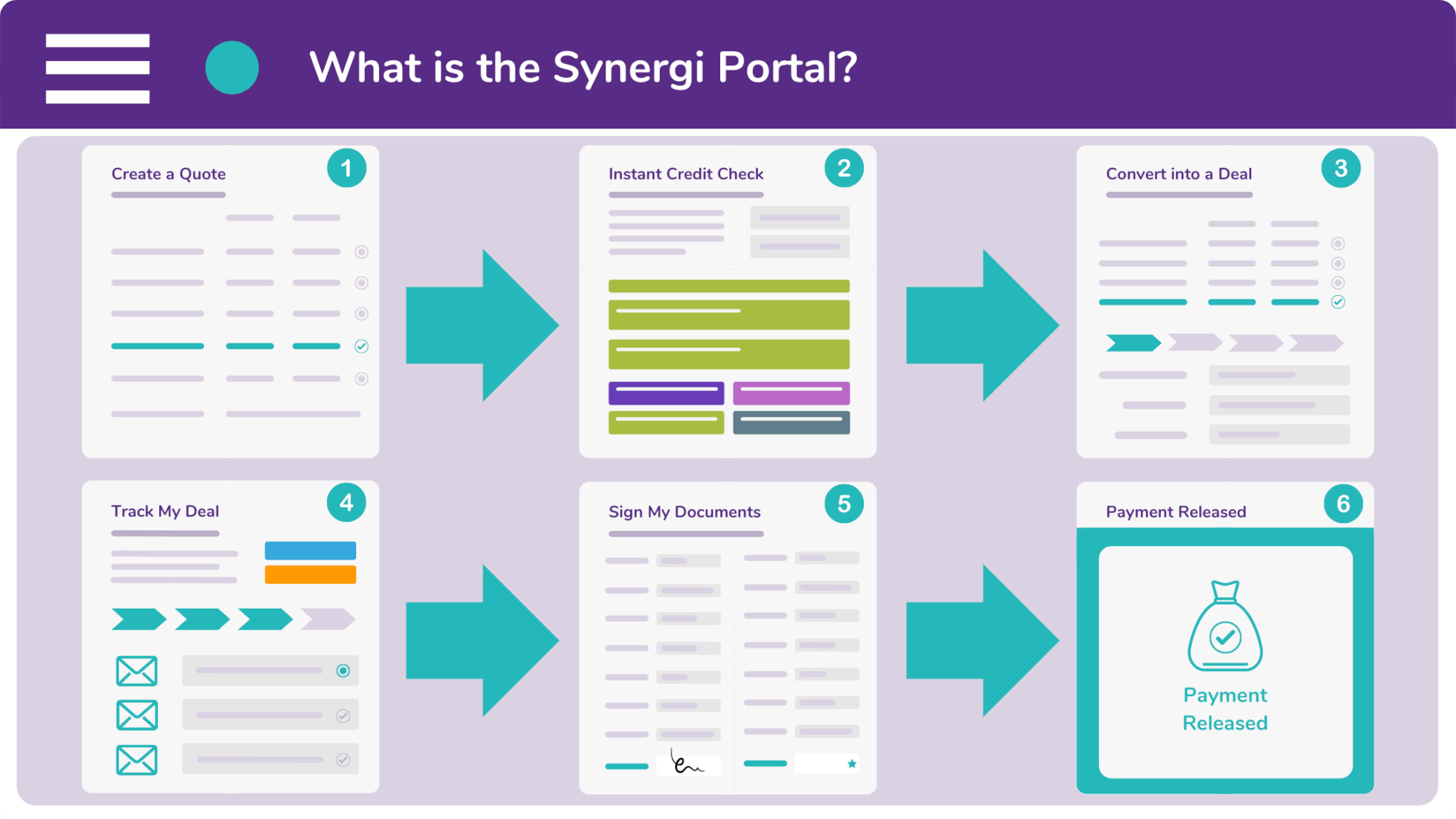

What online tool can boost your sales?

Synergi’s B2B vendors offer finance on their products and services through our multi-award winning portal. The Synergi Portal is a sales enablement tool which is free to use. And what’s more, it allows you to carry out four key functions. These include:

- Quoting

You can create a bespoke finance quotation for your customer. It will even have your company logo featured on it.

- Appraising

The Synergi Portal is integrated with Companies House and Credit Safe. You can therefore run credit appraisals on customers.

- Converting

Tell your broker that a quote has been given the green light by converting it into a deal. Synergi will then secure the finance.

- Tracking

And last of all, you can track your deals through the underwriting and documentation process. This keeps you in the know.

If you would like to improve your B2B sales performance, please visit our enquiry page. You will be directed to input your contact information, as well as some deal information (if you have one in mind).

But if your would rather speak to a human being, you can contact our friendly brokers by calling 0333 242 3311. Or drop a line to our office’s main inbox by emailing info@synergi-finance.co.uk.