The Golden Rule of Business was famously coined by the American industrialist, Jean Paul Getty. He said: “If it appreciates, buy it. If it depreciates, lease it.” But what does this phrase actually mean?

Essentially, there are two fundamental types of assets. There are appreciating assets. And there are depreciating assets. Appreciating assets grow in value. Whereas depreciating assets lose their value.

An example of an appreciating asset is a property. This will (typically) be worth more than what you paid for it in a few years’ time. Appreciating assets will look good on your company’s balance sheet.

In comparison, one example of a depreciating asset is a car. A new car will notoriously lose half its value the second it is driven off the sales court. And it will continue to lose more value over time.

However, there are some types of depreciating assets that are worth putting on your company balance sheet. And this is where we need to add a little caveat to the Golden Rule of Business.

To complicate this a little further, there are two types of depreciating assets: hard assets and soft assets. Hard assets are worth putting on your company balance sheet. Whereas soft assets are not.

Putting a soft asset on your balance sheet can actually cause it to become artificially inflated. And this is because the value you think you’ve added to your business will rapidly go down over time.

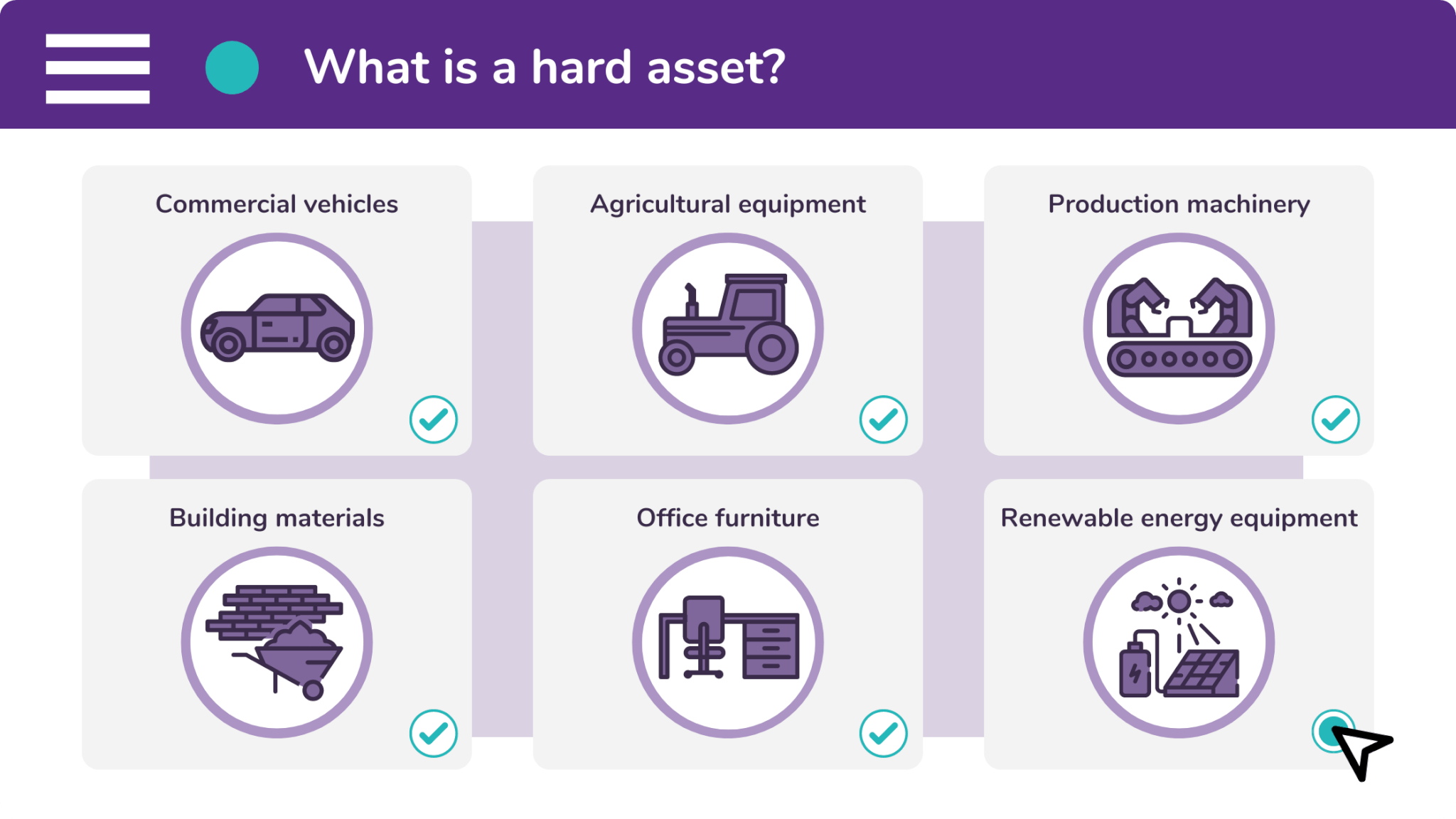

What is classed as a hard asset?

A hard asset is a product which depreciates very slowly. This means that, when the owner wants to sell the product on, it will be worth an amount of money which is closer to the original price.

Hard assets therefore retain their value much better than soft assets. What’s more, a person (or company) that has bought a hard asset will not have to find a replacement for a long time.

This is because hard assets tend to be more durable than those that we regard as soft. They are typically made out of strong materials and need to be serviced to maintain their working condition.

An example of a hard asset is a vehicle. Vehicles retain a substantial amount of value because they are not replaced very often. They are made of strong materials. And they are serviced regularly.

As well as this, hard assets hold onto more of their original value due to less competitive markets. While this cannot be said for commercial vehicles, this can be said for specialist pieces of machinery.

These too are classed as hard assets. And because manufacturers don’t often create an updated version of a specialist piece of machinery, the original model will depreciate in value very slowly.

A piece of bespoke machinery in a production line will then be classed as a hard asset. This is because there are no other products like it on the market, making it virtually irreplaceable.

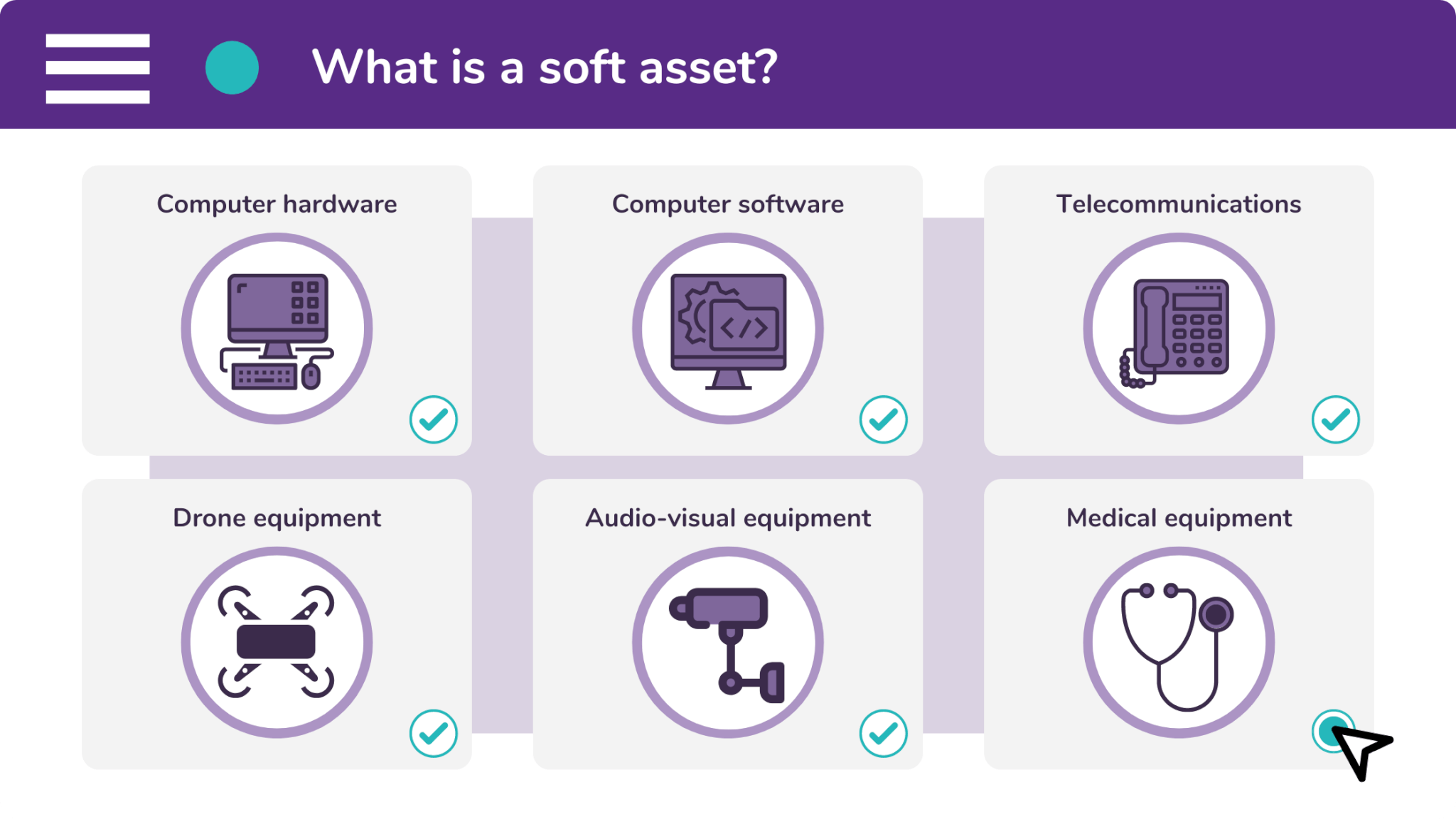

What is classed as a soft asset?

A soft asset is a product which rapidly depreciates in value. This means that when the owner wants to sell the product on, its value will have gone down dramatically when compared to a hard asset.

In addition to this, a person (or company) which has acquired a soft asset will have to buy a replacement within a short space of time. This is typically the case within three-to-five years.

Soft assets tend to be very technical and (unfortunately) consumable. An example of a soft asset is a mobile phone. They are sophisticated pieces of technology. But they aren’t known for being durable.

Furthermore, soft assets tend to have a short product life cycle. Now, a product life cycle does not refer to how long a certain product lasts. But instead refers to how long it spends on the market.

This is important because soft assets are normally situated in a competitive industry. As a consequence of this, companies will release updated versions of a product every three-to-five years.

Soft assets therefore become out-of-date very quickly and need to be replaced so that the owner can use new features. This is one reason why phone contracts tend to last two or three years.

The product owner, upon expiry of their contract, can then upgrade to the newest version of their iPhone, Samsung, Huawei, Nokia, etc. And the vendor will often take care of the outdated product.

Are you considering an investment into new assets for your business? If so, then please visit https://www.synergi-finance.co.uk/direct-finance-enquiry and input some details into our form.

Or are you a vendor of depreciating assets, who wants to offer a finance payment option at the point-of-sale? Then instead visit https://www.synergi-finance.co.uk/vendor-finance-enquiry.

If you would like to learn more about the Golden Rule of Business, contact us today.