There are two types of depreciating assets. And these include hard assets and soft assets. Hard assets hold on to their value for a long time. Whereas soft assets lose their value quickly.

Hard assets should be financed on an agreement where the borrower owns the ‘title’, like a hire purchase. But soft assets should be financed on a lease, where the borrower does not own the title.

Technology products, like computers and telecommunications, are classed as soft assets. And this is because they have a short product life cycle, meaning that they need to be replaced every few years.

There are three reasons why a soft asset (like technology) should be leased. And these include:

- You should not own the title

You shouldn’t own the title of a soft asset because it artificially inflates your balance sheet. Owning the title of an asset increases a company’s value. But if the asset is soft, any value gained is soon lost.

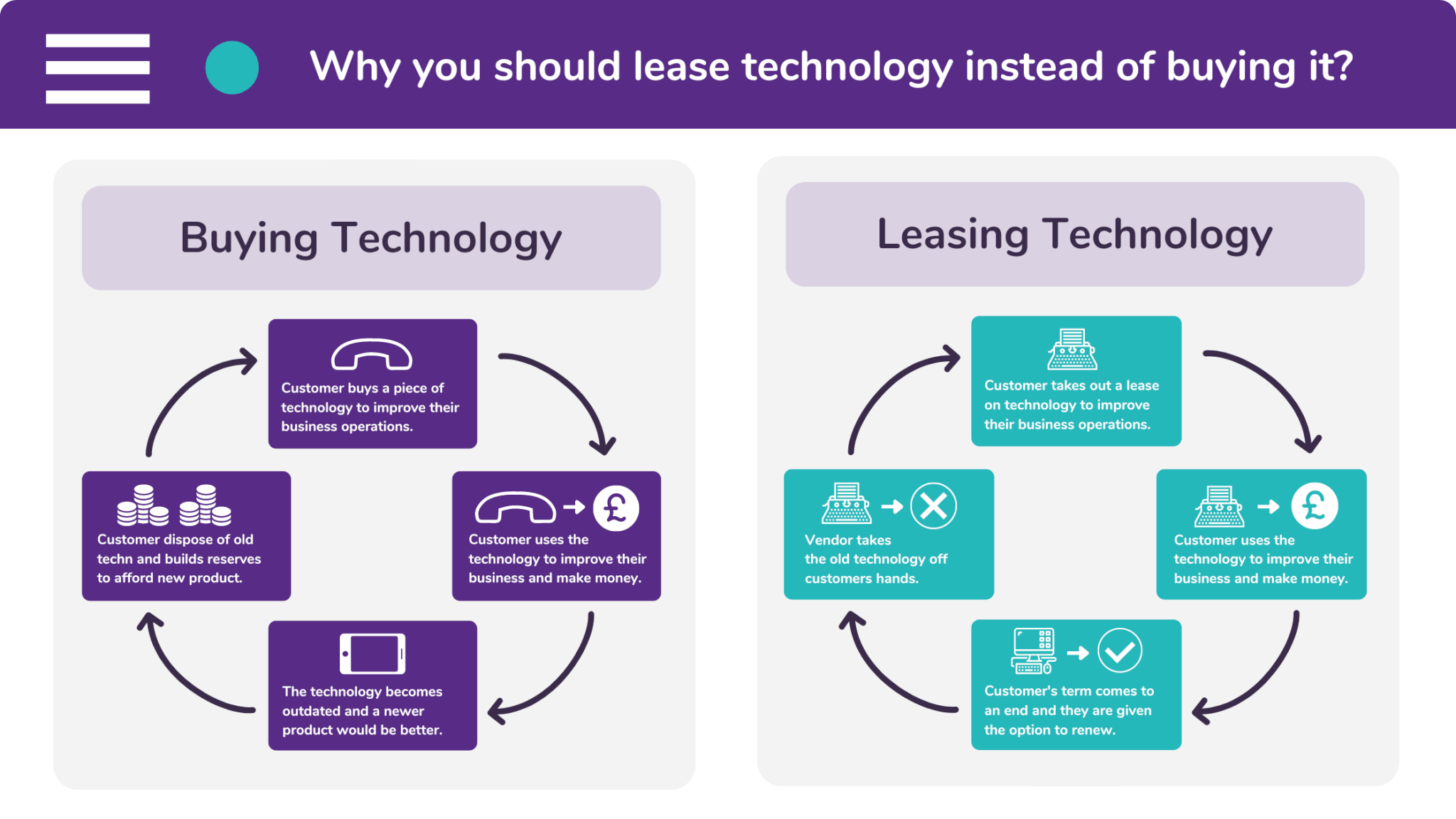

- You aren’t stuck with an outdated product

When you purchase a soft asset in cash, you will be stuck with that product in a few years, by which time it has become obsolete. You then have to find a way to sell it on and get some value back.

- You will get a renewal at the end

Oftentimes, the vendor of a soft asset will contact their customer towards the end of a lease agreement. At which point, they will be given the option to renew their lease on an updated model.

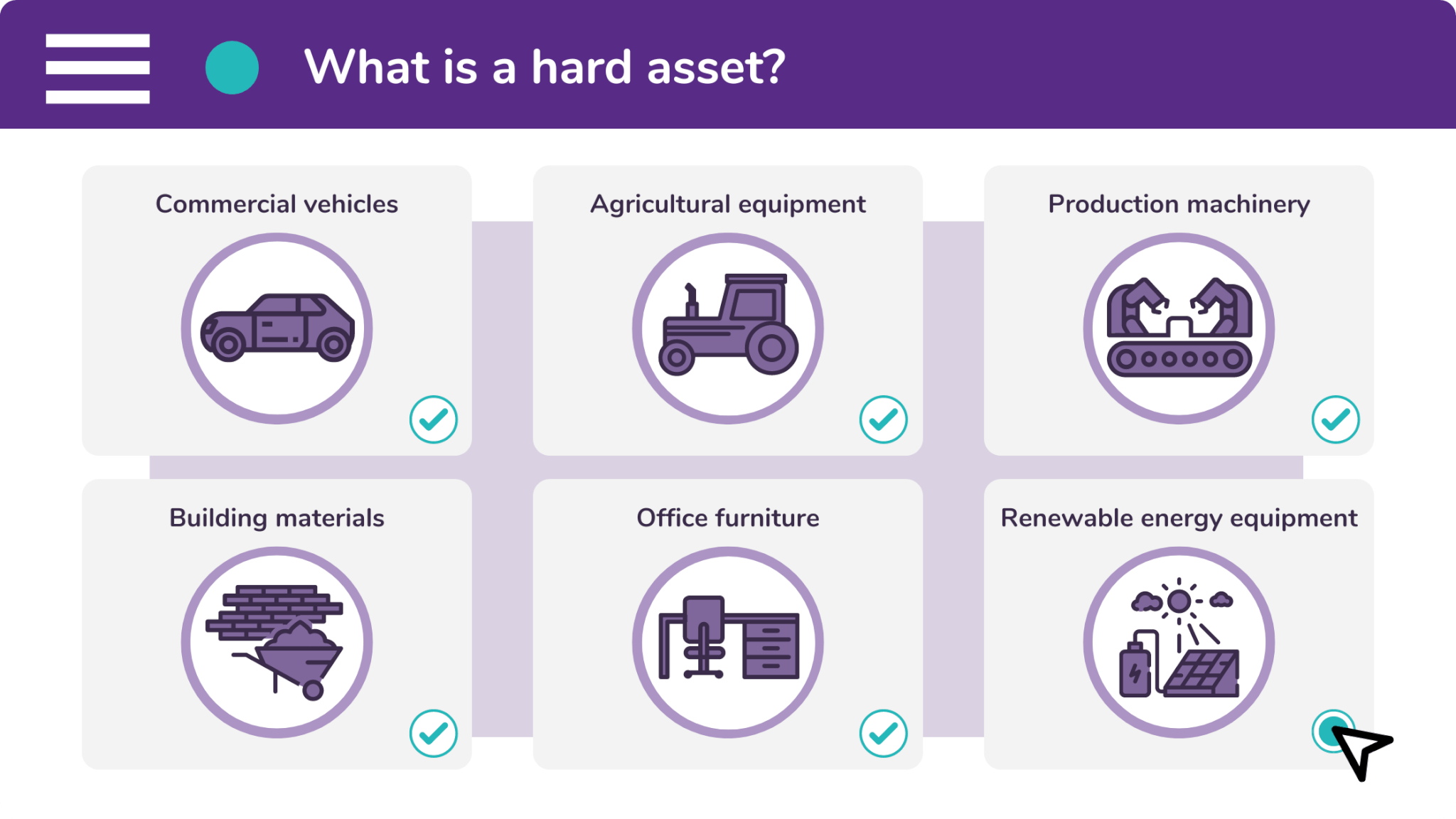

What is classed as a hard asset?

A hard asset is a product which depreciates very slowly. This means that, when the owner wants to sell the product on, it will be worth an amount of money which is closer to the original price.

Hard assets therefore retain their value much better than soft assets. What’s more, a person (or company) that has bought a hard asset will not have to find a replacement for a long time.

This is because hard assets tend to be more durable than those that we regard as soft. They are typically made out of strong materials and need to be serviced to maintain their working condition.

An example of a hard asset is a vehicle. Vehicles retain a substantial amount of value because they are not replaced very often. They are made of strong materials. And they are serviced regularly.

As well as this, hard assets hold onto more of their original value due to less competitive markets. While this cannot be said for commercial vehicles, this can be said for specialist pieces of machinery.

These too are classed as hard assets. And because manufacturers don’t often create an updated version of a specialist piece of machinery, the original model will depreciate in value very slowly.

A piece of bespoke machinery in a production line will then be classed as a hard asset. This is because there are no other products like it on the market, making it virtually irreplaceable.

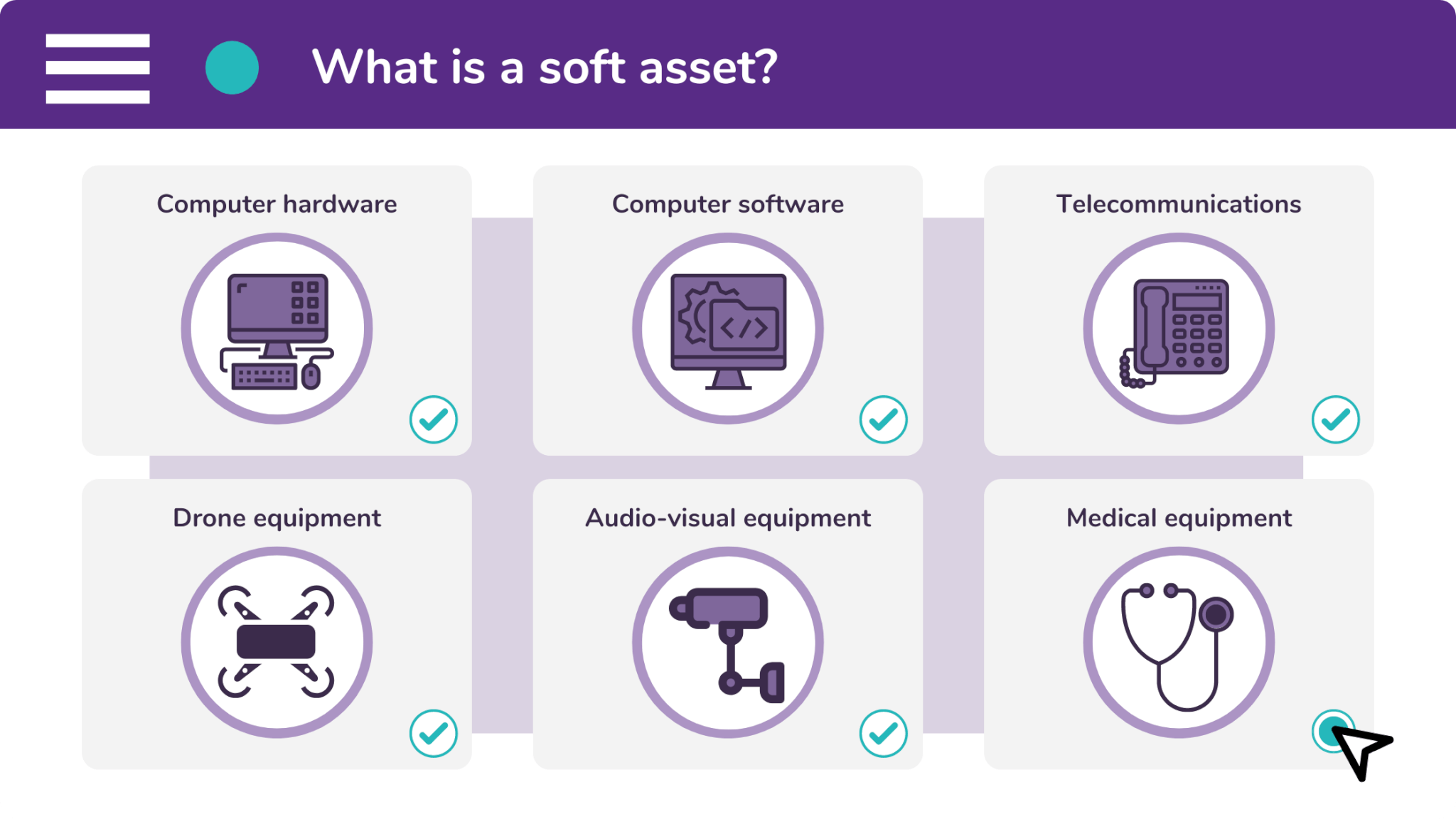

What products are classed as soft assets?

A soft asset is a product which rapidly depreciates in value. This means that when the owner wants to sell the product on, its value will have gone down dramatically when compared to a hard asset.

In addition to this, a person (or company) which has acquired a soft asset will have to buy a replacement within a short space of time. This is typically the case within three-to-five years.

Soft assets tend to be very technical and (unfortunately) consumable. An example of a soft asset is a mobile phone. They are sophisticated pieces of technology. But they aren’t known for being durable.

Furthermore, soft assets tend to have a short product life cycle. Now, a product life cycle does not refer to how long a certain product lasts. But instead refers to how long it spends on the market.

This is important because soft assets are normally situated in a competitive industry. As a consequence of this, companies will release updated versions of a product every three-to-five years.

Soft assets therefore become out-of-date very quickly and need to be replaced so that the owner can use new features. This is one reason why phone contracts tend to last two or three years.

The product owner, upon expiry of their contract, can then upgrade to the newest version of their iPhone, Samsung, Huawei, Nokia, etc. And the vendor will often take care of the outdated product.

If you’re interested in leasing a piece of technology for your company, go to https://www.synergi-finance.co.uk/direct-finance-enquiry and submit your details. We’ll be in touch with you shortly.

However, if you sell technology products and want to offer a lease payment option to your customers, visit https://www.synergi-finance.co.uk/vendor-finance-enquiry for a demo of our portal.