When Synergi Finance started trading, we broke into the IT and technology industries first. Our Managing Director, Rob Partridge, specialised in financing computer hardware and software.

And one of the first clients that Synergi took on was the HBP Group. The HBP Group consists of various IT companies, including HBP Systems, Kamarin Computers, and Jugo Systems, among others.

Kamarin Computers, one of the main businesses which make up the HBP Group, specialises in three main areas. These include IT solutions, electronic point-of-sale (EPOS), and accounting software.

The Managing Director of Kamarin, George Smith, contacted Synergi through HBP Systems. He had previously offered staged payments to his customers, adding to their packages over five years.

George stated: “Building finance into our solutions has been really important for us because some of our products are a decent investment size. They can be in the tens, or hundreds, of thousands.

“Our solutions are also arranged over a five-year cost of ownership. But the customer will want to achieve a lot during those five years. So we have had to deliver our solutions to match their cash flow.

“This has meant that in the past, our customers have gotten additional benefits as they progress through the staged payments. However, now we can bring all those benefits in from the very start.

“Finance has absolutely helped us from a sales point-of-view. It’s helped us to close more sales than we would have done. And it’s helped us to close bigger sales than we would have done as well.”

What types of payment options do Kamarin Computers offer?

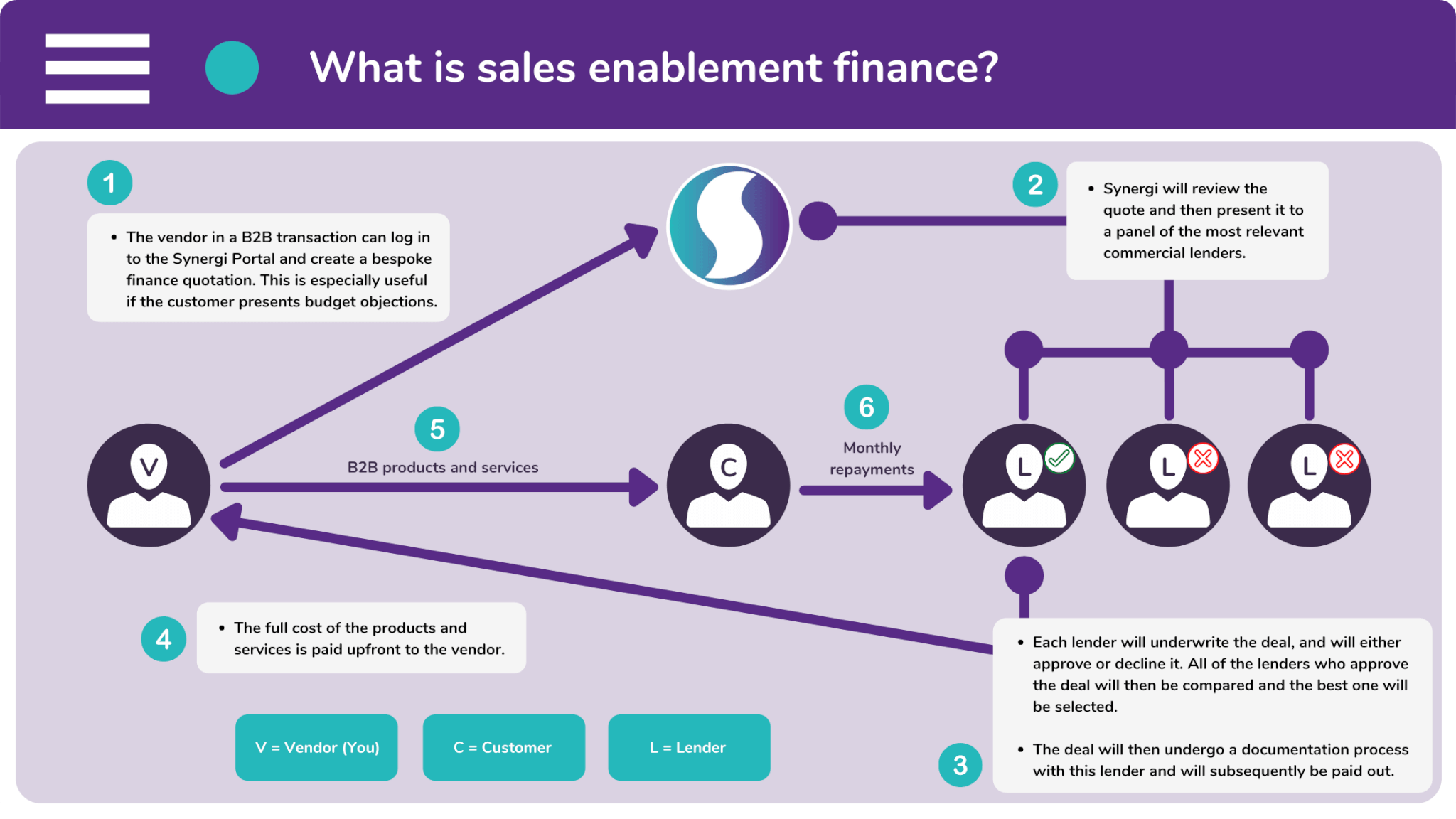

Sales enablement finance is commonly used by the sellers of B2B solutions. These vendors offer a finance payment option in order to improve their sales performance.

B2B solutions are typically expensive. Therefore, salespeople often encounter budget objections and customer hesitation. These problems are a drain on their valuable time.

Sales enablement finance overcomes budget objections by breaking costs down into a series of manageable installments. As a result, the products look much more affordable.

Vendors who offer a finance payment option experience fast transactions. They receive payment in full and upfront, giving salespeople the time to pursue other opportunities.

How is this possible? Simple. We invite a commercial lender into the transaction. The lender will buy the solution from the vendor. Then the customer will repay the lender.

Managed Service Solution Finance

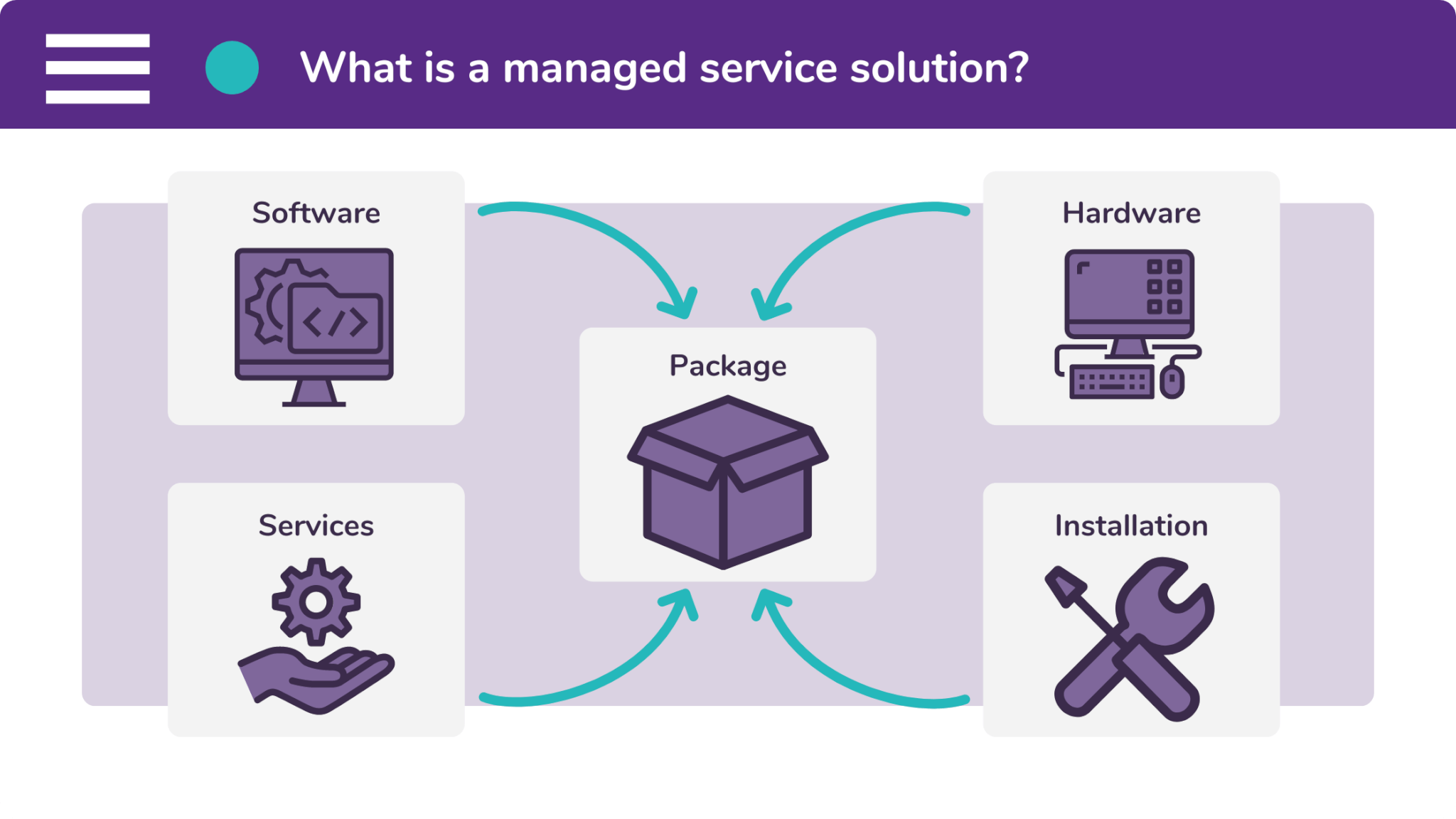

Before we explain ‘managed service solution finance’, we first need to establish what a ‘managed service solution’ is. And this is simply a bundle of both products and services.

These services include training, support, maintenance, and consultancy. These types of services are not products in themselves. Instead, they are associated to other products.

This combination of products and associated services means that the overall cost of a managed service solution is quite high. And this can lead to pesky budget objections.

To overcome budget objections, it is standard practice for the B2B vendors of managed service solutions to offer their customers a finance payment option at the point-of-sale.

This turns the combined cost of products and services into a single series of manageable payments. But in spite of this, the vendor will receive their payment in full and upfront.

How can you offer alternative payment options?

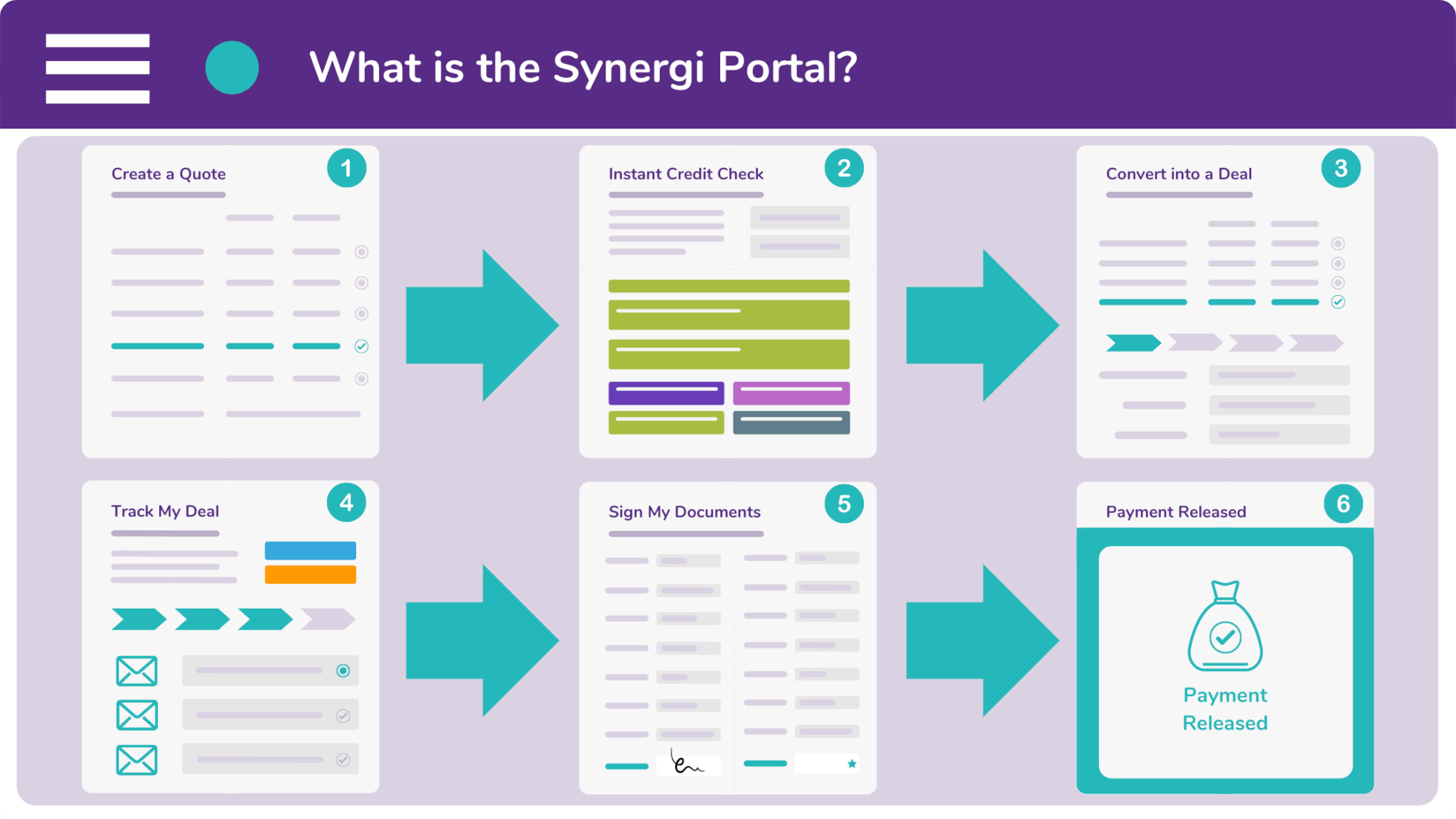

Synergi’s B2B vendors offer finance on their products and services through our multi-award winning portal. The Synergi Portal is a sales enablement tool which is free to use. And what’s more, it allows you to carry out four key functions. These include:

- Quoting

You can create a bespoke finance quotation for your customer. It will even have your company logo featured on it.

- Appraising

The Synergi Portal is integrated with Companies House and Credit Safe. You can therefore run credit appraisals on customers.

- Converting

Tell your broker that a quote has been given the green light by converting it into a deal. Synergi will then secure the finance.

- Tracking

And last of all, you can track your deals through the underwriting and documentation process. This keeps you in the know.

Register yourself for a demonstration of the Portal by submitting an enquiry. We’ll need a few contact details and some information about your deals, like what we would be financing.

But if you would rather speak to one of our friendly brokers, you can contact us on 0333 242 3311. Or email our offices at info@synergi-finance.co.uk. We look forward to working with you.