Stop doing your sales pitches on your own! Sure, it’s brave and you do get the occasional salesperson who can pull it off. But there is a better way to convert your B2B opportunities.

It’s clear why some salespeople want to handle the pitch on their own. They want all the glory. They want all the praise for getting an account onboard. And they want all the bragging rights.

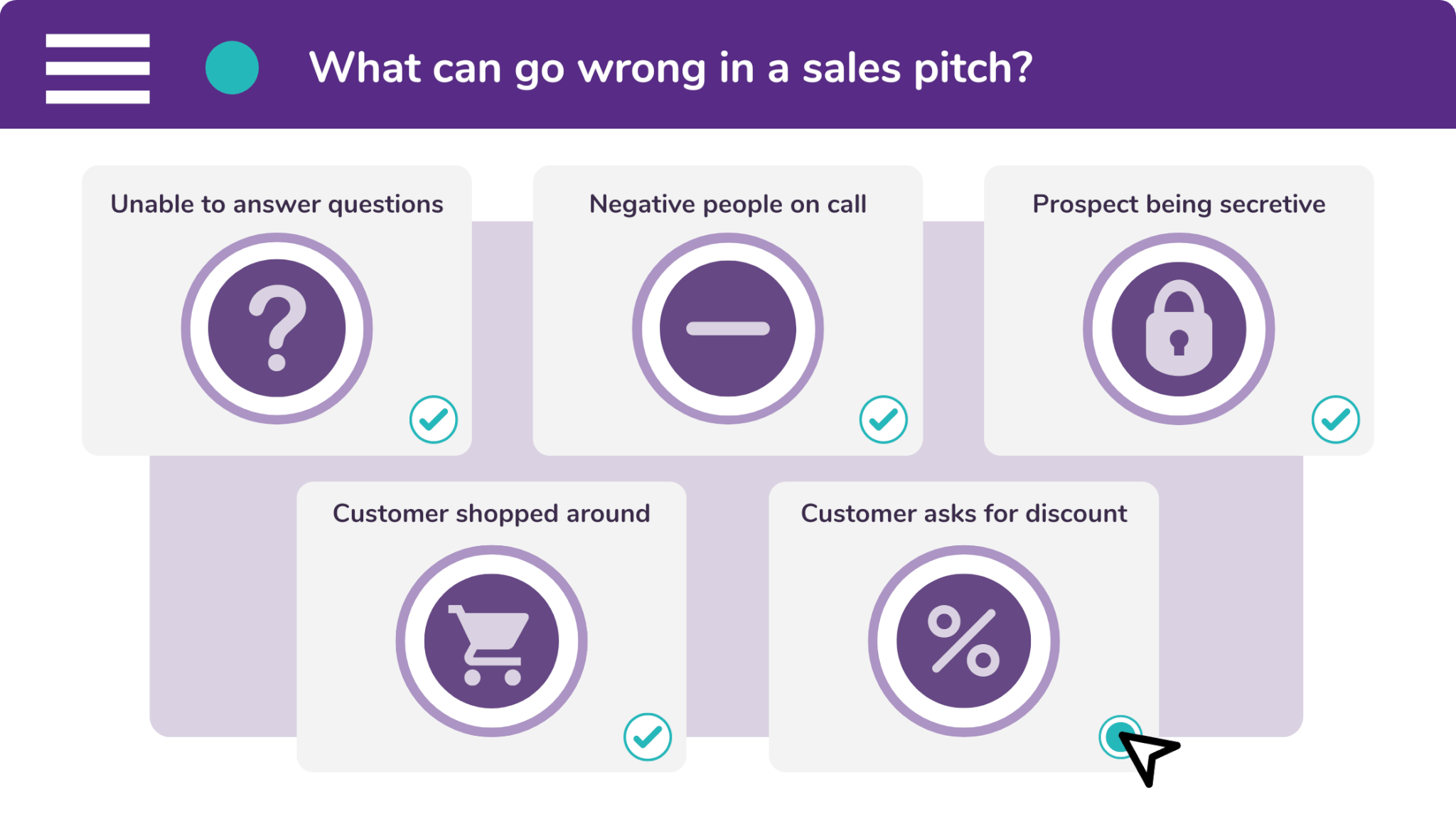

However, a sales pitch is a double-edged sword. Sure, if it goes well you’ll get all the glory. But if it doesn’t, you’ll get all the blame. And this can severely knock your confidence for other pitches too.

When you go into a pitch with back-up, not only are you sharing the responsibility, but you’re also dividing the workload as well. And when we say ‘back-up’, we don’t necessarily mean a colleague.

If you have a prospect who you think would benefit from an alternative payment solution, go in with a finance partner. You can discuss the features and benefits. And the partner can discuss payment.

You can make your company’s solutions look like a business essential. And your finance partner can make it look so affordable, that it’s a complete no-brainer. Now, doesn’t that make more sense?

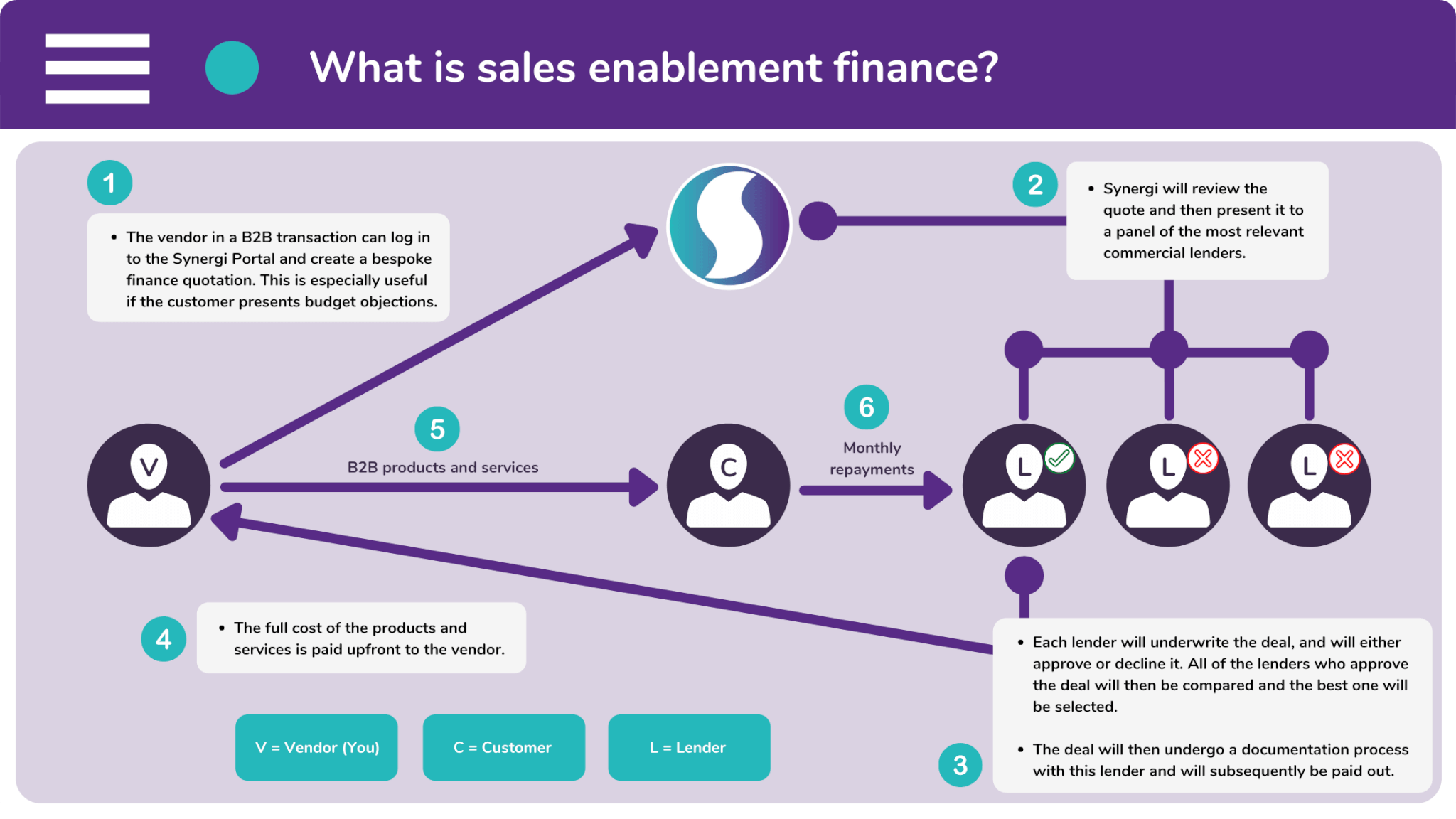

You might also be thinking, “What do you mean by an alternative payment option?” Well, did you know that your customers could pay in installments, whilst you get paid in full and upfront? This is all thanks to ‘sales enablement finance’.

What is sales enablement finance?

Sales enablement finance is commonly used by the sellers of B2B solutions. These vendors typically offer their customers a finance payment option in order to improve their sales performance.

B2B solutions are notoriously expensive. Therefore, salespeople often encounter budget objections and hesitation. These problems are a drain on their valuable time and stop them from closing further sales.

Sales enablement finance overcomes these obstacles by breaking costs down into a manageable series of installments. As a result, the products look much more affordable and much more appealing.

Vendors who offer finance subsequently go through quicker transactions. They receive full, upfront payment within 24 hours, giving salespeople time to make prospecting calls and pursue other opportunities.

How is this possible? Simple. We invite a commercial lender into the transaction. The lender will buy the solution from the vendor. And the customer will make their monthly repayments to them.

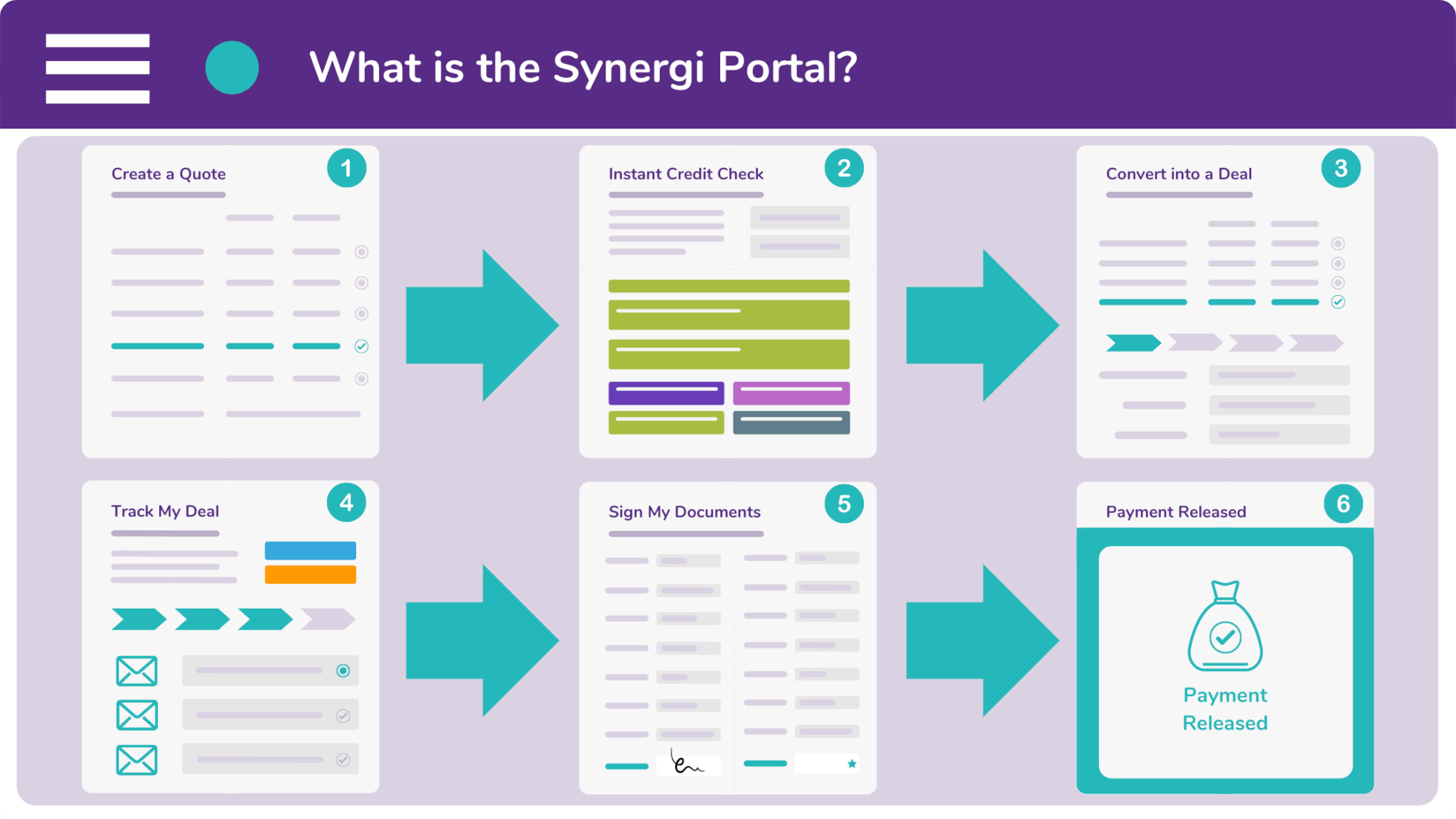

How do I offer a finance payment option for my products?

Synergi’s B2B vendors offer finance on their products and services through our multi-award winning portal. The Synergi Portal is a sales enablement tool which is free to use. And what’s more, it allows you to carry out four key functions. These include:

- Quoting

You can create a bespoke finance quotation for your customer. It will even have your company logo featured on it.

- Appraising

The Synergi Portal is integrated with Companies House and Credit Safe. You can therefore run credit appraisals on customers.

- Converting

Tell your broker that a quote has been given the green light by converting it into a deal. Synergi will then secure the finance.

- Tracking

And last of all, you can track your deals through the underwriting and documentation process. This keeps you in the know.

Do you want to improve your sales pitches and make your products look more affordable? If you do, then you should submit an enquiry with Synergi Finance for a demonstration of our Partner Portal.

One of our friendly brokers will be in touch within two working days. Although, you can call them to discuss your requirements on 0333 242 3311. Or email our offices at info@synergi-finance.co.uk.