Do you work in B2B sales? If so, have you ever lost out on an opportunity? If you have, don’t worry. It happens to the best of us. After all, selling expensive B2B products and services is a tricky business.

There are various reasons why an opportunity might be lost. In fact, we’ve identified five of them:

- Budget objections

Budget objections are the chief reason why salespeople lose an opportunity. According to our research, 63% of lost opportunities in the world of B2B sales are lost due to budget objections.

- Competitors stealing customers

B2B products and services tend to fall into very competitive industries. Therefore, you might find that a competitor has swooped in and offered a cheaper rate. Competition makes up for 12% of lost sales.

- Not the right product

Sometimes, the customer hasn’t done their homework. They call a salesperson, adamant they need a certain product. And then at the last minute, they’ve gotten it wrong. This covers 5% of lost sales.

- Bad sales technique

Whether it’s due to a lack of training, nerves, or (on the odd occasion) arrogance, sometimes a lost opportunity is down to a poor sales technique. And sadly, this accounts for 9% of lost customers.

- No urgency from the customer

And finally, there is a lack of urgency from the customer. This is actually the third most common reason for missing out on a sale. And this comprises 11% of all lost opportunities in B2B sales.

However, in spite of these five problems, there is a solution that can increase your conversion rate. And that solution goes by the name of ‘sales enablement finance’, sometimes called ‘vendor finance’.

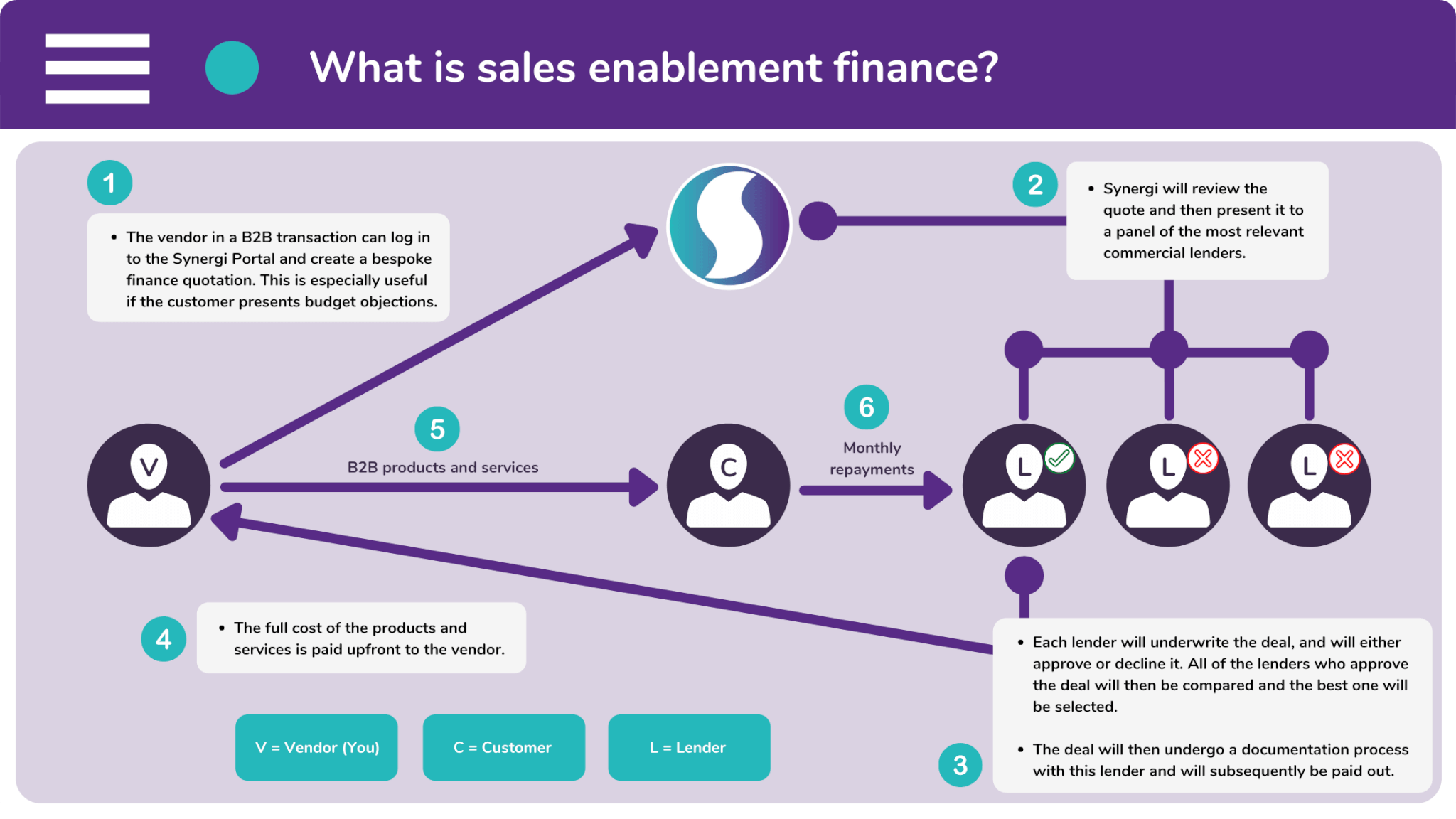

What is sales enablement finance?

Sales enablement finance is commonly used by the sellers of B2B solutions. These vendors typically offer their customers a finance payment option in order to improve their sales performance.

B2B solutions are notoriously expensive. Therefore, salespeople often encounter budget objections and hesitation. These problems are a drain on their valuable time and stop them from closing further sales.

Sales enablement finance overcomes these obstacles by breaking costs down into a manageable series of installments. As a result, the products look much more affordable and much more appealing.

Vendors who offer finance subsequently go through quicker transactions. They receive full, upfront payment within 24 hours, giving salespeople time to make prospecting calls and pursue other opportunities.

How is this possible? Simple. We invite a commercial lender into the transaction. The lender will buy the solution from the vendor. And the customer will make their monthly repayments to them.

How do I offer a finance payment option for my products?

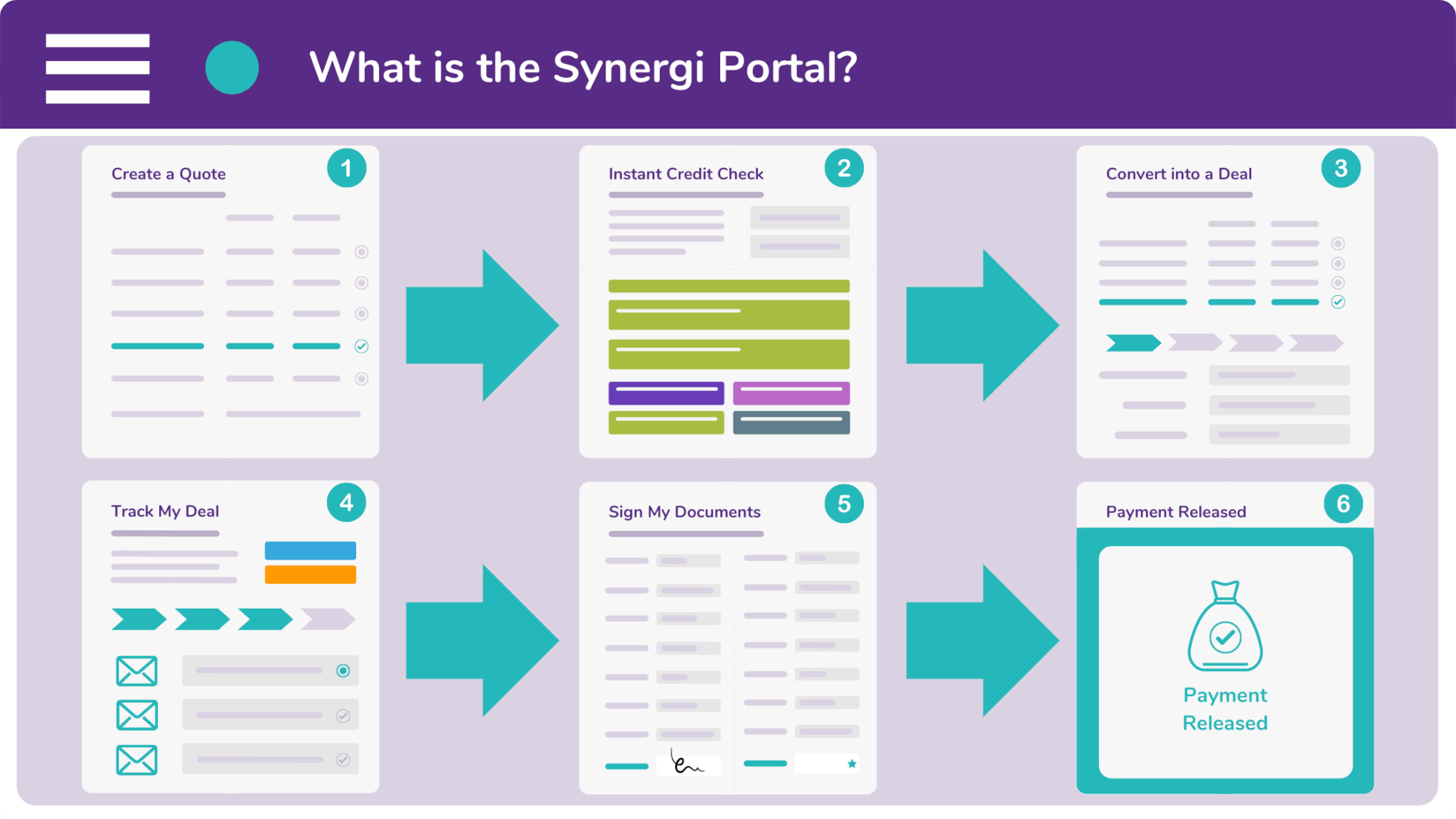

Synergi’s B2B vendors offer finance on their products and services through our multi-award winning portal. The Synergi Portal is a sales enablement tool which is free to use. And what’s more, it allows you to carry out four key functions. These include:

- Quoting

You can create a bespoke finance quotation for your customer. It will even have your company logo featured on it.

- Appraising

The Synergi Portal is integrated with Companies House and Credit Safe. You can therefore run credit appraisals on customers.

- Converting

Tell your broker that a quote has been given the green light by converting it into a deal. Synergi will then secure the finance.

- Tracking

And last of all, you can track your deals through the underwriting and documentation process. This keeps you in the know.

Do you want to turn your sales fails around? Then request a demo of the Synergi Portal by visiting our enquiry page and submitting your details. A representative will be in touch with you shortly.

Alternately, you can contact our offices by calling 0333 242 3311. Or email us at info@synergi-finance.co.uk. Our friendly brokers will gladly answer any questions that you have.