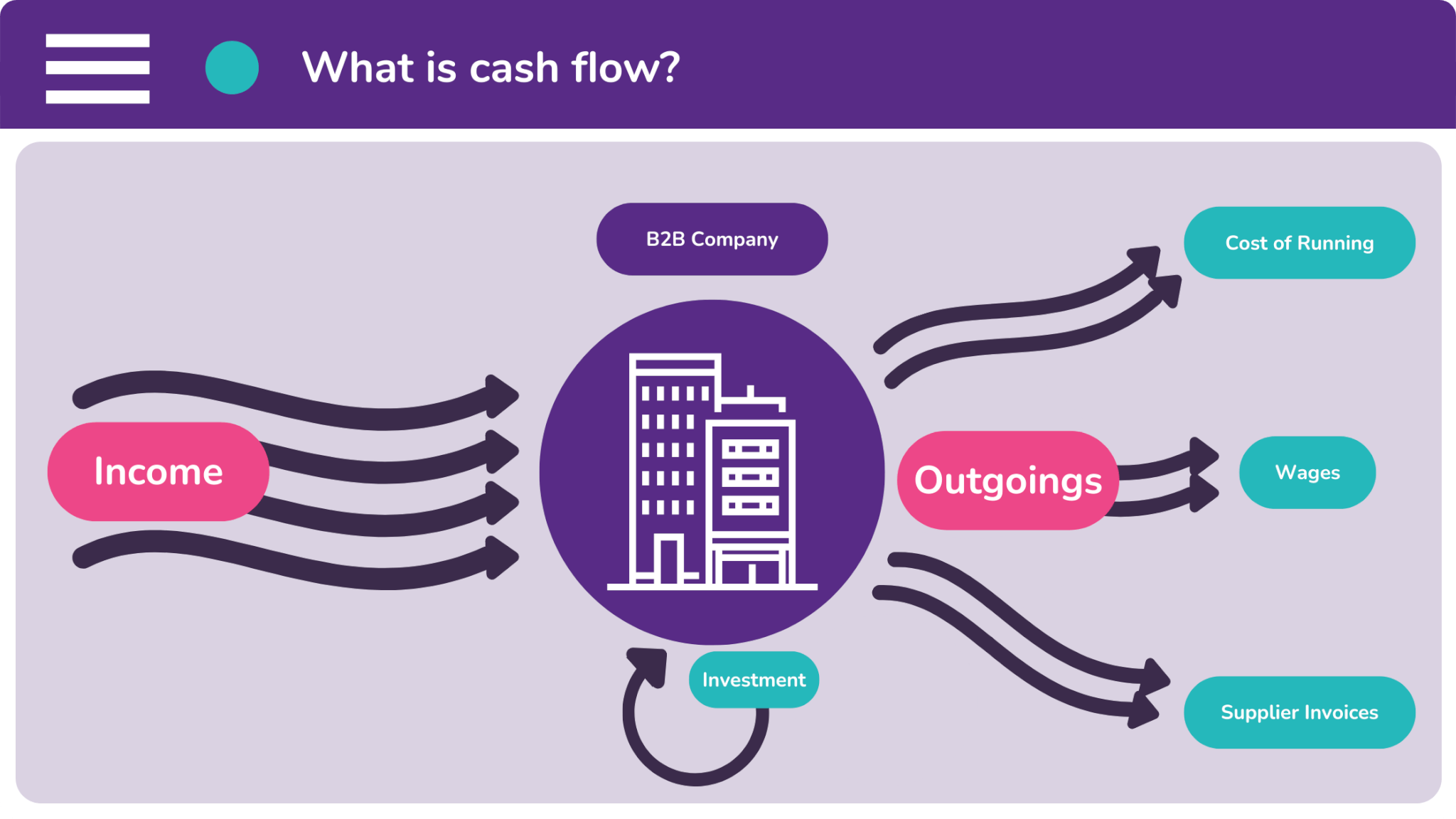

What’s your business model?

Most companies simply exchange their goods and services for cash. But you should really take a look at how you ask your customers to pay, as well as how you then manage your business’s earnings.

If you’re just starting up your company, it can be difficult to solidify your business plan. After all, it typically comes down to trial and error. Some of the veteran owners amongst you can attest to this.

However, if you want to save yourself some time and money, you should put your company’s cash flow at the forefront of your plans. Get into this head space by saying the phrase: “Cash flow is king.”

Keeping the cash flowing through your business is imperative to both your company’s survival and its growth. Without a healthy cash flow, business stalls and your decisions and judgements are clouded.

It’s okay if you weren’t aware of this. The people who start businesses are experts in their field, whether that’s software or pharmaceuticals. You’re not finance gurus or commercial strategists.

With that in mind, you should stick to the five fundamental rules of good business practice.

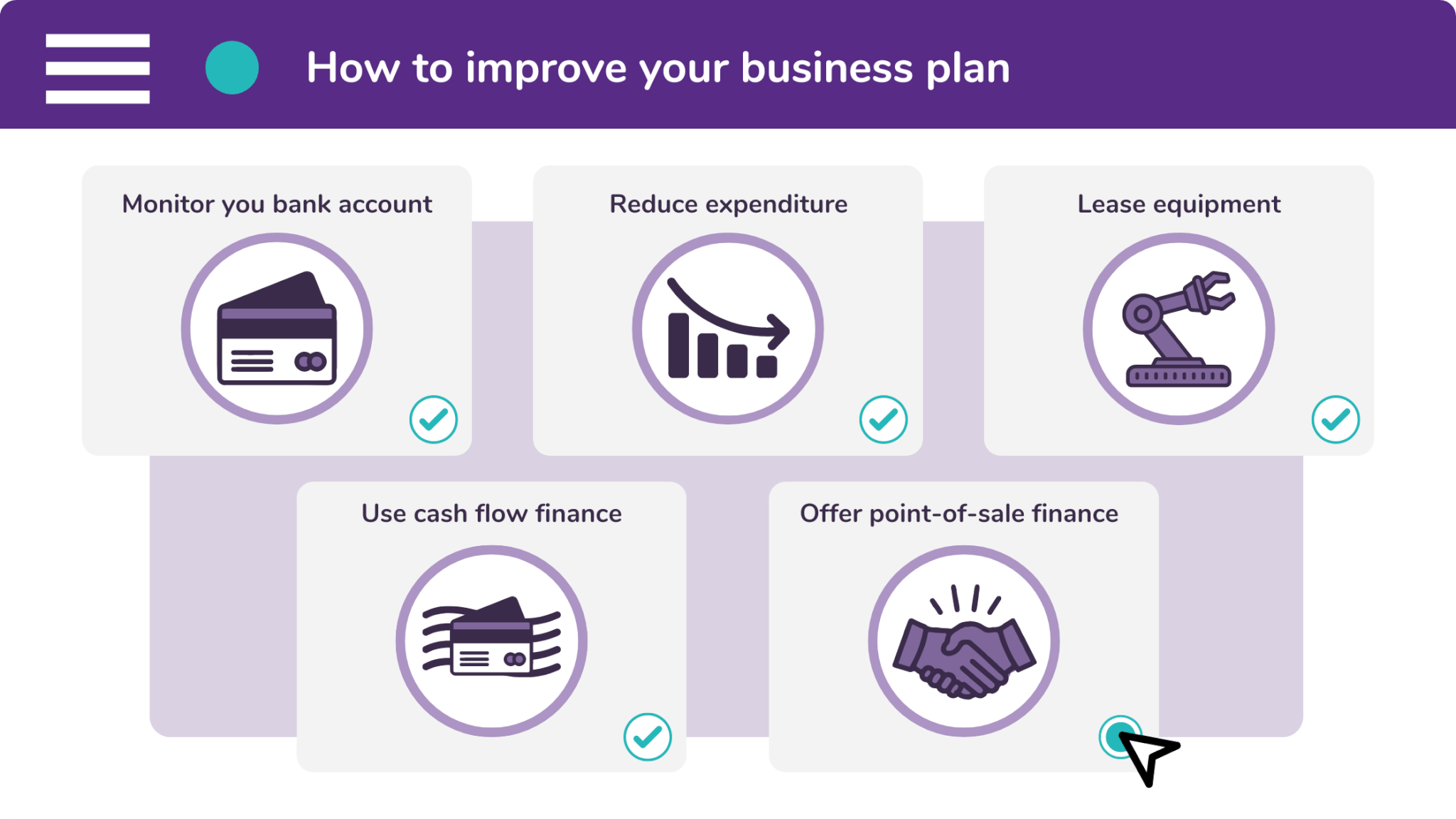

How to Improve Your Business Plan

To make sure that you’re keeping an eye on your cash flow, we suggest that you do five things:

- Number 1 – Monitor your bank account every day,

You should keep a handle on your company’s incomings and outgoings. Just because it’s considered normal to give your customers thirty days’ worth of credit, doesn’t mean that you have to abide by it.

- Number 2 – Cut down on unnecessary expenditure,

There is always unnecessary expenditure in a business. Whether that comes down to inefficient assets, over-staffing, or even poorly thought-out processes. Separate the wheat from the chaff.

- Number 3 – Lease business equipment instead of buying it,

Don’t sink your hard-earned cash into depreciating assets. You should finance equipment over the course of it’s economic life. That way, your company won’t be stuck with old, outdated products.

- Number 4 – Use cash flow finance to reduce your debtor days,

You can bridge the gap between an invoice being sent and a payment being received with invoice finance. You could also smooth out trade with a flexible finance facility, such as revolving credit.

- And Number 5 – Offer a point-of-sale finance option to your customer.

By offering your customer an affordable monthly payment plan, you swiftly overcome budget objections, bringing the deal closer to you, and taking it away from any of your competitors.

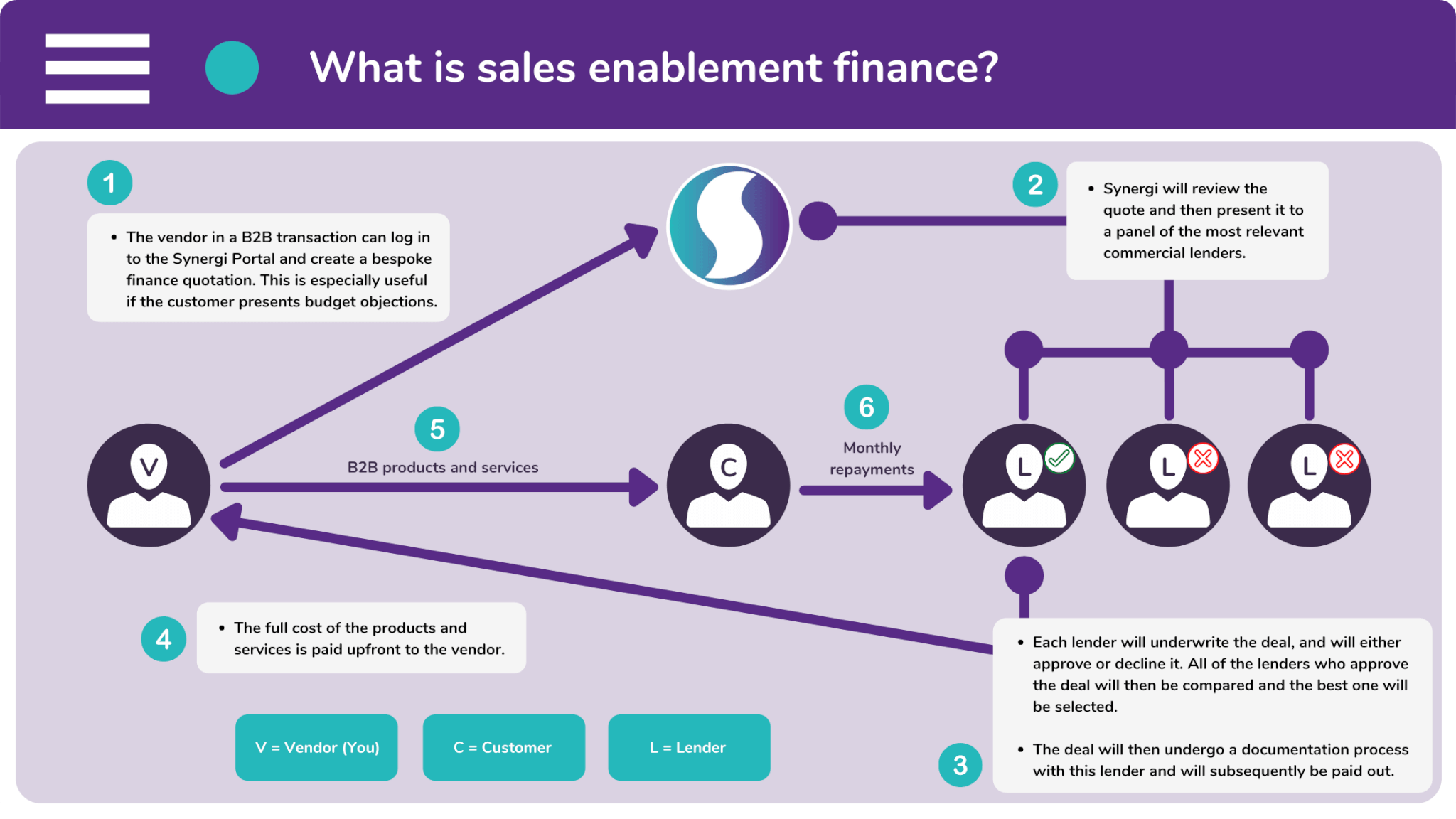

What is Sales Enablement Finance?

Sales enablement finance is commonly used by the sellers of B2B solutions. These vendors typically offer their customers a finance payment option in order to improve their sales performance.

B2B solutions are notoriously expensive. Therefore, salespeople often encounter budget objections and hesitation. These problems are a drain on their valuable time and stop them from closing further sales.

Sales enablement finance overcomes these obstacles by breaking costs down into a manageable series of installments. As a result, the products look much more affordable and much more appealing.

Vendors who offer finance subsequently go through quicker transactions. They receive full, upfront payment within 24 hours, giving salespeople time to make prospecting calls and pursue other opportunities.

How is this possible? Simple. We invite a commercial lender into the transaction. The lender will buy the solution from the vendor. And the customer will make their monthly repayments to them.

Do you want to focus your business plan on your company’s cash flow? Submit an enquiry on our website and begin offering a point-of-sale finance option at no cost to you or your B2B customers.

Although, if you would like to find out more about sales enablement finance before you commit to offering it, call one of our friendly brokers on 0333 242 3311. Or email info@synergi-finance.co.uk.