What’s your company’s credit score?

It’s a bit sensitive isn’t it? It can be uncomfortable to share this all important number, which shows how good you are with money. And people don’t like revealing their ‘numbers’, let alone businesses.

Just take your weight as an example. People aren’t very open to talk about it. In fact, they can be very defensive. And this is just one way in which your finances and your health are very similar.

In addition to these being sensitive numbers, they can also be very misleading. Looking back at your weight, the number on the scale might look ideal. But that doesn’t necessarily mean that you are fit.

After all, just because you aren’t overweight doesn’t mean that you can run a marathon. And it’s the same with credit. Just because the number looks good, doesn’t mean you’ll be approved for finance.

Your weight can be a healthy number and you can be very unfit. Just as your credit can be healthy, yet your finances can also be unsupportive. So, what actually makes a business financially fit?

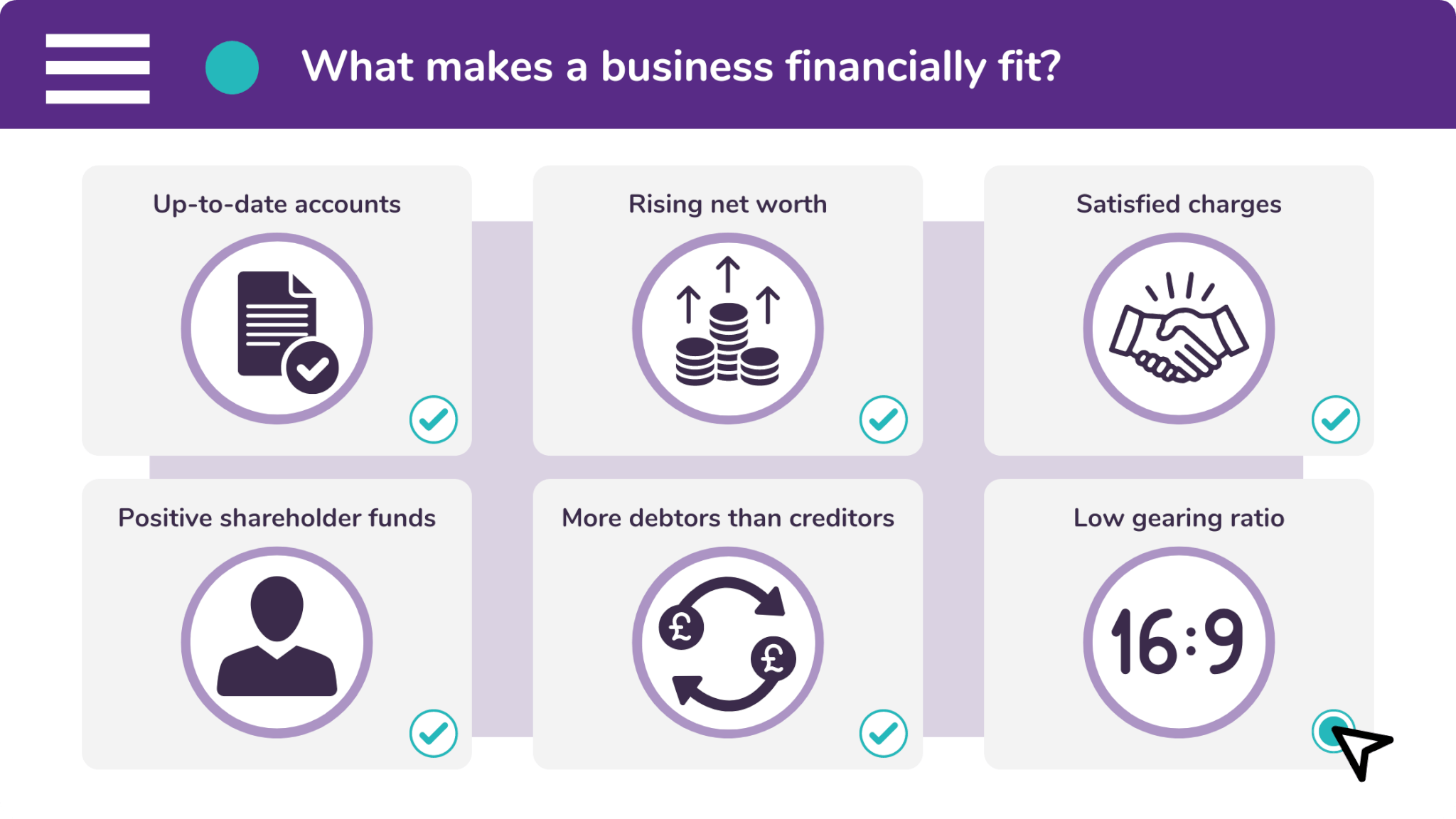

What makes a business financially fit?

There are six things, besides credit score, which tell you whether you are financially fit. These are:

- Up-to-date accounts

Your accounts are a collection of documents which show how you performed over the accounting period. Everyone should deliver their accounts to Companies House at the end of the financial year.

- Consistently rising net worth

Your company’s net worth is an illustration of all the assets that your company owns (minus the total liabilities). A company which has a growing net worth is viewed as both healthy and sustainable.

- Satisfied charges

If your company has had charges sent to them (such as an invoice) and has successfully paid them, it works in your favour. This is because it shows that your company can comfortably pay what it owes.

- Positive shareholders’ funds

When you’re applying for finance from a commercial lender, they will prefer it if your company’s shareholders have plenty of funds. This is because the lender can ask for security or a guarantee.

- More debtors than creditors

When you have more debtors than creditors, it means that more people owe you money than you owe other people money. This is typically illustrated in a ‘Creditors and Debtors Report’.

- Low gearing ratio

And finally, a low gearing ratio is an indication that there isn’t a great deal of debt in your business. Naturally, lenders will like this because it shows that you don’t have many other financial burdens.

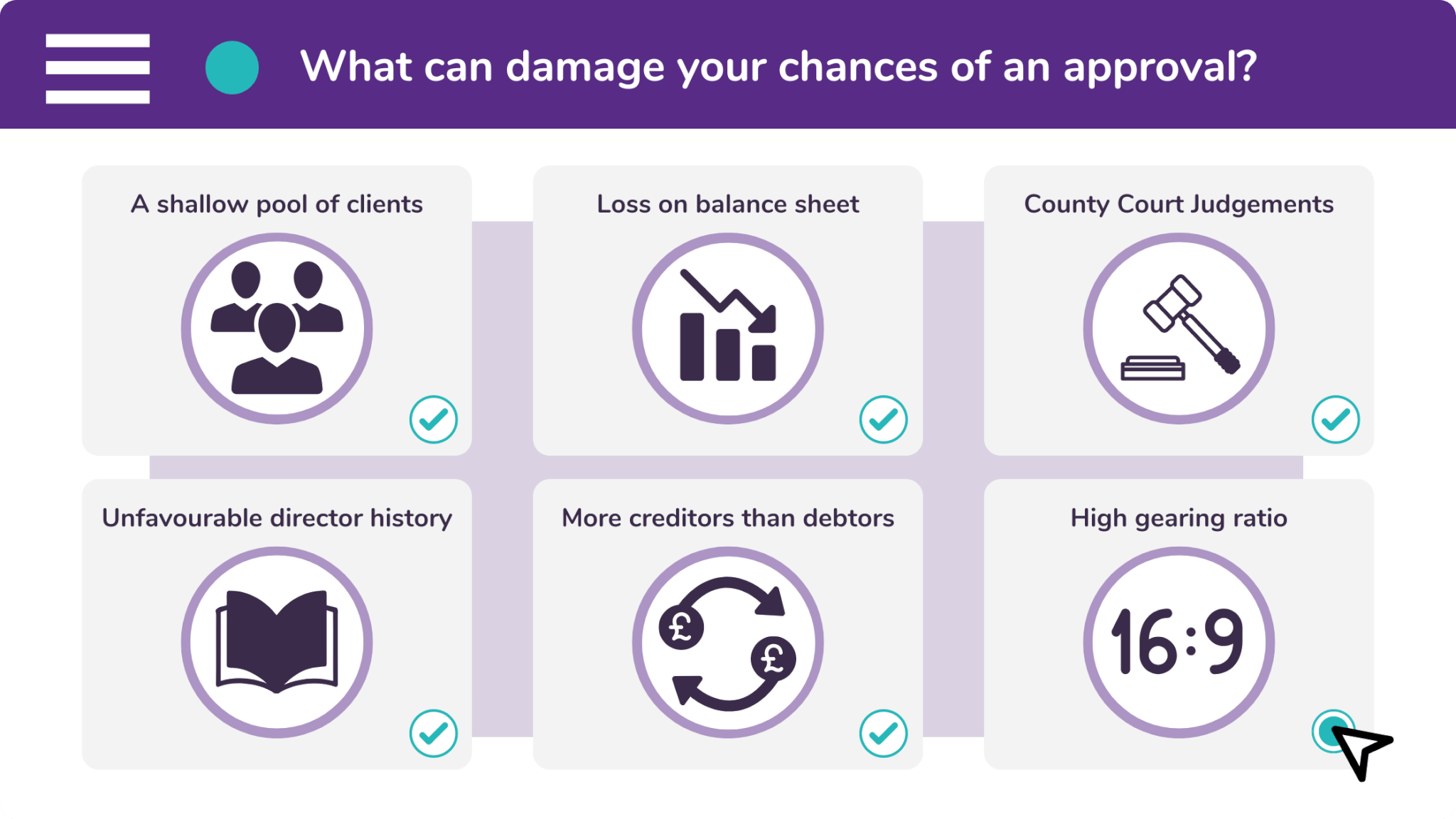

What can damage your chances of an approval?

Likewise, there are six things which tell lenders whether you are financially unfit. These are:

- A shallow pool of clients

A shallow pool of clients is the first pitfall that lenders look for. If you deal with a small client base, you become dependent on them. As the old saying goes, “Don’t put all your eggs in one basket.”

- Loss on the company balance sheet

When your company’s balance sheet indicates a loss, it means that your business has lost some of its value. This can be a sign of poor performance. Or having to sell assets to pay off other debts.

- County Court Judgements (CCJs)

A CCJ is an immediate red flag! Lenders will not consider any businesses which have outstanding CCJs. This is because leaving them unpaid is an indication that you cannot afford to pay them off.

- Unfavourable director’s history

Lenders are guaranteed to look into a director when their company is seeking finance. If the director previously owned businesses which became insolvent, it can harm your chances of an approval.

- More creditors than debtors

If you have more creditors than you have debtors, you owe more people money than people owe you money. This shows lenders that you have other financial responsibilities, which is unfavourable.

- High gearing ratio

And last of all, a high gearing ratio means that there is a lot of debt in a business. If your company cannot afford to pay these debts, a lender will not feel confident lending you money.

How can you improve your financial fitness?

- File your latest accounts

A commercial lender will ask for your latest accounts. Therefore, if you deliver your accounts to Companies House every year, it saves you from having to dig these out and it shows consistency.

- Satisfy any outstanding CCJs

As we’ve already mentioned, CCJs are an enormous red flag. So you should satisfy these as soon as you’re aware of them. A CCJ on your history isn’t ideal but removing it should resolve any issues.

- Diversify your customer base

When you have an extensive customer base, it shows that you have no issues with finding new customers. We would suggest building this, through activities like marketing and telesales.

- Invest in company assets

To cap things off, we would also recommend that you invest in more business assets. When you acquire the ‘title’ of these, the assets will go on your company balance sheet and increase its value.

Do you want to improve your financial fitness? If the answer is yes, you should speak to one of our friendly finance brokers. You can do this by submitting your interest on our website’s enquiry page.

Alternatively, you can call us on 0333 242 3311. Or email our offices at info@synergi-finance.co.uk.