Are you in the market to borrow some money?

But are you concerned by the possibility of a decline affecting your company’s credit score?

If this is the case, we would like to invite you to play something called the ‘Risk and Reward Game’.

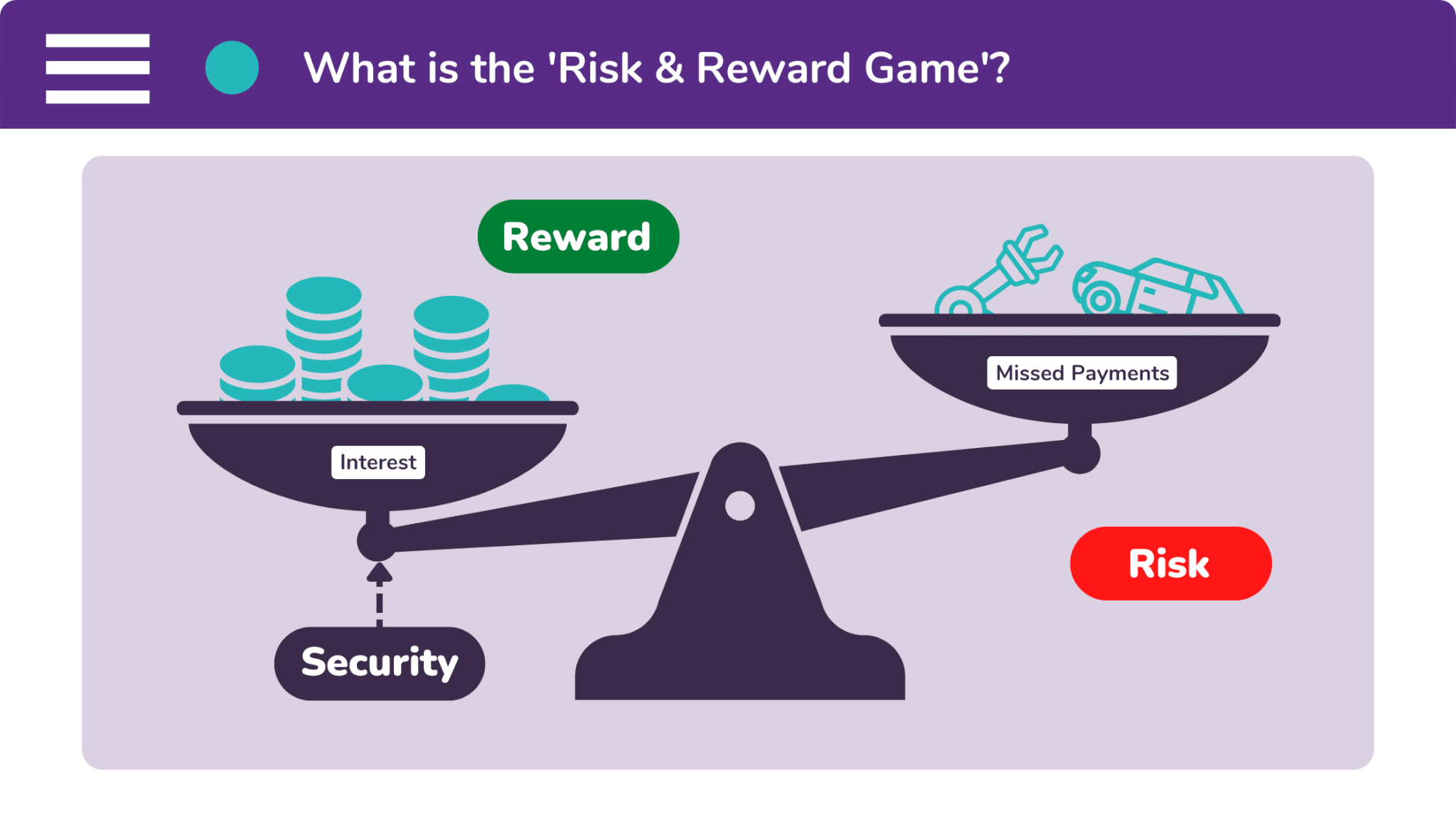

The ‘Risk and Reward Game’ is something that lenders play to determine whether they are going to lend you money. It’s basically the same as weighing up your options before placing a bet.

To simplify things, just ask yourself this: “What do lenders do?” It’s simple, right? They lend money.

This is what makes lenders a lot like gamblers, they take a risk in the hopes of being rewarded. The risk in this case is lending money and not being repaid. Whilst the reward would be earning interest.

Although, like any good gambler, lenders try to offset this risk with security.

Now that we’ve established what a lender does, ask yourself: “What do I (a business owner) do?”

Obviously, you exchange products and services for money. And doesn’t that make you a gambler as well? After all, customers can sometimes skip payment. Or, at least, take a very long time to pay.

So, how do you balance this risk of not getting paid against the reward of earning cash?

Well, like a lender, you offset it with security. Don’t you see? We all want the same thing.

However, in the world of finance, a lender wants to take as much security as possible. Whereas you (the borrower) want to give away as little security as possible.

How does the ‘Risk and Reward Game’ work?

Let’s create an example.

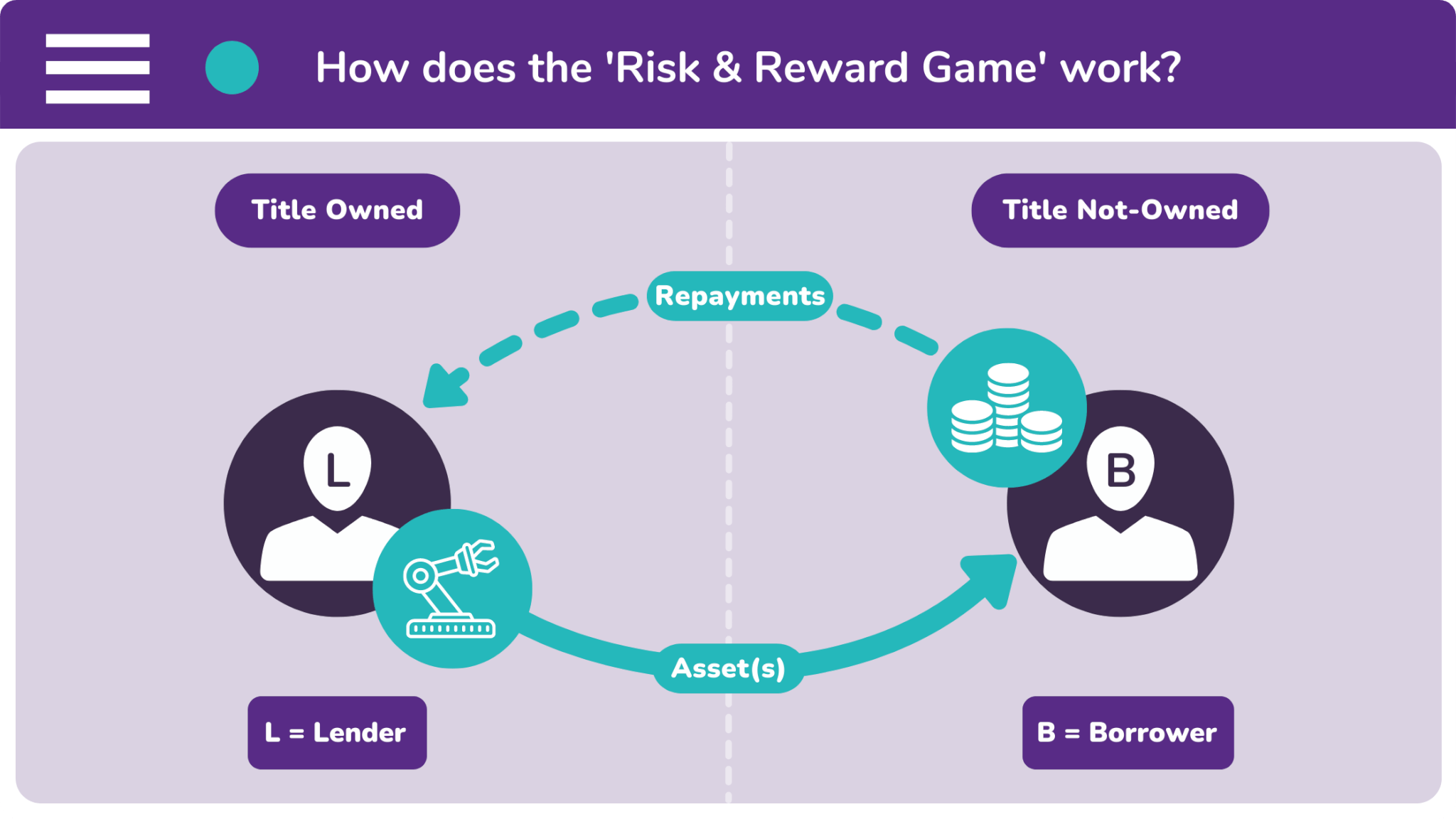

A company wants to borrow money to invest in itself. The owner wants to purchase an asset. This asset is a piece of machinery, which will step-up their production line and bring in more profit.

Although sadly, this piece of equipment is very expensive and would significantly drain their cash reserves. Therefore, the business is given the option of taking out an asset finance agreement.

The company then accepts this agreement. And the lender purchases the machinery on their behalf. But, to offset the risk of the borrower missing repayments, the lender retains the ‘title’ of the asset.

This means that the lender is the legal owner of the machinery. And they will have it on their ‘balance sheet’. If the borrower misses several repayments, the lender could repossess the asset and sell it on.

If this scenario were to unfold, the losses for each party would be minimal.

In the case of the borrower, they have lost an asset which could have helped them. However, they never owned the asset. And they never drained their cash reserves in order to acquire it.

Whereas in the case of the lender, they have missed out on being paid interest. But they were able to get some value back from the asset by selling it on.

What are the benefits of knowing the game?

Now you understand what the ‘Risk and Reward Game’ is, as well as how it is played. But you’re probably now asking yourself the question: “Why do I need to bother with understanding it?”

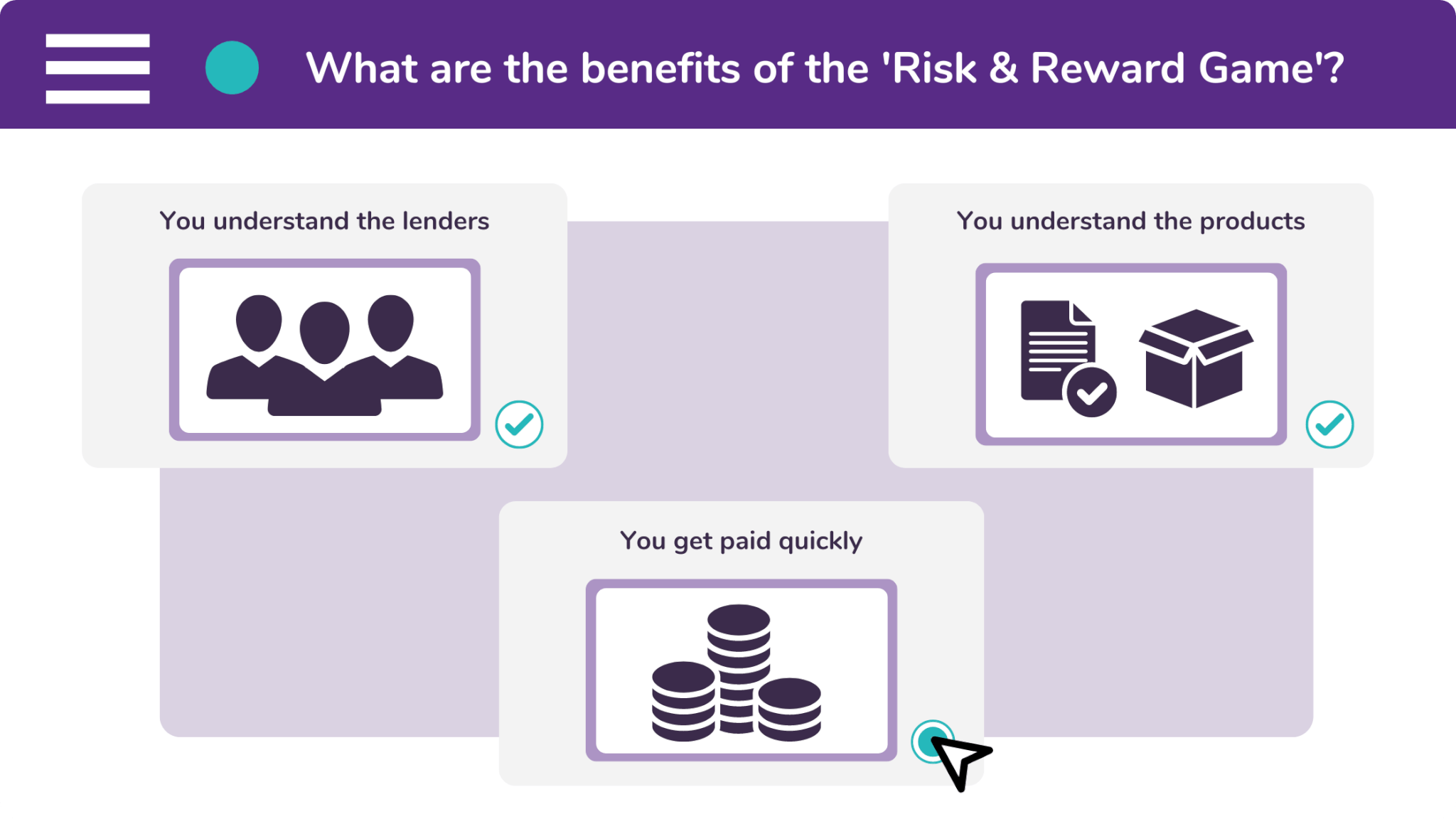

Well, there are three reasons why you should go through the ‘Risk and Reward Game’. These are:

- To understand the lenders,

The ‘Risk and Reward Game’ helps you to understand the lenders’ mindset. This means you’ll know what information the lenders want from you. And you’ll therefore be more likely to get an approval.

- To understand the products,

In addition to knowing the lenders’ mindset, you’ll have an understanding of what product you need.

Let’s say that you want to have an asset on your balance sheet. You should then take out a hire purchase. But this takes the security away from the lender. You could then allow them to hold a charge over a property, in order to make them feel more comfortable.

- And to get paid quickly.

Once you understand all of this you’ll be more likely to get an approval. And when you get approved by a commercial lender quickly, you will receive your funding quickly as well.

If you would like to learn more about the types of funding that are available to your business, you should contact one of our friendly brokers. You can call them on 0333 242 3311. Or email our offices at info@synergi-finance.co.uk.