If you’re a business owner, you should ask yourself this question: Why do I have a finance broker?

Do you turn to a commercial broker when the bank says no? Are they your plan B when all other avenues have been explored? Well, allow us to explain to you why a commercial finance broker should be your first port of call.

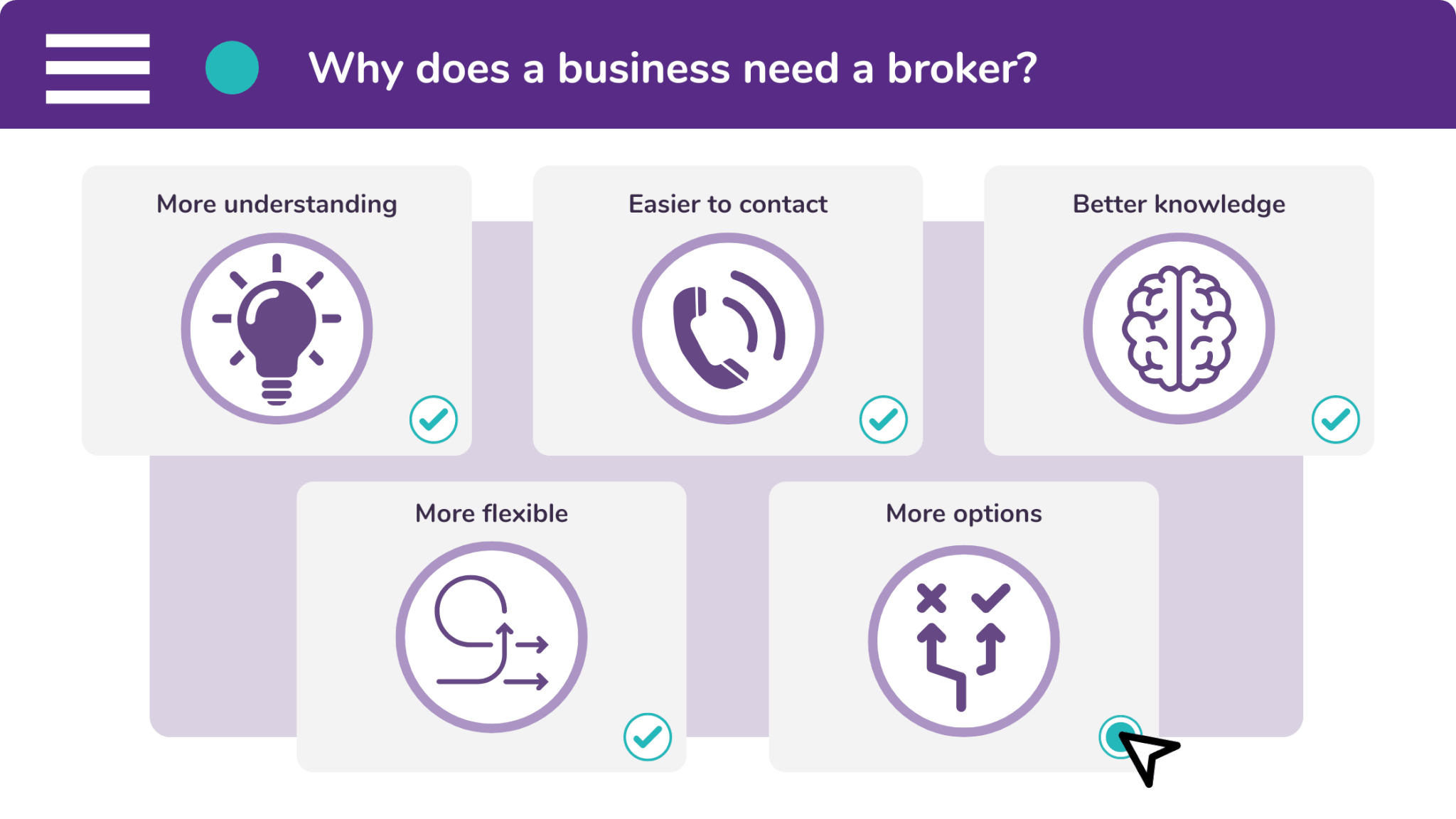

- Brokers have more understanding

Commercial finance brokers specialise in arranging finance for businesses. We understand that growth and investment are your top priorities. And it’s our goal to support your investment plans.

- Brokers are easier to contact

A commercial finance broker will assign you your own account manager. You will therefore speak to the same person every time you need us. And you will have this person’s individual contact details.

- Brokers have better knowledge

Whilst we have a better understanding than most lenders of what your business needs, we also have a better knowledge of the facilities that are available to you. Whether it’s asset finance or cash flow.

- Brokers are more flexible

Where a commercial lender may try to keep you in one of their finance agreements (like invoice finance) a broker will not. It’s not in our interest to keep you hooked on an agreement. We would be more likely to recommend a flexible facility (like revolving credit) instead.

- Brokers provide more options

When you go directly to a commercial lender, you might not get the best rates. And if you shop around for something more competitive, the rates could then change. Finance brokers have access to a wide panel of lenders. Therefore, we immediately know who to place you with to get the best deal.

Which commercial facilities do we offer?

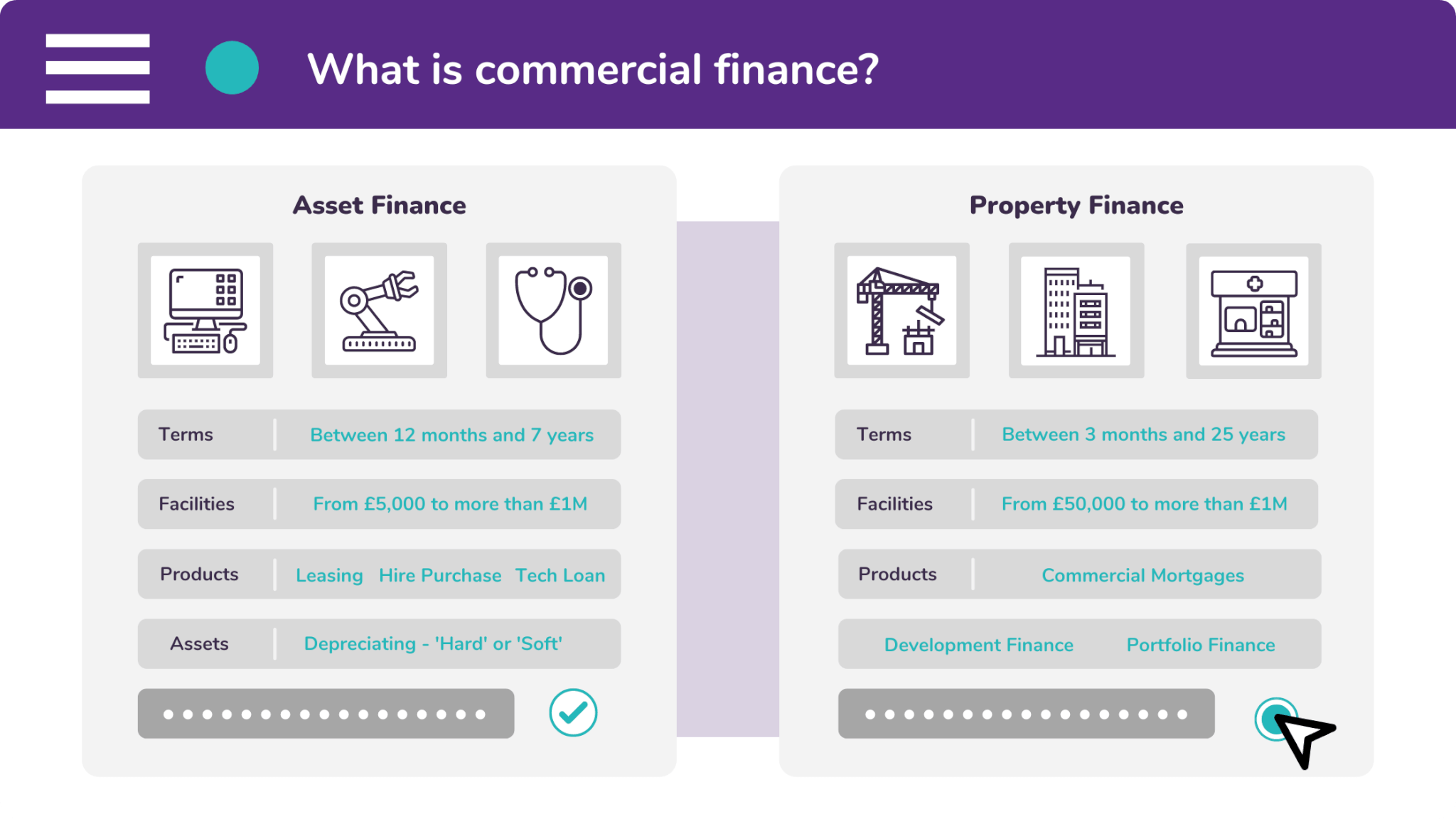

Asset finance is useful for companies that want to spread the cost of investing in new equipment. This is typically achieved with products like leases, hire purchases, and sometimes a technology loan.

Leases are best used when the asset is classed as ‘soft’, meaning that it rapidly depreciates in value. Whereas a hire purchase is best used when the asset is ‘hard’, meaning that it slowly depreciates.

A technology loan, on the other hand, is best employed when lots of intangibles form a part of a technology solution. These intangibles include services like training, maintenance, and consultancy.

Property finance is useful for businesses which need to purchase a commercial premises. It is also useful if they want to leverage funding from an existing property. This can be achieved through one of three different facilities: a commercial mortgage, a buy-to-let mortgage, or a bridging loan.

A commercial mortgage works the same way as a residential one. The borrower secures a loan against the property that they’re buying. A buy-to-let mortgage is a similar facility that is explicitly for properties which are going to be rented out. And a bridging loan is a short-term facility that allows you to kick-start your property projects.

Which cash flow facilities do we broker?

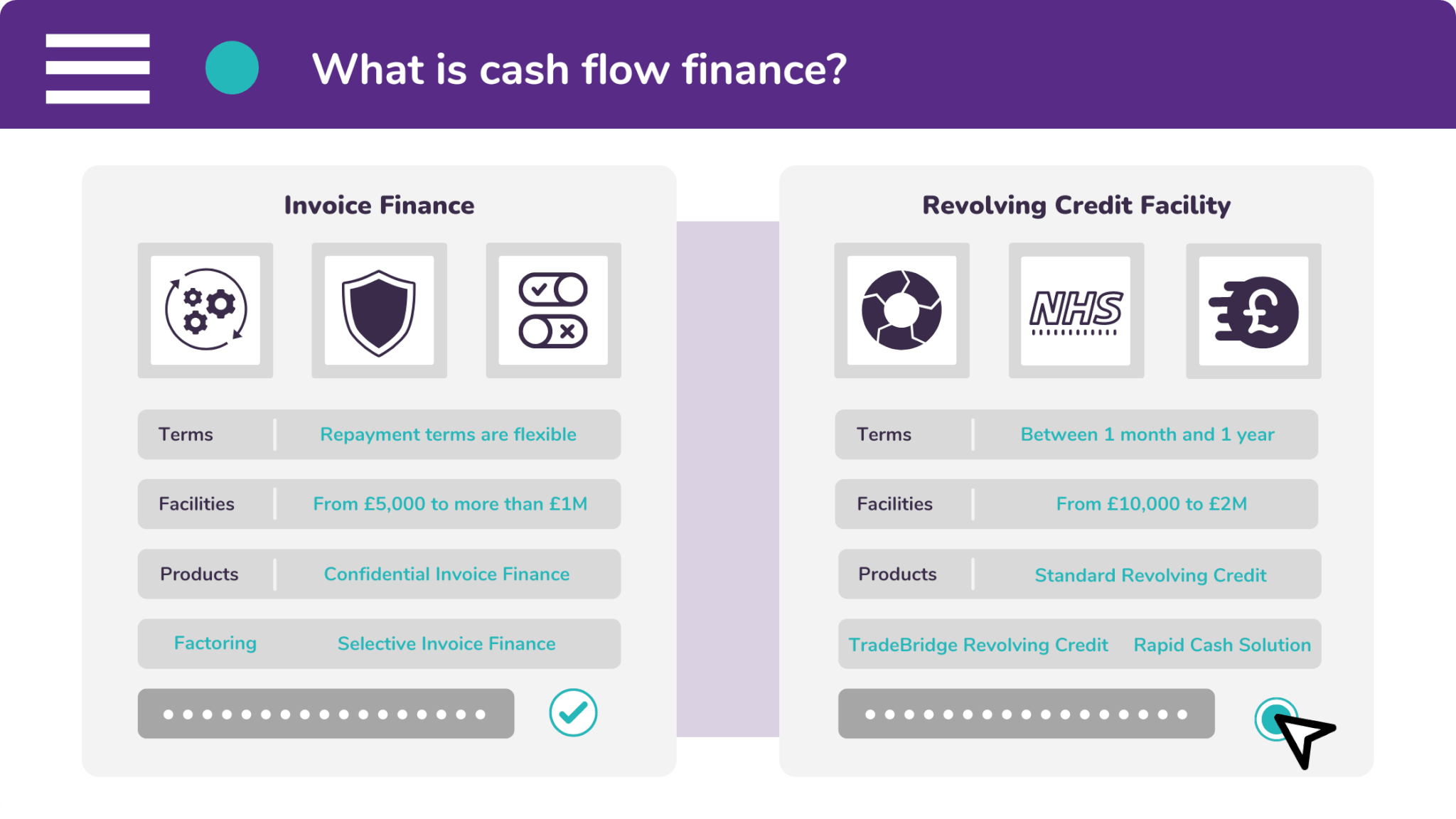

Invoice finance benefits companies whose customers are paying beyond their terms. This can cause cash flow problems, where suppliers need to be paid but the customer has not paid their invoice yet.

Invoice finance protects your cash flow by providing immediate access to a pre-agreed portion of an invoice’s outstanding value. The facility can then be repaid when the customer makes their payment.

There are three types of invoice finance: factoring, confidential, and selective. A lender collects the customer’s payment when factoring is used. But that responsibility is yours when it is confidential.

Selective invoice finance allows you to decide which invoices to finance, and which ones to run their course. That way, you are not financing customers who you know are good at paying.

And finally, revolving credit is a lot like a traditional bank overdraft. It is essentially a revolving loan with a credit limit. Interest is charged on the outstanding balance on a daily basis, but it is collected and serviced monthly.

There are three types of overdraft alternatives: standard revolving credit, healthcare revolving credit, and trade finance. Standard revolving credit works in the way that is detailed above. Whereas healthcare revolving credit applies to healthcare businesses. Trade finance allows you to pay your suppliers with a sum of borrowed capital.

If it sounds like your business could benefit from one of these finance facilities, submit an enquiry with us through our web form. We’ll send you confirmation and get back to you as soon as possible.

But if you don’t want to submit your details on our website, you can call one of our friendly brokers on 0333 242 3311. Or email our office at info@synergi-finance.co.uk.