Synergi Finance has a number of partners within the healthcare and pharmaceutical industries. However, one business which stands out is Invatech Health. Invatech are a leading pharmaceutical technology company, based in Bristol.

Invatech Health offers two different products: Atlas and Titan. Atlas is a technology product, which is predominantly served to care homes. It allows care home staff to administer and re-order medicine. This is achieved by connecting the care home to a pharmacy.

By comparison, Titan is focused on the pharmacy itself. It is also a technology solution. But it allows pharmacists to trade more efficiently. Invatech’s competitors offer similar products on a strict four-year contract. Whereas Invatech wanted to set themselves apart.

The Chief Executive Officer at Invatech, Tariq Muhammad, got in touch with Synergi Finance to arrange an affordable payment option for his customers. He now offers a three-year contract, where customers can buy hardware and software through a series of monthly payments.

Tariq went on to say: “When you offer a product like ours, the customer’s decision to go ahead has to be a no-brainer. It has to be an arrangement where people struggle to find the negatives.

“We decided to partner with Synergi Finance because their portal is very helpful. Once a customer has agreed to go ahead, the Synergi Partner Portal sorts out the customer’s paperwork very efficiently.”

What types of finance did Invatech Health offer?

Sales Enablement Finance

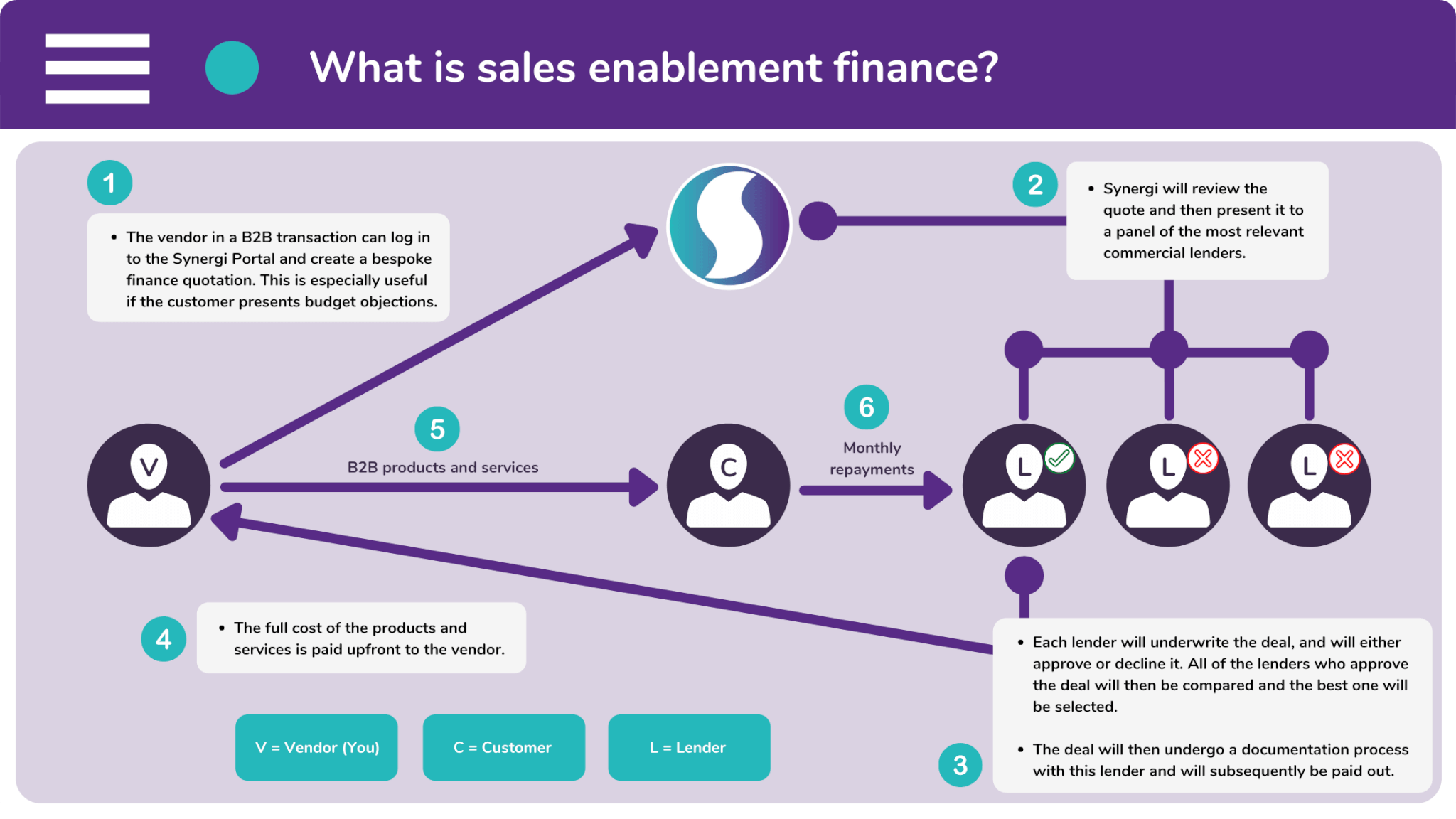

Sales enablement finance is commonly used by the sellers of B2B solutions. These vendors typically offer their customers a finance payment option in order to improve their sales performance.

B2B solutions are notoriously expensive. Therefore, salespeople often encounter budget objections and hesitation. These problems are a drain on their valuable time and stop them from closing further sales.

Sales enablement finance overcomes these obstacles by breaking costs down into a manageable series of installments. As a result, the products look much more affordable and much more appealing.

Vendors who offer finance subsequently go through quicker transactions. They receive full, upfront payment within 24 hours, giving salespeople time to make prospecting calls and pursue other opportunities.

How is this possible? Simple. We invite a commercial lender into the transaction. The lender will buy the solution from the vendor. And the customer will make their monthly repayments to them.

Lease Rental

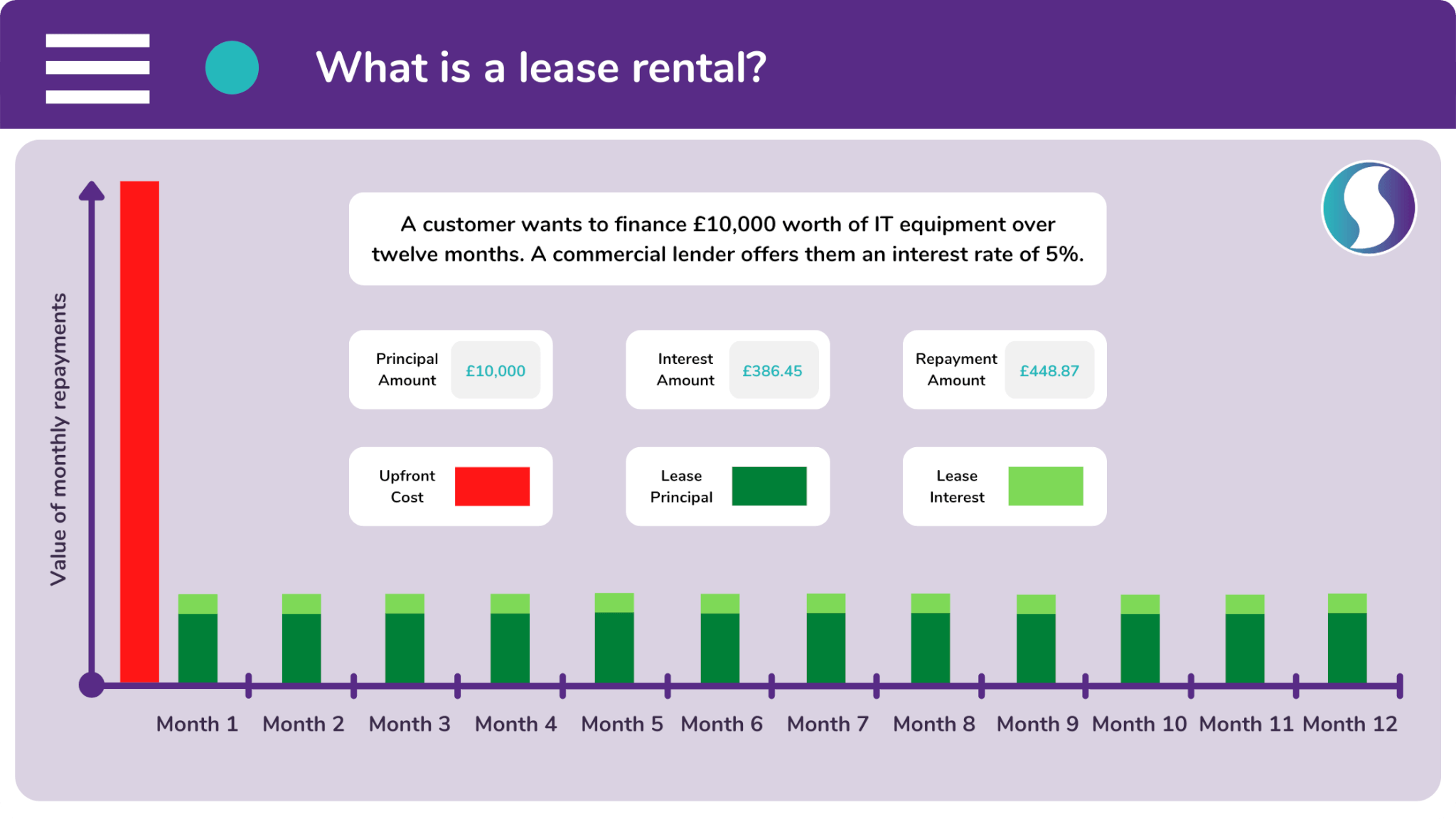

A lease rental is the most common form of sales enablement finance. It allows a vendor (also called the ‘seller’) to offer their products through a series of manageable payments.

A lease rental allows your customers to spread the cost of your products and services. And this is achieved through a number of repayments, all of which are the same value.

These installments will not rise or fall in line with inflation. The rate will be fixed. And for added benefit, the repayment term can be matched to the lifespan of your product.

The main advantage of a lease is that the vendor can offer a renewal or an upgrade at the end. You can therefore increase your customer retention, as well as lifetime value.

Overall, a lease rental is a transparent and flexible payment option for your customers. It’s simple for them to understand. And it’s quick for our commercial lenders to set up.

Discounted and 0% Finance

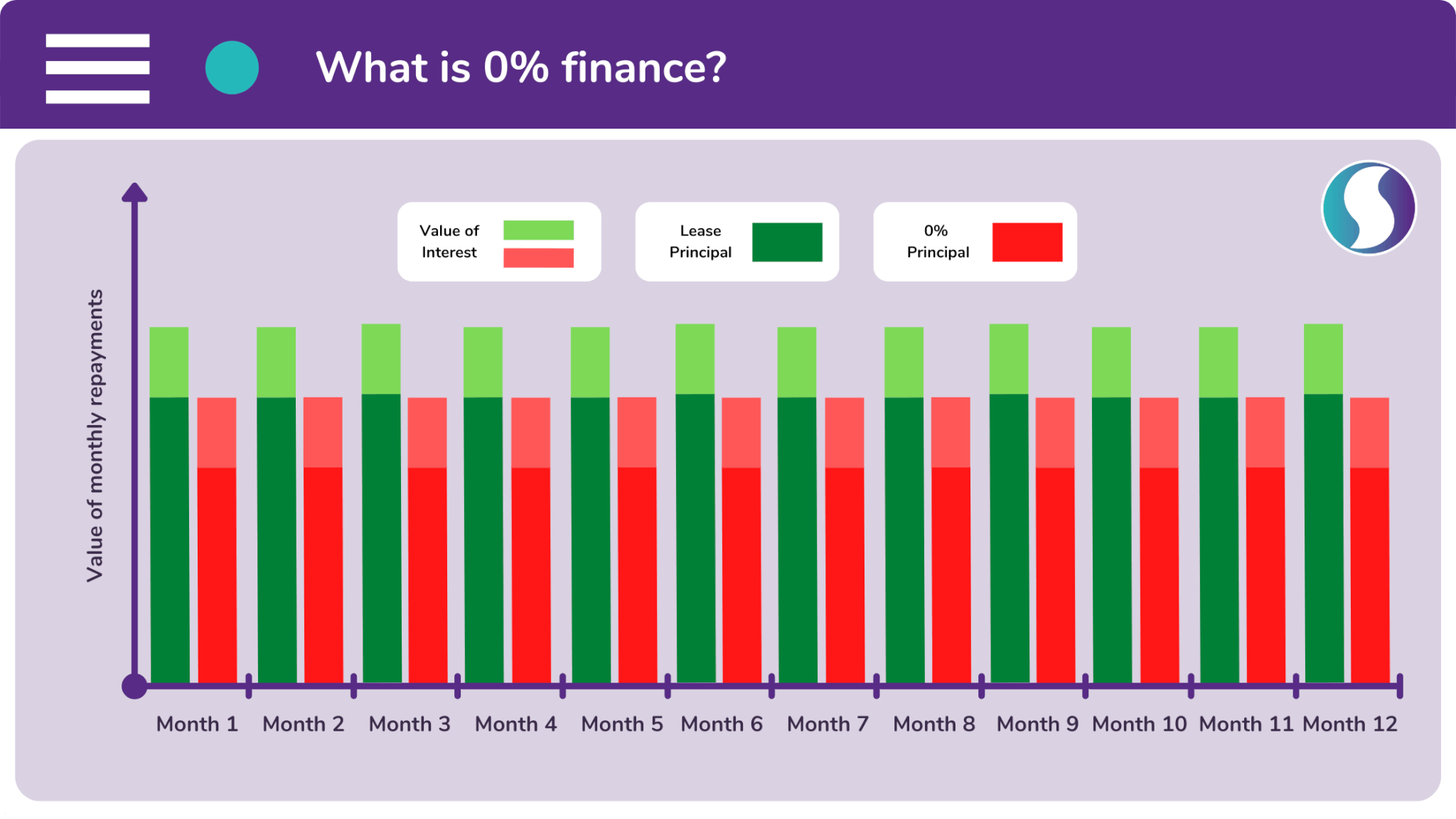

The world of finance has a disturbing confession to make. Discounted and 0% finance agreements don’t actually exist. In truth, you’ll always have to pay interest on a lease.

Essentially, the vendor (often known as ‘the seller’) removes the cost of interest with a ‘blind discount’. The interest is actually still there. But the customer is not able to see it.

A blind discount is the same as a normal one. You lower the price to get past any budget objections. But a blind discount is different because the overall cost will stay the same.

This works by offering a finance payment option at the point-of-sale. Although instead of having the customer pay any interest, the vendor also offers them a hidden discount.

This discount will be equal to all (or some) of the cost of interest, leading the customer to believe there is no interest to cover. They’re simply paying for the product in stages.

How can you offer something similar?

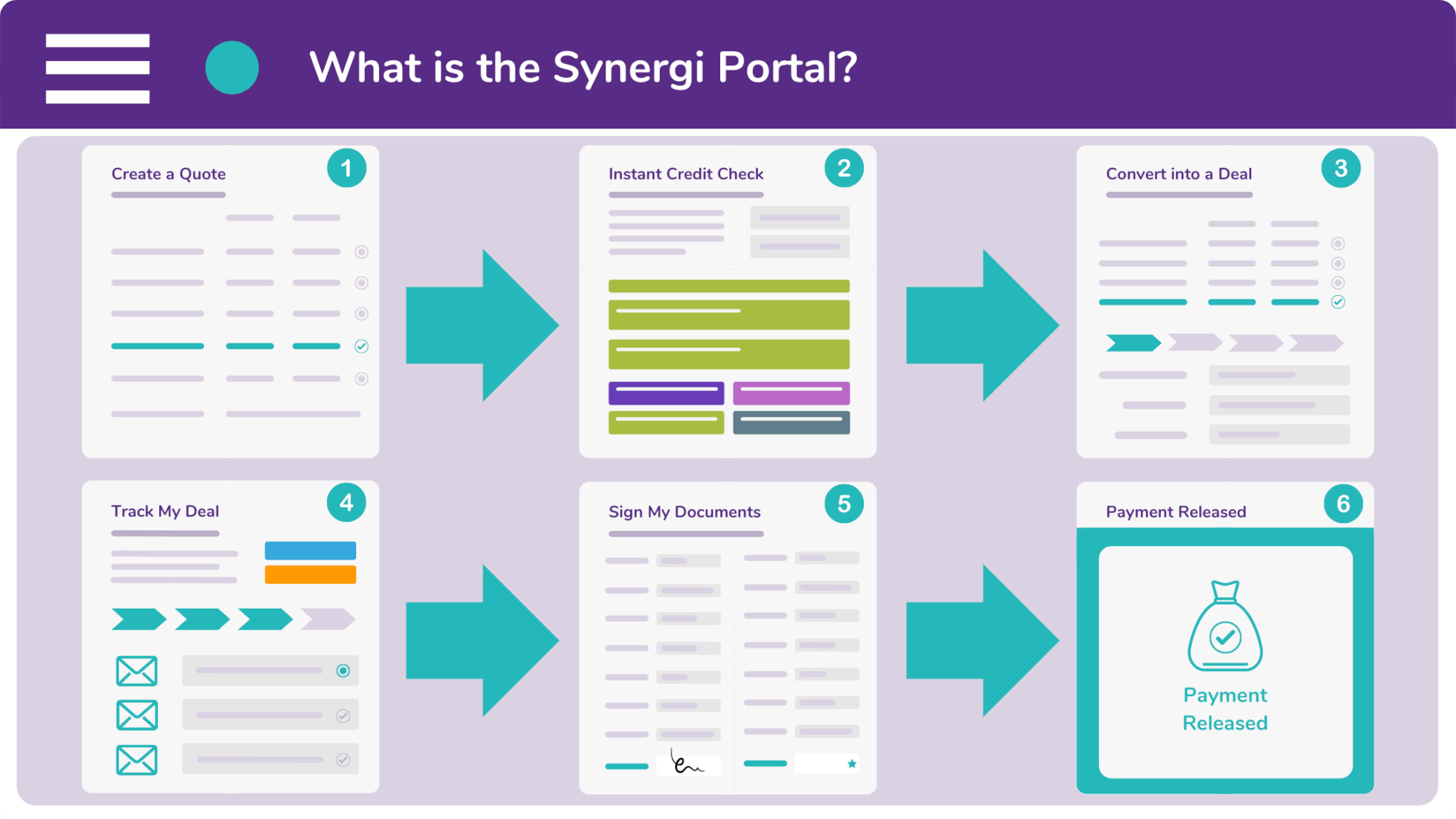

Synergi’s B2B vendors offer finance on their products and services through our multi-award winning portal. The Synergi Portal is a sales enablement tool which is free to use. And what’s more, it allows you to carry out four key functions. These include:

- Quoting

You can create a bespoke finance quotation for your customer. It will even have your company logo featured on it.

- Appraising

The Synergi Portal is integrated with Companies House and Credit Safe. You can therefore run credit appraisals on customers.

- Converting

Tell your broker that a quote has been given the green light by converting it into a deal. Synergi will then secure the finance.

- Tracking

And last of all, you can track your deals through the underwriting and documentation process. This keeps you in the know.

You can register for a demo of the Partner Portal by navigating to our enquiry form and submitting your details. Alternatively, you can contact one of our friendly brokers by calling 0333 242 33 11. Or send an email to info@synergi-finance.co.uk.