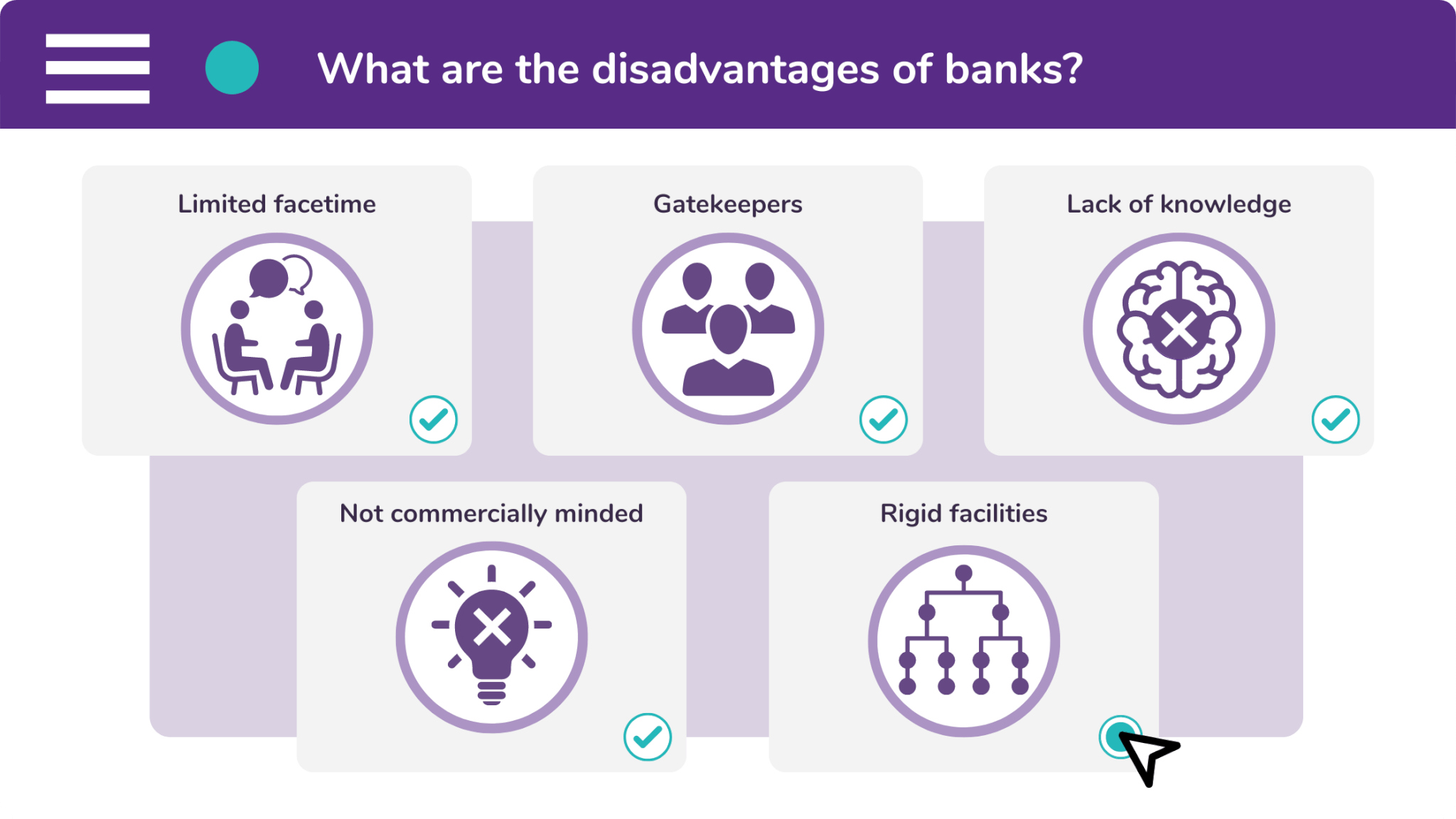

Do you know the name of your bank manager? It would be surprising if you did. In days gone by, it would be normal to meet and go to lunch with them. But banks are now such large organisations that this has become unrealistic.

This impersonal relationship between a business and its bank has meant that banking products don’t usually suit a company’s needs. Banks are unfamiliar with your business, your industry, and your products.

Nowadays, banks are run like a restaurant with a set menu. They may have the ability to go off-menu, but they don’t like to do that. Generally, everyone is expected to have the same thing, but different businesses have different needs.

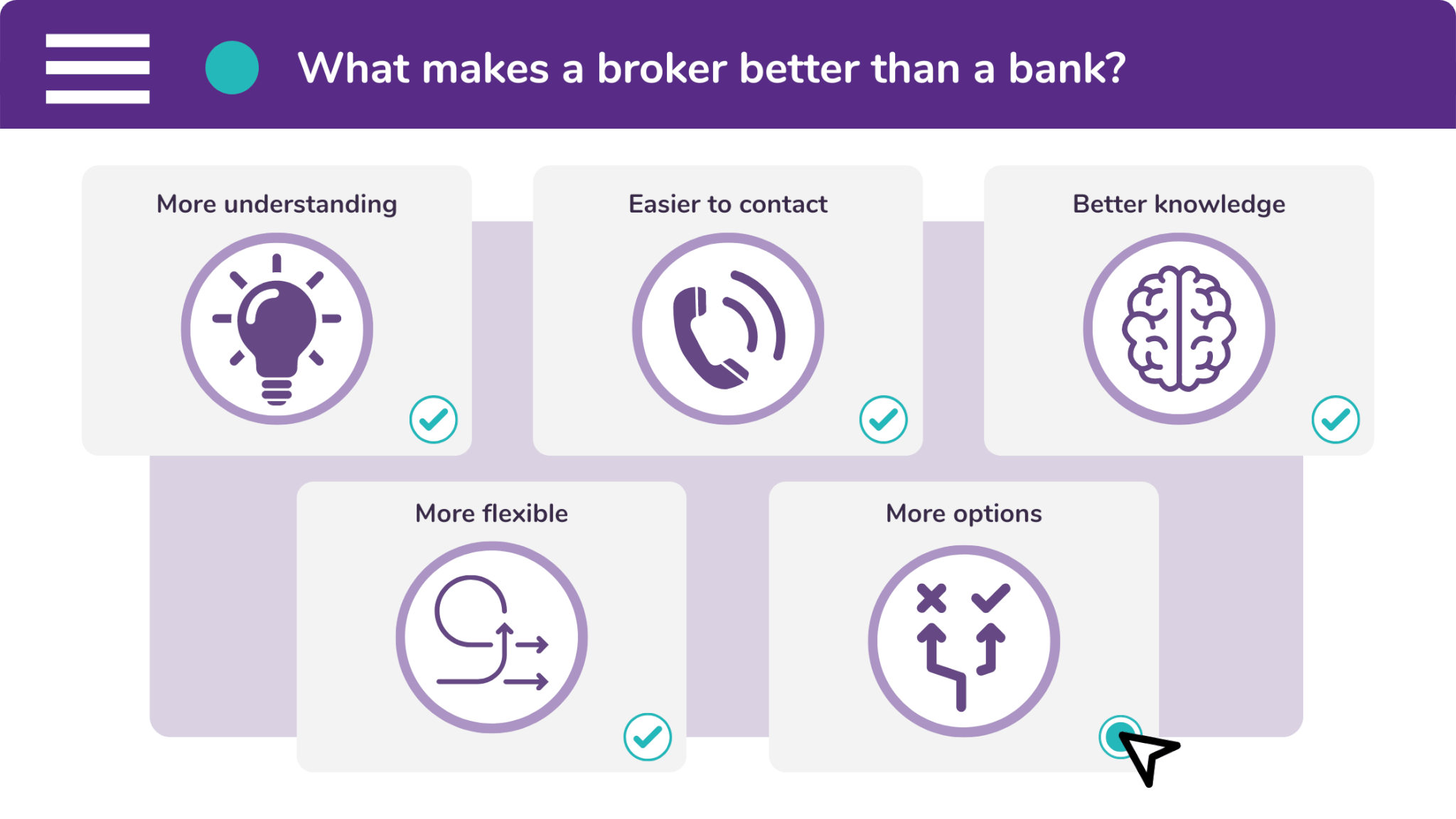

By comparison, a finance broker is more like a personal chef. A broker takes the time to understand your business, your industry, and your products. They can then create a finance facility that keeps your business running smoothly and efficiently.

What makes a broker better than a bank?

At Synergi Finance, we tend to quote five main reasons why it is better for your business to have a finance broker than just use your bank. These are that brokers:

- Have more understanding

Commercial finance brokers specialise in arranging finance for businesses. We understand that growth and investment are your top priorities. And it’s our goal to support your investment plans.

- Are easier to contact

When you contact a bank, there are countless gatekeepers who you have to speak to before you reach someone that can help. Whereas a finance broker will give you a direct line to your account manager.

- Have better knowledge

Oftentimes, a banker will know little more about a commercial finance product than the business that needs it. Comparatively, a broker has an in-depth knowledge of commercial finance products because these are the sole focus of their industry.

- Are more flexible

As we’ve said, a broker is like a personal chef. They can create a finance facility with unique features to suit your business perfectly. These features could include the size of the facility, the term of the repayments, whether you hold the ‘title’ of an asset, and more.

- Provide more options

A finance broker has access to various different lending streams. Because of this, a broker can give you several different options. These might vary in regard to the term of the agreement or even the interest rate.

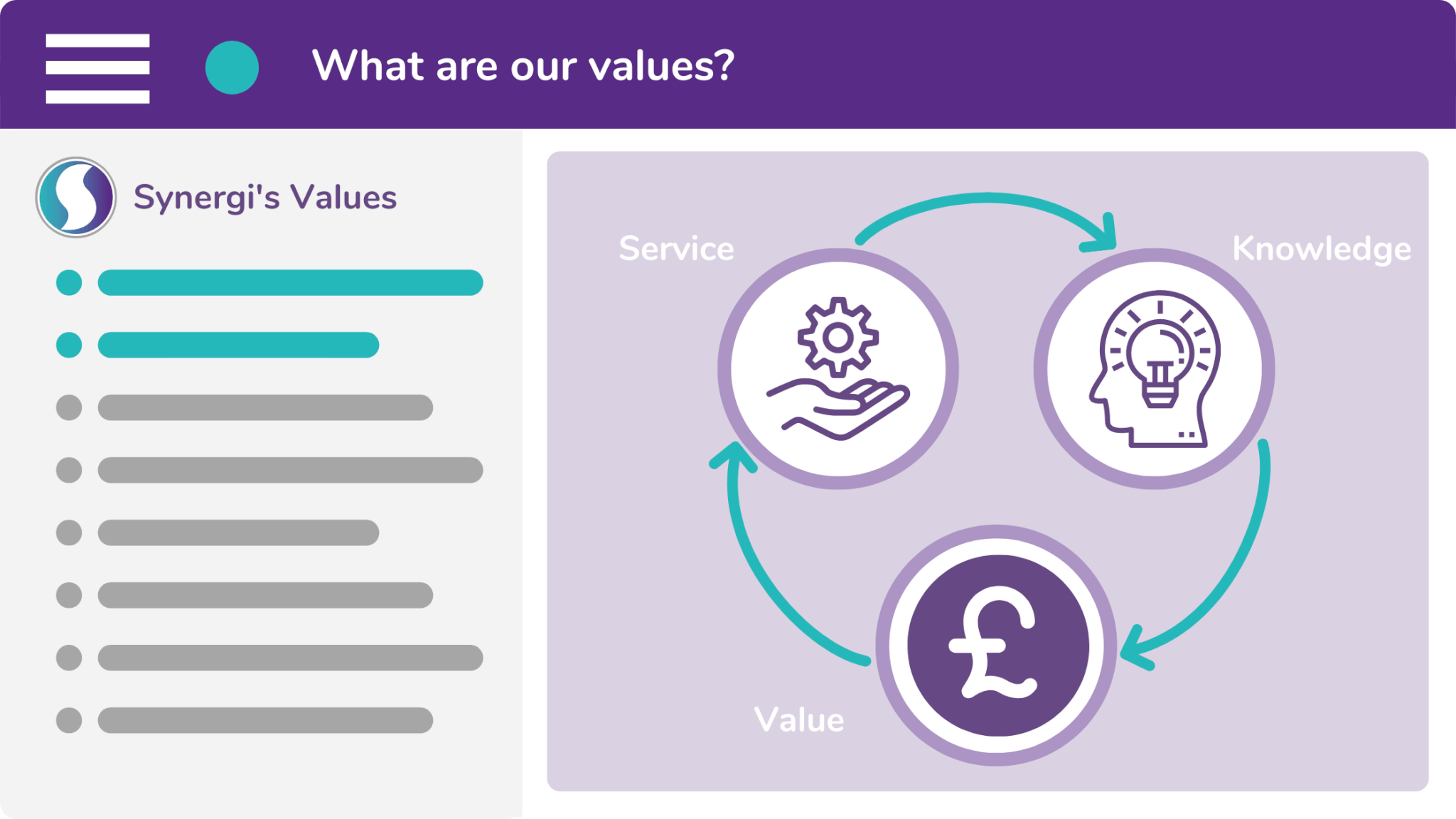

What makes Synergi better than other brokers?

Naturally, we think Synergi Finance is the best broker for helping your business achieve its financial goals. We stand out from other brokers for three main reasons:

- Service

Service is the first pillar of our business mantra. And we feel that ‘service’ is something which many businesses fail to appreciate. But this (in a selfish way) can actually be seen as a good thing.

This is because a company which masters exceptional service will stand out from the crowd. It costs nothing to provide good customer service, yet the benefits for your business are immeasurable.

- Knowledge

Knowledge is the second pillar of our mantra. Therefore, it isn’t surprising that we believe in the notion of substance over style. This is key for building a strong, trusting relationship with customers.

We make sure that we have an in-depth, working knowledge of a wide variety of finance products. This means that we can broker finance to almost any business and to suit various different purposes.

- Value

Value is the third and final pillar of our business mantra. And in the commercial world, you are recognised for the value that you add to your customers, as well as your introducers.

As finance brokers, this is something that we prioritise. The facilities we arrange for our customers and vendors are designed to trim their overheads and provide a measurable return on investment.

If you want to improve your business with a commercial finance facility, enter your details on our enquiry page. Alternatively, you can contact one of our friendly brokers by calling 0333 242 3311. Or send an email to info@synergi-finance.co.uk.