The Recovery Loan Scheme (RLS) is a government-backed program, which was set-up to replace three similar arrangements. These were:

- The Bounce Back Loans (BBLs)

- The Coronavirus Business Interruption Loan Scheme (CBILS)

- The Coronavirus Large Business Interruption Loan Scheme (CLBILS)

In the aftermath of the COVID-19 pandemic, a lot of companies struggled with rising costs and supply chain issues. As a result, the government decided to implement each of the abovementioned systems in order to help businesses cope.

These schemes ended on the 31st of March 2021. Whereas the deadline for the RLS isn’t until the 30th of June 2022.

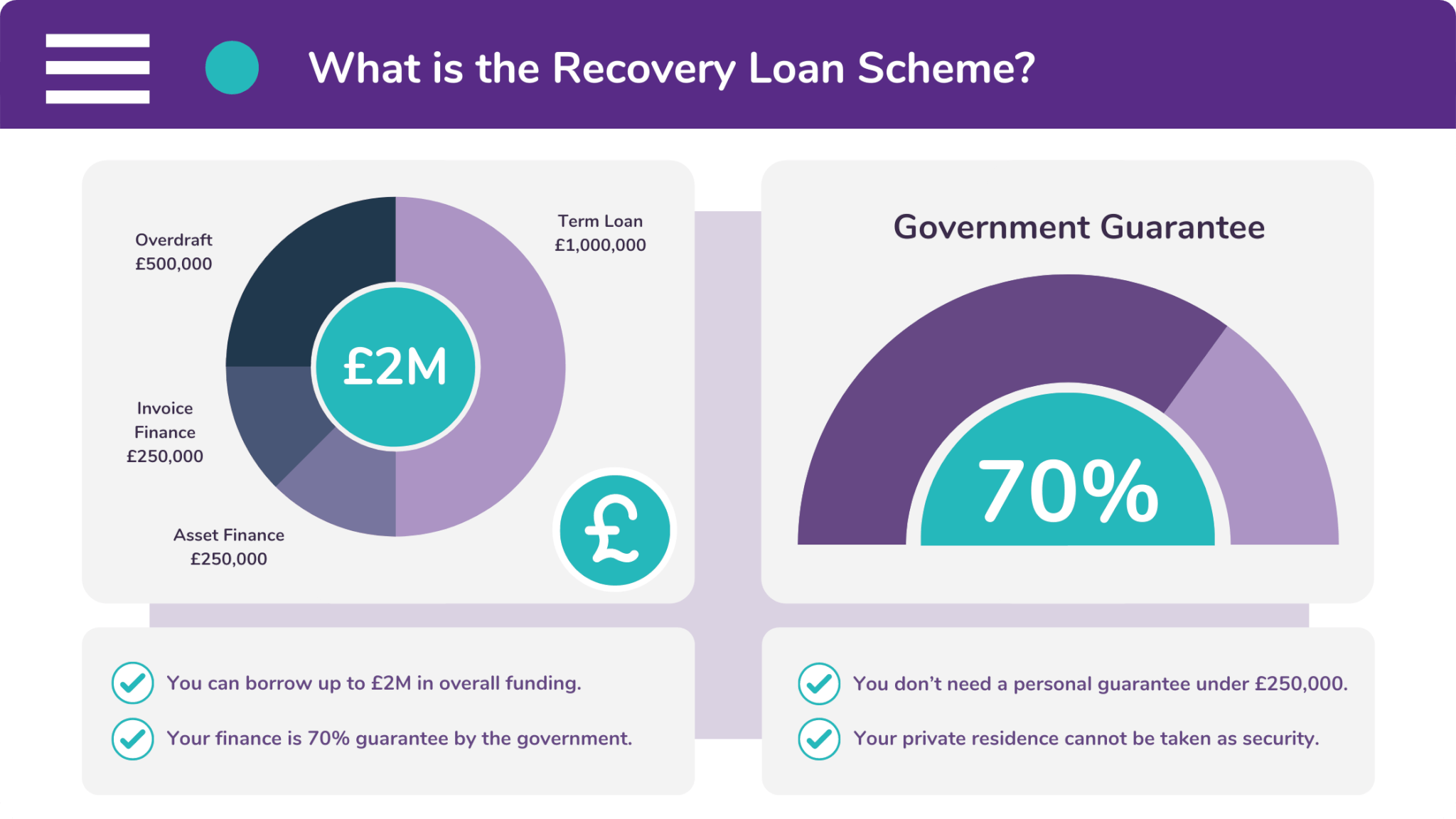

There are four key features of the RLS, which you should know about. These include:

- You can borrow up to £2M in overall funding.

- Your finance is 70% guaranteed by the government.

- You don’t need a personal guarantee under £250,000.

- Your principal, private residence cannot be taken as security.

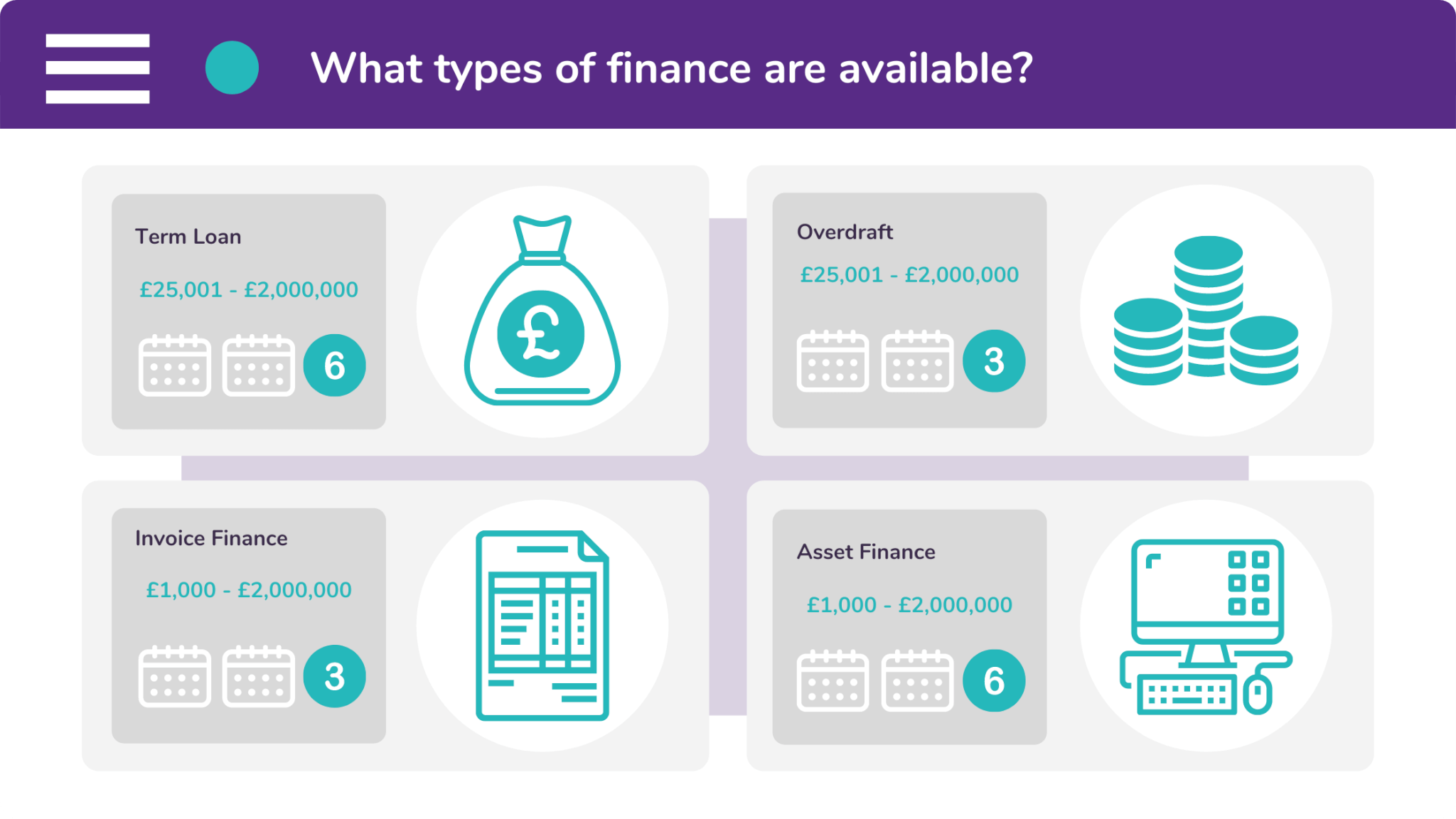

What types of finance are available?

You can apply for four types of finance under the RLS. These include term loans, overdrafts, invoice finance, and asset finance:

- You can apply for a term loan with a value between £25,001 and £2M per business. The repayment terms on these loans can go up to six years.

- You can arrange overdrafts where the credit limit is between £25,001 and £2M as well. However, the terms on overdrafts only go up to three years.

- You could also arrange an invoice finance facility between £1,000 and £2M in value. With terms on these facilities likewise going up to three years.

- And lastly, you can apply for asset finance between £1,000 and £2M. Although (like a loan) repayment terms on these facilities can go up to six years.

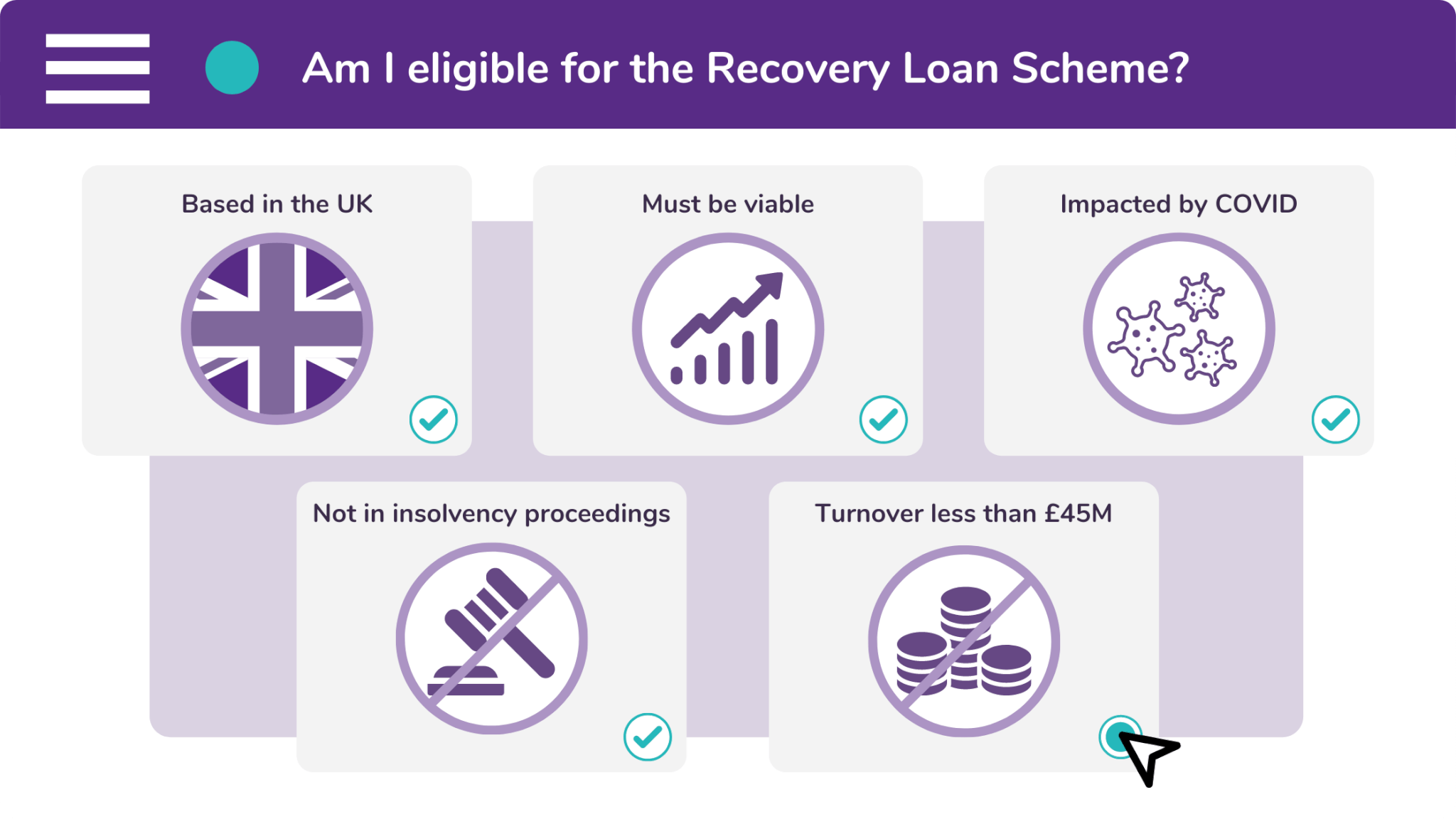

Am I eligible for the Recovery Loan Scheme?

Your company will be eligible for RLS funding if it meets the following list of criteria:

- Your business must be based in the UK. And must also carry out the majority of it’s trade in the UK.

- Your business must be viable. Or it would be viable, were it not for circumstances cause by the pandemic.

- Your business must have been impacted by the pandemic. This can be either positive or negative.

- Your business must not be going through collective insolvency proceedings.

- Your business must not have a turnover which exceeds £45M per annum.

It is worth mentioning that any company which has received funding from the BBLs, CBILS, and CLBILS can still apply for the RLS. That being said, the amount of money you borrowed from the previous schemes may limit your RLS borrowing amount.

Who is not eligible for the Recovery Loan Scheme?

Unfortunately, there are several organisations which are not eligible for the RLS. These are included in the list below:

- Banks

- Building societies

- Insurers (but not insurance brokers)

- Re-insurers (but again, not insurance brokers)

- State funded primary schools

- State funded secondary schools

To find out whether you could benefit from the Recovery Loan Scheme, contact our team of friendly brokers. We can determine your eligibility and recommend the best finance facility for your business. We look forward to hearing from you.