Are you worried about the state of the economy?

Many peoples’ response to any form of economic uncertainty is to batten down the hatches. People then tighten their belts, hold off on investments, and go out of their way to protect their savings.

However, at this moment in time, is that the right thing to do?

The Bank of England’s interest rates are currently sitting at 0.1%. Whilst precautionary measures are also being taken for potentially negative rates. So is it smart to sit on your money right now?

Your money won’t work for you whilst it’s sat in your bank account. And you won’t be making any interest at the moment. In fact, if interest rates do turn negative, you could end up losing money.

So how can people safeguard their finances, as well as their business, in such uncertain times?

Simple. Make that money work for you. Resist your natural instincts to hold on and wait. And instead, invest your capital into your business so that it brings in a return.

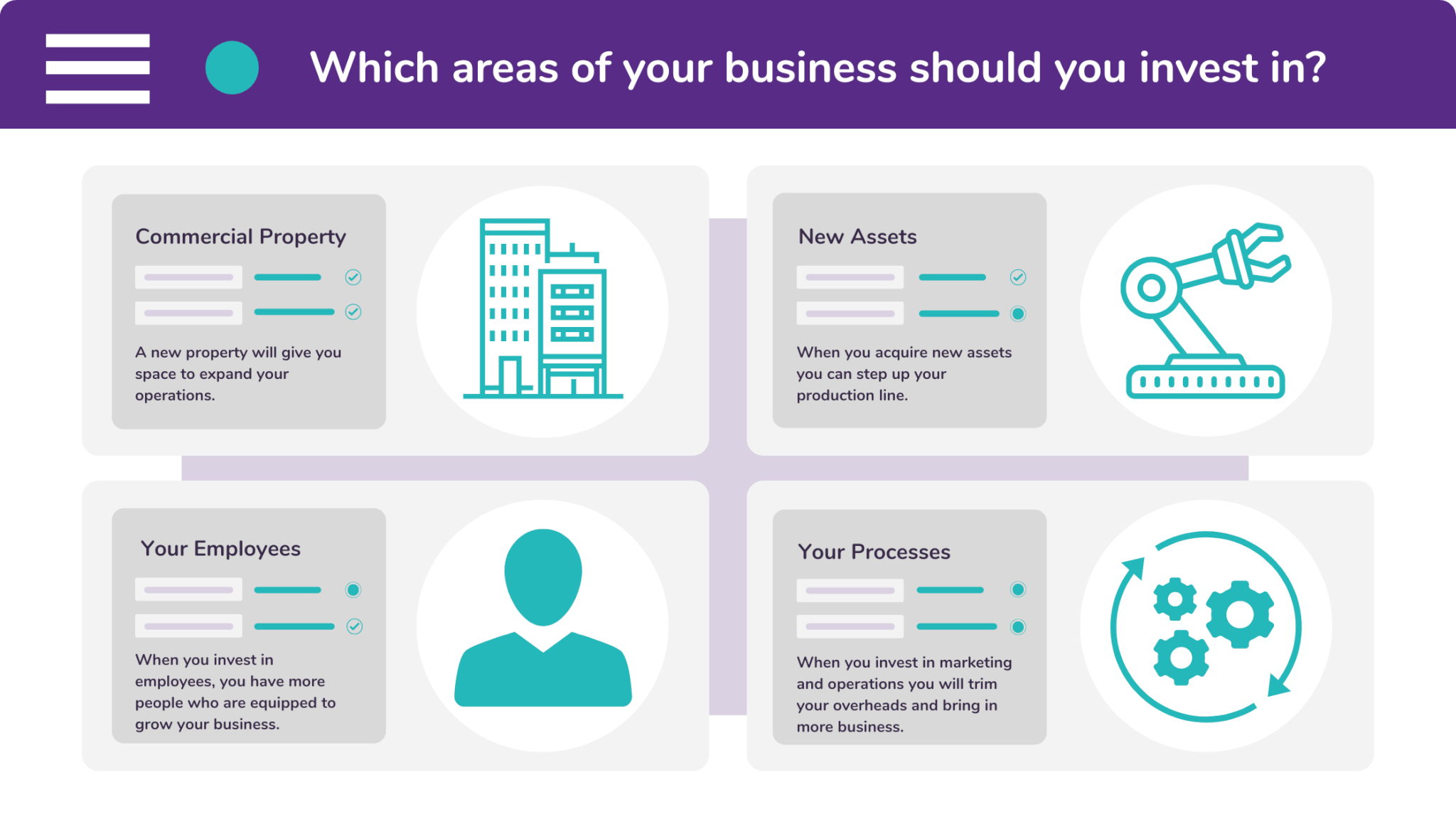

Which areas of a business should you invest in?

There are several ways for you to invest in your business. You can:

- Invest in a commercial property,

A new property will give you space to expand your operations. You can increase the volume, and therefore the output, of your production lines. And it will also give you the space to hire more staff.

- Invest in new assets,

When you acquire new assets you can step up your production line, create new products, and offer new services. You can then be more adaptable and meet the demands of your target market.

- Invest in your employees,

When you invest in recruitment and training, you have more employees who are better equipped to grow your business. Likewise, you won’t have to outsource as many responsibilities to third parties.

- And invest in your processes.

And finally, when you invest in marketing and operations you will trim your overheads whilst also bringing in more business. Less time will be spent on prospecting, and more time will be spent on selling.

How should you achieve this investment?

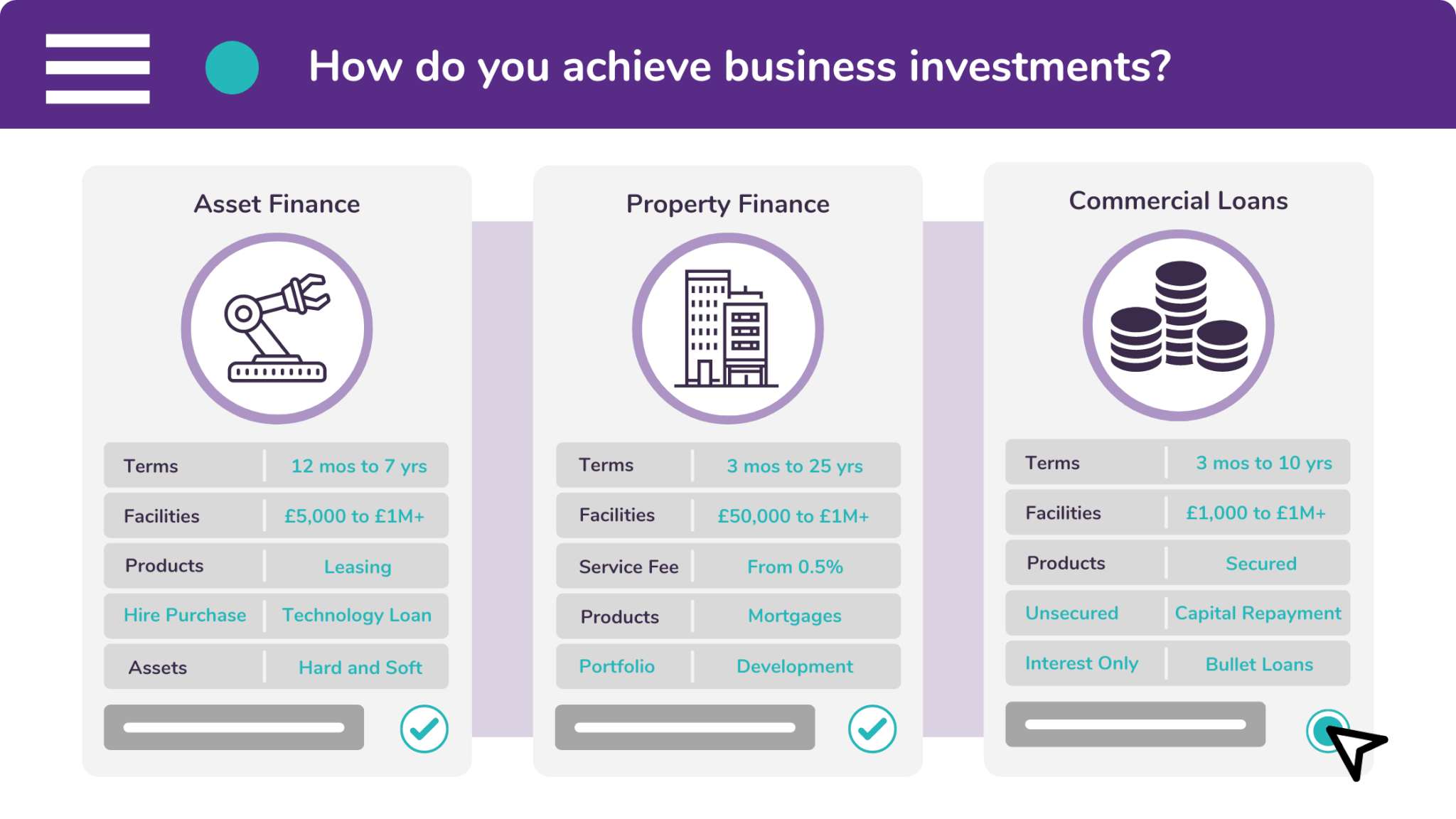

We recommend three methods when it comes to business investment. These are:

Property finance is useful for businesses which need to purchase a commercial premises. It is also useful if they want to leverage funding from an existing property. This can be achieved through one of three different facilities: a commercial mortgage, a buy-to-let mortgage, or a bridging loan.

Asset finance is useful for companies that want to spread the cost of investing in new equipment. This is typically achieved with products like leases, hire purchases, and sometimes a technology loan.

Leases are best used when the asset is classed as ‘soft’, meaning that it rapidly depreciates in value. Whereas a hire purchase is best used when the asset is ‘hard’, meaning that it slowly depreciates.

Commercial loans provide businesses with an injection of funding. The provision of a loan is not dependent upon the purpose of its use. This means that you can spend it on marketing, training, or even recruitment.

Would you like to start investing in your business? Do any of these finance products sound like they could be useful? If that’s the case, submit your details, and an enquiry, through our web form.

Alternatively, you could contact one of our friendly finance brokers by calling 0333 242 3311. Or email our offices at info@synergi-finance.co.uk.