Overdraft Alternatives

Overdrafts can be a useful finance product for businesses. But sometimes, an alternative solution is a better option. There are three main alternatives that are worth considering.

One alternative is ‘standard revolving credit’. This is a revolving loan with a credit limit. Interest is charged daily on the amount that you withdraw, and it is collected monthly.

Another alternative is ‘healthcare revolving credit’. This is similar to standard revolving credit, but it is different because your repayments will be collected from NHS contracts.

The last alternative is ‘trade finance’. Trade finance is a solution which provides import and export businesses with enough funding to conduct international trade transactions.

Overdraft alternatives are extremely useful for businesses in seasonal or turbulent sectors. Funding can be withdrawn during industry lulls and repaid during peaks.

Overdraft Alternatives

What is an Overdraft Alternative?

Overdrafts can be a useful finance product for businesses. But sometimes, an alternative solution is a better option. There are three main alternatives that are worth considering.

One alternative is ‘standard revolving credit’. This is a revolving loan with a credit limit. Interest is charged daily on the amount that you withdraw, and it is collected monthly.

Another alternative is ‘healthcare revolving credit’. This is similar to standard revolving credit, but it is different because your repayments will be collected from NHS contracts.

The last alternative is ‘trade finance’. Trade finance is a solution which provides import and export businesses with enough funding to conduct international trade transactions.

Overdraft alternatives are extremely useful for businesses in seasonal or turbulent sectors. Funding can be withdrawn during industry lulls and repaid during peaks.

Why should you use overdraft alternatives?

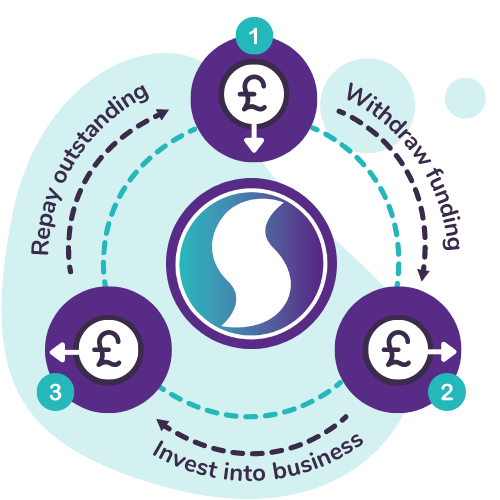

Overdraft alternatives allow you to withdraw funding from a facility up to a pre-agreed limit. This means that you will only have to repay the amount which you withdraw. You will not be charged interest on the entire facility amount.

One of the main benefits of an overdraft alternative is that you can use the funding for anything. The provision of a facility is not dependent on the purpose of its use. You can therefore use it to pay overheads or kickstart projects.

You can settle an overdraft alternative at any point within the agreed term. The only thing worth bearing in mind is that interest will be charged on the amount that you withdraw each day, and it will be collected each month.

Overdraft alternatives allow you to pay your overheads and make business investments without eating into your cash reserves. You could use the facility for working capital or projects, whilst keeping savings in the bank.

A strong cash flow is one of the most important things for growing your business. Sometimes your cash flow can become restricted because of an industry lull. Overdraft alternatives can overcome this problem.

Overdraft alternatives offer a safety net for businesses in seasonal or turbulent industries. These companies could use a facility during an industry lull and repay the outstanding balance during an industry peak.

What is standard revolving credit?

Standard revolving credit follows a straightforward process. It is very similar to an everyday overdraft. This means that you and a commercial lender will both agree upon your credit limit, as well as a term.

You can then withdraw funding up to this limit over the course of your term. Any interest will be charged daily on the amount that you withdraw. And this will also be collected on a monthly basis.

You only have to repay the money which you take out. And you will only be charged interest on this amount as well. The funding from your facility can be put towards any purpose within your business.

However, one characteristic of standard revolving credit is that it’s based on the equity in your home. Commercial lenders will grant you a facility which is worth half the equity in your personal property.

Naturally, this means that the borrowing party in a revolving credit scenario should be a company director. They should also be a homeowner. And they must have stable accounts to be approved.

What is healthcare revolving credit?

Healthcare revolving credit is very similar to standard revolving credit in terms of how it works. It is also like a traditional overdraft. It allows the borrower to dip in and out.

Although, healthcare revolving credit differs enormously in regard to how it is repaid. This type of revolving loan is paid with funding that is gained from NHS contracts.

As a result, this form of commercial finance is used by companies in the healthcare and pharmaceutical industries. They will typically take on contracts from the NHS.

In this situation, a lender will set up a two-way portal where you can access up to four times your average NHS income. This will be calculated on a six-month basis.

Once a withdrawal is made, you start being charged interest. And when the contract is paid, the money is transferred into this account to cover your outstanding balance.

What is trade finance?

Trade finance is an overdraft alternative that is ideal for anyone in the import and export industry. However, it can simply be used by companies which buy from other businesses.

Essentially, trade finance allows resellers to pay their suppliers upfront using a sum of borrowed capital. They will then repay this capital over time in a series of installments.

This is ideal for resellers because when they pay their suppliers in cash, their capital is tied up in buying goods which might not arrive for weeks. Their cash flow is restricted.

Suppliers will also benefit from trade finance if they have customers who wait to make their payment until they have received the goods. This will tie up their working capital.

Trade finance bridges the cash flow gap in a supplier/reseller transaction. This frees up the working capital of both parties so they can pay their overheads and trade smoothly.